This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

5 New Deals incl. DBS, Olam, HDB; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 16, 2021

US equities ended flat with the S&P and Nasdaq almost unchanged. Sectoral gains were led by Utilities, up 0.9% while losses were led by Materials, down 0.5%. US 10Y Treasury yields rose 5bp to 1.61%. European markets were mixed with the DAX, CAC and FTSE up 0.3% 0.5% and 0.1% respectively. Brazil’s Bovespa ended 1.2% lower. In the Middle East, UAE’s ADX was down 0.3% and Saudi TASI was down 0.6%. Asian markets have opened higher – Shanghai, HSI and Nikkei were up 0.2%, 1.1% and 0.3% while STI was flat. US IG CDS spreads were flat and HY CDS spreads were 0.6bp tighter. EU Main CDS spreads were 0.3 and Crossover CDS spreads were 1bp wider. Asia ex-Japan CDS spreads tightened 0.4bp.

US President Joe Biden signed a $1.2tn bipartisan infrastructure bill into law. Chinese Industrial Production for October rose 3.5% YoY, higher than the forecasted 3% while Fixed Asset Investments came slightly lower than forecasts of 6.2% at 6.1%. Retail Sales saw a stellar beat in October, up 4.9% YoY vs. 3.5% forecasted.

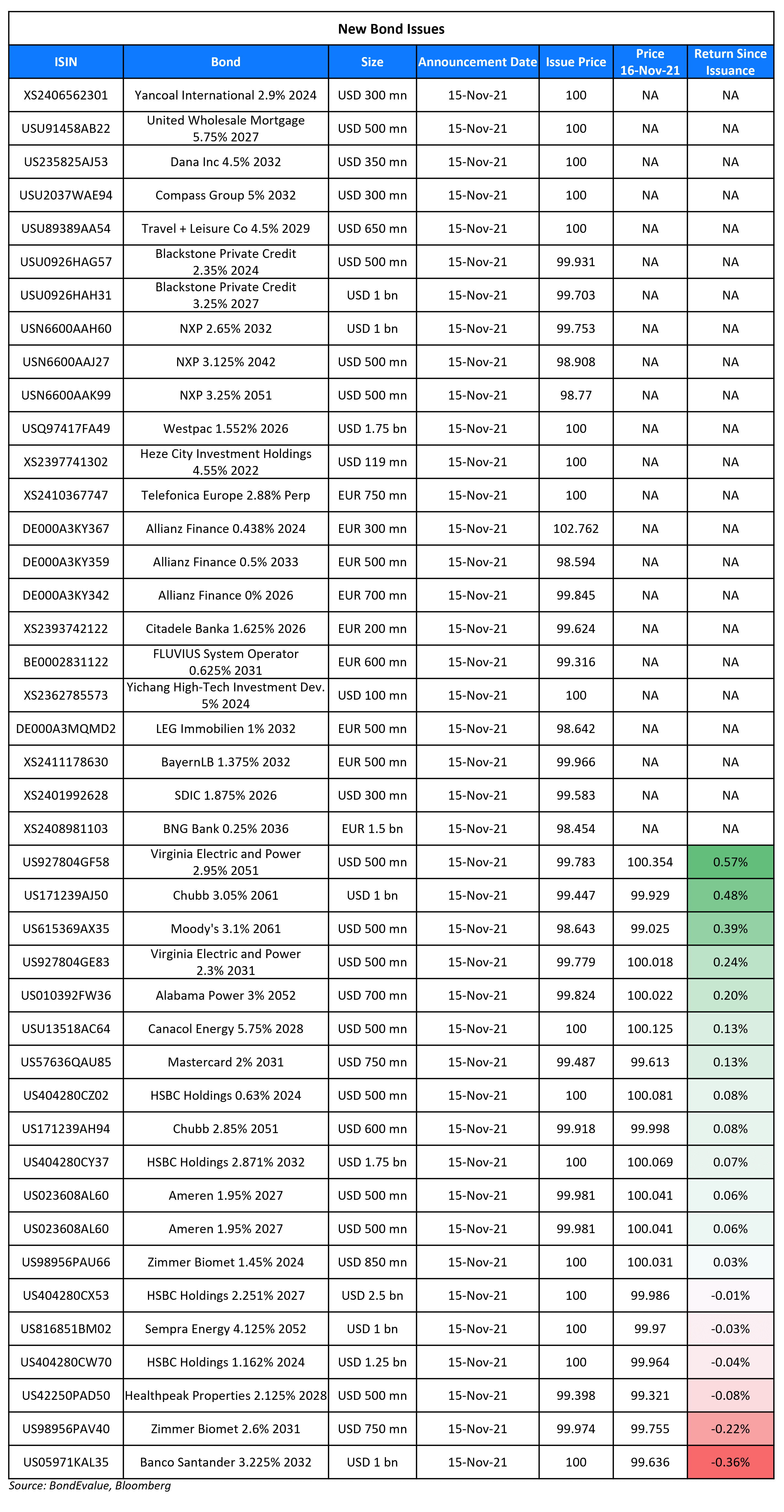

New Bond Issues

- DBS $ 3Y at T+50bp area; $ 3Y FRN at SOFR+bp equivalent

- Olam S$ tap of 5.375% Perp at 5.368% area

- HDB S$800mn 5Y at 1.645%

- China Great Wall AMC (International) $300mn 5Y at T+215bp area

- Shaoxing Shangyu Urban Construction $ 5Y sustainability at 3.7% area

HSBC raised $6bn via a four-tranche deal. It raised:

- $1.25bn via a 3NC2 bond at a yield of 1.162%, 20bp inside initial guidance of T+85bp area

- $2.5bn via a 6NC5 bond at a yield of 2.251%, 20bp inside initial guidance of T+120bp area

- $1.75bn via a 11NC10 bond at a yield of 2.871%, 20bp inside initial guidance of T+145bp area

- $500mn via a 3NC2 FRN bond at a yield of 0.63% or SOFR+58bp vs initial guidance of SOFR-equivalent.

The new 3Y fixed rate bonds are priced 19.2bp wider than the existing 3.95% 2024s that yield 0.97%. The bonds have expected ratings of A3/A–/A+. Proceeds will be used for general corporate purposes.

Banco Santander raised $1bn via a 11NC10 bond at a yield of 3.225%, 15-20bp inside initial guidance of T+175/180bp. The bonds have expected ratings of Baa2/BBB+/BBB. The bonds are callable on and anytime after November 22, 2031. If not called, the coupon will reset on November 22, 2031 to the prevailing US 1Y Treasury + 160bps.

Temasek is raising up to S$350mn via a 5Y bond at a yield of 1.80%, 6bp inside initial guidance of 1.86% area. S$250mn was priced and will be allocated to institutional, accredited and other specified investors, while up to S$100mn will be open for retail investors today. In the event of oversubscription, Temasek may upsize the combined offer to a maximum of S$500mn. The bonds have expected ratings of Aaa/AAA (Moody’s/S&P), and the institutional tranche received orders over S$1.542bn, 6.2x issue size. Singapore bought 85% while the remaining 15% went to others. Insurers took 41%, central banks and agencies 33%, banks 13%, fund managers 12%, while corporations and others received the remaining 1%. The bonds are issued by Temasek Financial IV and guaranteed by Temasek Holdings.

Yanzhou Coal Mining raised $300mn via a 3Y bond at a yield of 2.9%, 35bp inside initial guidance of 3.25% area. The bonds have expected ratings of Ba1 (Moody’s). Proceeds will be used to repay offshore debt. The bonds have a change of control put at 101, and are issued by Yancoal International Resources Development and guaranteed by Yanzhou Coal Mining.

State Development & Investment Corp (SDIC) raised $300mn via a 5Y bond at a yield of 1.963%, 50bp inside initial guidance of T+125bp area. The bonds have expected ratings of A2/A+ (Moody’s/Fitch), and received orders over $2.5bn, 8.3x issue size. Proceeds will be used for overseas project construction and general corporate purposes. The bonds are issued by Rongshi International Finance and guaranteed by SDIC. Banks bought 60%, asset managers 17%, financial institutions 15% and government and sovereign-related investors 8%. APAC took 99% and the rest went to EMEA. The new bonds are priced 32.7bp tighter to its existing 3.625% May 2027s that yield 2.29%.

Yichang High-Tech Investment Development raised $100mn via a 3Y bond at a yield of 5%, 10bp inside initial guidance of 5.1% area. The bonds have expected ratings of BB+ (Fitch). Proceeds will be used for offshore debt refinancing.

Heze City Investment Holdings raised $119mn via a 364-day note at a yield of 4.55%, 75bp inside initial guidance of 5.3% area. The bonds are unrated. Proceeds will be remitted onshore for investment in subsidiaries, project investment, debt refinancing and general corporate purposes. The bonds are issued by wholly owned subsidiary Heze City Investment Holdings International and guaranteed by Heze City Investment Holdings.

New Bonds Pipeline

- Export-Import Bank of Malaysia hires for $ bond

- Government of Hong Kong hires for $/€ green bond

- Sinochem Hong Kong hires for $ 3Y and € 4/7Y bond

- Jinan Hi-tech Holding hires for $ bond

- Renesas Electronics hires for $ 3Y green / 5Y bond

- NTT hires for € bond

- Port of Newcastle hires for $ 10Y bond

- Plaza Indonesia hires for $ 5NC3 sustainability-linked bond

Rating Changes

- Moody’s upgrades Diamondback Energy to Baa3; outlook stable

- Moody’s upgrades Devon Energy to Baa3

- Fitch Upgrades NXP Semiconductors to ‘BBB’; Outlook Stable

- Moody’s affirms Weibo’s Baa2 ratings; outlook revised to negative from stable

- Marubeni Outlook Revised To Positive On Stronger Finances; ‘BBB’ Ratings Affirmed

- Moody’s changes outlook on Nokia’s ratings to positive from stable

Term of the Day

Indexation

Turkey’s corporates, banks and government have a combined $13bn in external debt due through November and December, of which $8bn is due in November. This is the largest amount due over the next 10 months as per Bloomberg data. Bloomberg notes that these repayments tend to increase demand for foreign currency, thereby adding downward pressure on the lira. Further, as the government expects gas consumption to rise 25% in 2021, there is likely to be an increase in demand for natural gas from overseas sources that will also lead to a higher demand for dollar, that could further weaken the lira. Given the current backdrop of the central bank cutting rates twice in September, it underlines the risk of such actions on the economy, which relies heavily on external financing. The lira is already down 25% YTD to a record low and continues to trade weak at 10.01 to the US dollar.

Talking Heads

On China’s debt crisis unlikely to infect global markets – JPMorgan’s Jamie Dimon

“We do not expect China’s property woes to have a big impact…[The Fed’s] job is to highlight the risks. He said mainland China’s recent debt crisis led by property companies will not be a big issue because the country has made strides in improving transparency and regulations.

On Ex-Fed Officials Dudley, Lacker See Rates Rising to at Least 3%

Ex-New York Fed President William Dudley

“They will probably start after June or a little bit later, and go to a higher rate than people think… I certainly expect the peak to be well above the 1.75% price point… The crystal ball is cloudy as you get further out.”

Former Richmond Fed President Jeffrey Lacker

“It seems to be plausible we get to 3.5% or 4% and in addition that we push the economy into a recession”

On Inflation Posing High Risk for Investment-Grade Bonds

Morgan Stanley strategists

With current high valuations, there’s little room for error, and even slight stresses can weigh on returns, . On top of that, corporate earnings are increasingly at risk from supply-chain problems and wage pressure. The likelihood of a mid-cycle correction is high.

Gregory Staples, head of fixed income at DWS North America

“We’ve been running short duration in our portfolios”

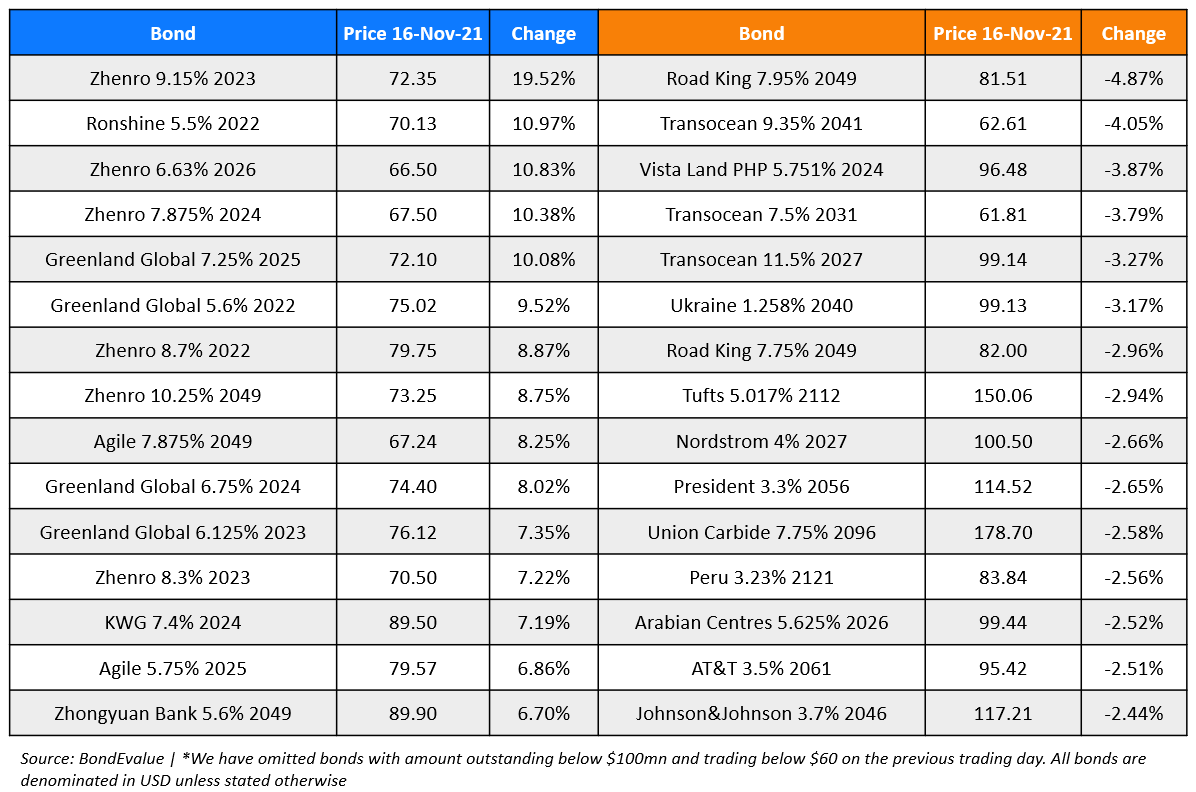

Top Gainers & Losers – 16-Nov-21*

Go back to Latest bond Market News

Related Posts: