This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

8 New Deals Incl. NWD, Yango, Times China; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

May 27, 2021

S&P closed higher by 0.2% while Nasdaq ended up by 0.6%. Tesla was among the gainers, up 2.4%. Fed officials continue to play down inflation fears with US 10Y Treasury yields easing 4bp to 1.58%. European Indices remained almost unchanged with FTSE and CAC flat while DAX down 0.1%. US IG CDS spreads were 0.3bp tighter and HY spreads were 2bp tighter. EU main spreads were 0.2bp tighter and crossover spreads tightened 2.6bp. Asian equities are off to a soft start, down ~0.1% while Asia ex-Japan CDS spreads tightened 0.7bp. Another busy day for Asian primary markets with 8 new issues including the likes of Greenland, NWD, Times China and Yango.

Do you invest or plan to invest in CoCo/AT1 bonds?

If yes, do attend the upcoming masterclass conducted by debt capital market professionals Pramod Shenoi, Head of Research APAC at CreditSights and Rahul Banerjee, Founder and CEO at BondEvalue. The session will cover understanding the AT1 structure, common features & covenants, and how to pick the right AT1 bond(s) for you. Click on the banner below to register.

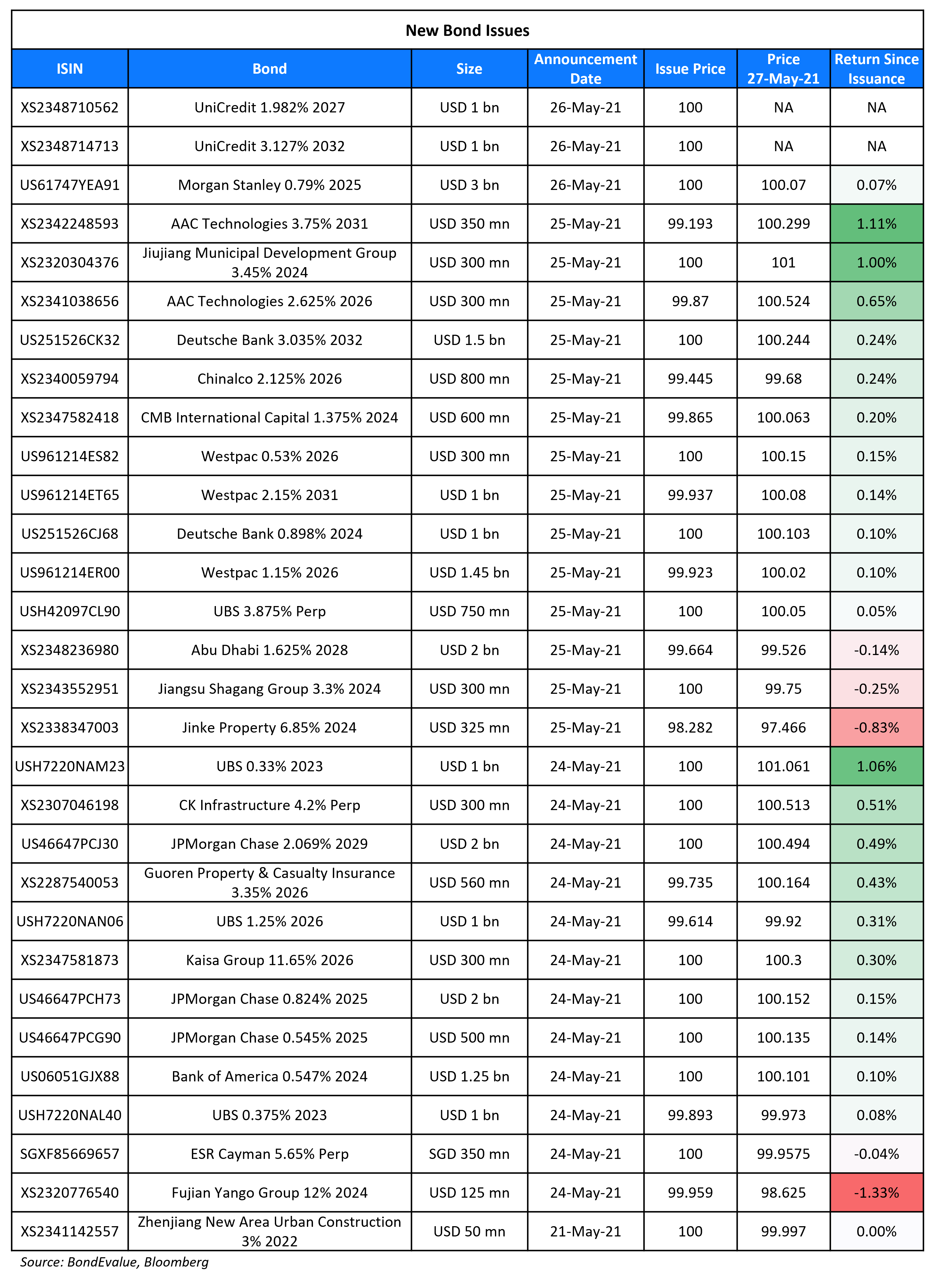

New Bond Issues

- New World Development $ PerpNC7 at 4.5% area, alongside tender offer

- Greenland Hong Kong 364-day $ notes at 9.75% area

- Times China Holdings $ 3NC2 bonds at 6.05% area

- Yango Group capped $290mn 3.25NC2.25 green bond at 8.45% area

- Shandong Finance Investment $ 5Y bond at 2.8% area

- Zhuzhou Geckor Group $50mn 3Y credit-enhanced bonds at FPG 3.5%

- Lendlease Global Commercial REIT S$ PerpNC5 at 4.35% area

- Mamoura $ 10Y and 30Y Formosa at MS+130bp area and 3.7% area

Westpac raised $2.75bn via a three-trancher. It raised:

- $1.45bn via a 5Y bond at a yield of 1.166%, 22.5bp inside initial guidance of T+62.5bp area.

- $500mn via a 5Y floater (FRN) at SOFR+52bp vs. initial guidance of SOFR equivalent area

- $1bn via a 10Y bond at a yield of 2.157%, 27.5bp inside initial guidance of T+87.5bp area

The bonds are unrated and received combined orders over $8bn, 2.9x issue size.

Morgan Stanley raised $3bn via a 4Y non-call 3Y (4NC3) bond at a yield of 0.79%, 17bp inside initial guidance of T+65bp area. The bonds have expected ratings of A1/BBB+/A. The bonds are callable at par one month prior to maturity and also have a make whole call (MWC) until May 30, 2024. Proceeds will be used for general corporate purposes.

UniCredit raised $2bn via a dual-trancher. It raised $1bn via a 6NC5 bond at a yield of 1.982%, 25bp inside initial guidance of T+145bp area. It also raised $1bn via a 11NC10 bond at a yield of 3.127%, 25bp inside initial guidance of T+180bp area. The bonds have expected ratings of Baa1/BBB/BBB-. The 6NC5s are callable on June 3, 2026 and the 11NC10s are callable on June 3, 2031 at par, and if not called, the coupon resets to the 1Y Constant Maturity Treasury (CMT) + initial margins of 120bp and 155bp respectively.

OUE Commercial REIT raised S$150mn via a 5Y bond at a yield of 3.95%, 20bp inside initial guidance of 4.15% area. The bonds are unrated and received orders over S$415mn, 2.8x issue size. Private banks will get a 25 cent rebate. OUE CT Treasury is the issuer and DBS Trustee is the guarantor.

CMB (China Merchants Bank) International Capital raised $600mn via a 3Y bond at a yield of 1.421%, 40bp inside initial guidance of T+150bp area. The bonds have expected ratings of Baa1, and received orders over $2.5bn, 4.2x issue size. Asian took 99% and Europe 1%. Banks and financial institutions were allocated 67%, fund/asset managers 29%, and sovereign wealth funds/insurers/private banks 4%. The bonds are issued by wholly owned subsidiary Legend Fortune and guaranteed by CMB International Capital. CMB’s investment banking arm plans to use proceeds for general corporate purposes.

Jiangsu Shagang Group raised $300m via a debut 3Y bond at a yield of 3.3%, 50bp inside initial guidance of 3.8% area. The bonds have expected ratings of BBB-, and received orders over $1.1bn, 3.7x issue size. Asian took 98% and Europe/offshore US took 2%. Banks and financial institutions received 57%, fund/asset managers 39%, and sovereign wealth funds/insurers/others 4%. Proceeds will be used for offshore debt refinancing. The bonds will be issued by Wealthy Vision Holdings and guaranteed by Jiangsu Shagang.

AAC Technologies raised $650mn via a two-trancher. It raised $300mn via a 5Y bond at a yield of 2.625%, 40bp inside the initial guidance of T+225bp area. It also raised $350mn via a 10Y bond at a yield of 3.75%, 45bp inside the initial guidance of T+270bp area. The bonds were rated Baa2 and received combined orders of over $5.2bn, 8x the issue size. For the 5Y bond, APAC bought 88% and EMEA 12% – Asset/fund managers got 79%, insurers and pensions 14%, and banks/private banks/others 7%. For the 10Y, APAC bought 78% and EMEA 22% – Asset/fund managers got 81%, insurers and pensions 11%, and banks/private banks/others 8%. Proceeds will be used for refinancing and general corporate purposes. AAC listed in HK, is a manufacturer of miniature components including acoustic and touch screen feedback systems for smartphones.

Jiujiang Municipal Development Group raised $300m via a 3Y bond at a yield of 3.45%, 45bp inside the initial guidance of 3.9% area. The bonds have expected ratings of BBB- and received orders of over $1.4bn, 4.7x issue size. Proceeds will be used for onshore project construction. The issuer is wholly owned by The Jiujiang State-owned Assets Supervision and Administration Commission, an investment/financing/construction platform in Jiangxi province.

Chinalco Capital Holdings Ltd raised $800mn via a 5Y bond at a yield of 2.125%, 40bp inside the initial guidance of T+185bp area. The bonds were rated A- and received orders of over $4bn, 5x the issue size. Asian investors took 99% and Europe 1%. Banks and financial institutions were allocated 67%, fund/asset managers 29%, and sovereign wealth funds/insurers/private banks 4%. The bonds are guaranteed by state-owned Aluminium Corporation of China (Chalco). Proceeds will be used for offshore debt refinancing.

Jinke Property raised $325mn via a 3Y bond at a yield of 7.5%, 20bp inside the initial guidance of 7.7% area. The bonds have expected ratings of B+, a notch lower than the issuer rating and received orders over $1.45bn, 4.5x the issue size. The notes provide a 20-cent rebate for private bank orders.

Hong Kong-listed Chinese natural gas operator, Zhongyu Gas pulled its $200mn 3Y issuance. Prior to the announcement, the bonds were expected to be issued at a yield 6%, 10bp inside the initial guidance at 6.1% area. The bonds had expected ratings of Ba3/B+, and had received orders over $520mn, 2.6x the issue size. The reason for pulling the bond deal is unclear.

Rating Changes

- Lufthansa’s Hybrid Bond Downgraded To ‘CC’ By S&P On Deferral Risk; Other Ratings Unchanged

- Kongsberg Automotive Outlook Revised To Positive From Negative By S&P On Strong Deleveraging Prospects; ‘B-‘ Rating Affirmed

- GeoProMining Investment (CYP) Ltd. ‘B+’ Rating Affirmed And Removed From CreditWatch Negative By S&P; Outlook Negative

- Coca-Cola Consolidated Inc. Outlook Revised To Positive By S&P On Continued Debt Repayment, Ratings Affirmed

- Fitch Revises Baytex’s Outlook to Stable; Affirms Ratings at ‘B’

- Fitch Affirms CEMEX’s IDRs at ‘BB-‘; Outlook Revised to Stable

- Fitch Revises Outlook on Prudential plc to Stable; Affirms IDR at ‘A’

- Mexican Conglomerate Grupo KUO Outlook Revised To Stable From Negative By S&P On Likely Stronger Performance, Rating Affirmed

- British Airways PLC’s 2020-1 Class A Pass-Through Certificates Upgraded To ‘A+(sf)’ By S&P On Depositary Provider Termination

- Moody’s withdraws Enel Generacion Chile S.A. rating for business reasons

New Bond Pipeline

- Qingdao Jiaozhou Bay Development hires for $ bonds

- Indofood CBP Sukses Makmur hires for $ bond

- Pakistan WAPDA $ green bond

- Maldives HDC $ sukuk

- CSC Financial sets up US$3bn

Term of the Day

Keepwell Provision

A keepwell provision is a legal agreement between a parent company and a subsidiary to ensure solvency and financial stability of the subsidiary for the duration of the agreement. Keepwell provisions are included in bond terms to offer bondholders confidence on the issuer’s ability to repay. The keepwell structure emerged around 2012-2013 to assuage concerns of investors over a bond issuer’s creditworthiness. However, it is important for investors to understand that keepwells are not a guarantee that the parent company will support the subsidiary in the event of a default, and there has previously been no precedent on the enforcement of keepwell structures.

Peking University Founder Group (PUFG) was accused in a filing to Hong Kong’s High Court this week after failing to make good on keepwell deeds for its dollar bonds. Bloomberg also reports that keepwell structures are also present on China Huarong’s bonds with most of its $22bn of dollar debt having such provisions from the onshore parent.

Talking Heads

Randal Quarles, Fed vice-chair

“If my expectations about economic growth, employment, and inflation over the coming months are borne out . . . and especially if they come in stronger than I expect . . . it will become important for the [Federal Open Market Committee] to begin discussing our plans to adjust the pace of asset purchases at upcoming meetings,” Quarles said. “In particular, we may need additional public communications about the conditions that constitute substantial further progress since December toward our broad and inclusive definition of maximum employment,” he added. “The best analysis we currently have is that the rise in inflation to well above our target will be temporary. But those of us on the FOMC are economists and lawyers, not prophets, seers and revelators. We could be wrong, and what happens then?” “Part of the calculus in balancing the risks of either overshooting or undershooting our 2 per cent goal is that the Fed has the tools to address inflation that runs too high, while it is more difficult to raise inflation that falls below target.” “If we had changed our monetary policy framework at 6 per cent inflation, that would be a different sort of thing. We have some elbow room to be wrong here.”

Richard Clarida, Fed vice-chair

“There will come a time in upcoming meetings, we’ll be at the point where we can begin to discuss scaling back the pace of asset purchases.” “It’s going to depend on the flow of data that we get.”

“There will come a time in upcoming meetings, we’ll be at the point where we can begin to discuss scaling back the pace of asset purchases.” “It’s going to depend on the flow of data that we get.”

Mary Daly, San Francisco Fed president

We’re talking about talking about tapering, and that is what you want out of us,” she said. “You want to be long-viewed here.”

“The policy trend is now focused on ensuring financial stability,” said Wolf. “Beijing will want to resolve bubbles risks at the outset, in a targeted manner, using strong rhetoric and small adjustments to policy. That appears to be enough for now.” “When you have a closed capital account like China and you loosen policy through the credit channel, the money stays contained domestically.” “It then needs to find a place. It can be housing, it can be stocks — it moves across the financial system. This is one of the biggest constraints to policy and is why China has been quick to remove stimulus this year.”

Larry Hu, chief China economist at Macquarie Group

“Notably, the government said in April that insolvent local government financing vehicles should go bankrupt,” Hu said. “Since LGFV bonds have never defaulted before, it could cause market jitters if it happens for the first time.”

In a note by Citic Securities

“In general, given the countercyclical adjustment to the pandemic and the [recent] tightening of LGFVs, it indicates that the risk of a correction in the LGFVs market is increasing.”

Banny Lam, head of research at CEB International Investment

“China’s economy is still recovering,” said Lam. “So I think a restructuring is more likely, possibly through state companies to minimise the impact on confidence. Huarong is a good example.”

Zhang Ming, senior fellow and deputy director at the Institute of Finance & Banking at the Chinese Academy of Social Sciences

“In the future, we may have to swap a kind of special national debt to replace local government debt. If the central government does not intervene in time, then once local government debt breaks out, the pressure will shift to the banking system.” “Considering that the banking system plays an important role in the country’s financial system, when there’s a systemic crisis, the central government will definitely intervene.”

“Due to an internal processing error, nevertheless provisional credits were made and became visible to clients. No payment has been made.”

“We are underwhelmed by the goals and penalties associated with recent SLB deals,” Liberatore wrote. “The goals or targets can be gamed to make them relatively easy to achieve, sometimes based on the issuer’s current trajectory, and without the need for meaningful new investment.” “This makes it virtually impossible for an investor to know how the proceeds of the bonds were directed and what specific outcomes they delivered,” wrote Liberatore. “And while it doesn’t meet our impact standards, it may contribute to our view of the issuer as an ESG leader willing to source capital in public markets with a link to goal-setting and accountability,” he wrote.

Dave Plecha, the global head of fixed income at Dimensional

“Rising interest rates do not automatically imply a negative return for a bond,” said Plecha. “We develop portfolios with higher expected returns than the benchmark and over the years we’ve delivered on that.” “[Eugene] Fama’s work shows that, on average, when yield curves are upwardly sloped, you can expect larger premiums for moving out the curve,” he said. “That tells us to go out and extend duration and collect them.”

Eugene Fama, professor at the University of Chicago Booth School of Business and Dimensional consultant

“Companies and governments are issuing tons of debt and they’re all getting snapped up.” “Investors are still buying a lot of bonds.”

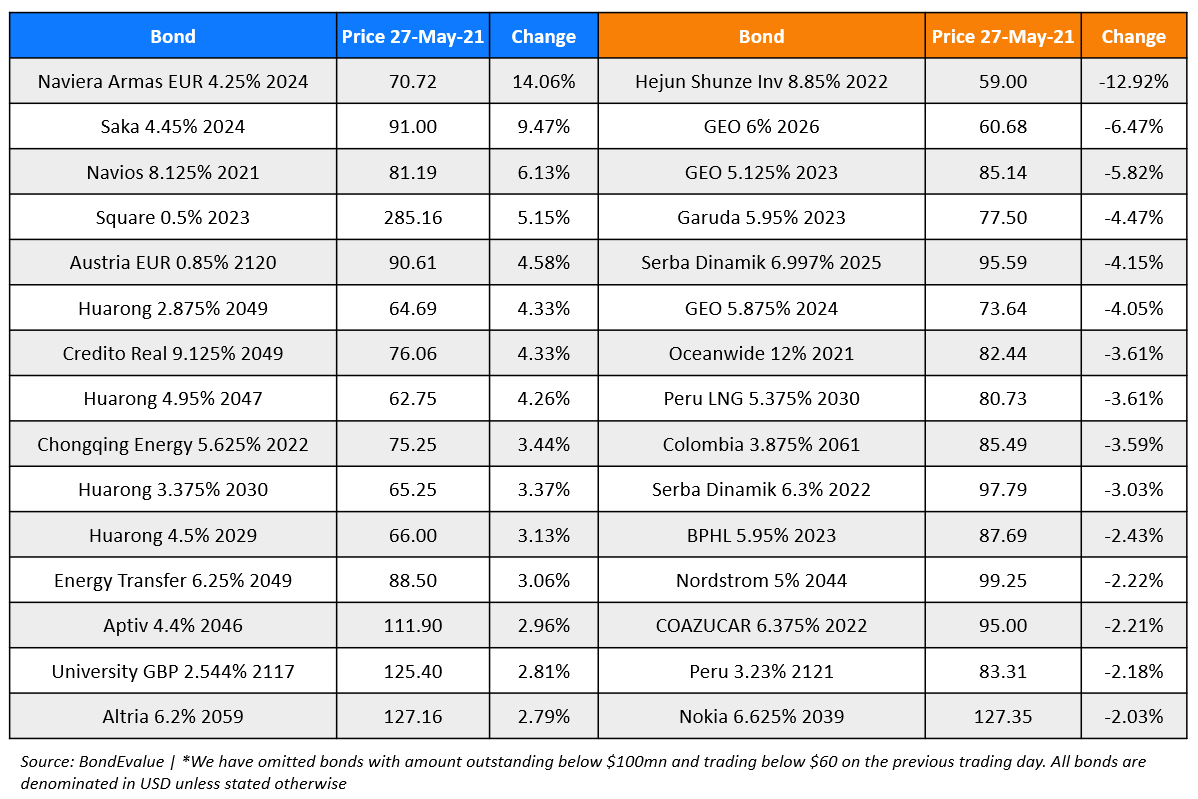

Top Gainers & Losers – 27-May-21*

Go back to Latest bond Market News

Related Posts: