This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

AA REIT, Qingdao China Launch Bonds; Vedanta Plans to Raise $1.5bn via Bonds; Boeing & Nomura Outlook Lowered

August 6, 2020

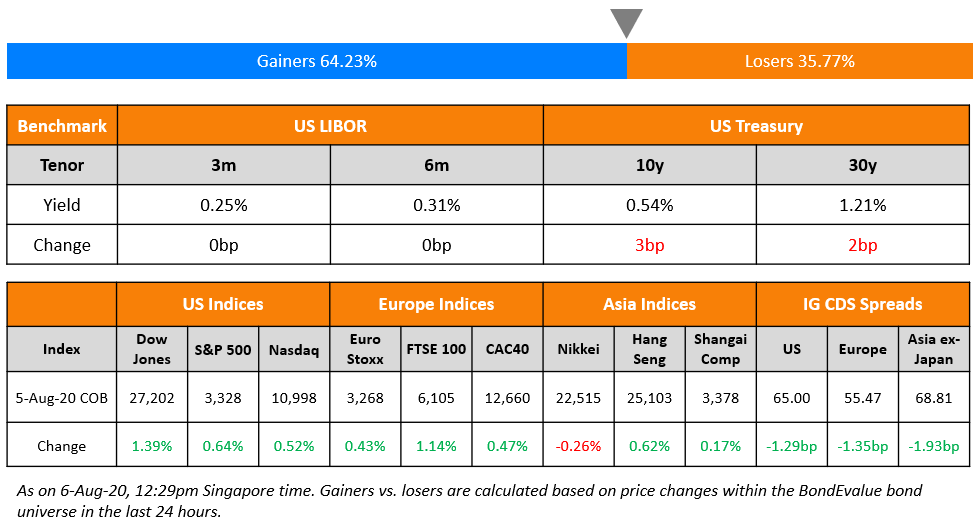

Another positive session overnight on Wall Street as solid earnings and hopes of the new Covid-19 stimulus package from US lawmakers improves sentiment. Data was mixed with only a slight increase in US ISM services index and a disappointing ADP employment report that showed that private sector jobs rose by only 167k vs a 1.5mn forecast. This could be signalling a weak July payrolls this Friday. Stock indices rose, powered by an 8.8% rise in Disney and 2.1% rise in Amazon. European shares posted similar increases. A $270bn increase in the US government’s Q3 supply forecast weighed on Treasuries where yields were higher by 1-3bp. CDS spreads continued to tighten and in the Asian dollar bond market, spreads are tightening at a faster pace with a busy issuance pipeline.

New Bond Issues

- AA REIT S$ Perp NC5 @ 5.75% area

- Qingdao China Prosperity $ 200 mio 3yr @ 3.9% area

Barclays raised $1.5bn via perpetual non-call 5.3Y (PerpNC5.3) Additional Tier 1 bonds at a yield of 6.125%, 50bp inside initial price guidance of 6.625% area. The bonds have an expected rating of Ba2/B+/BBB-. The bonds are callable at par plus any accrued interest from December 2025 to first coupon reset date in June 2026, or on any subsequent reset date thereafter. The coupon will reset every five years to the 5Y Treasury yield plus a margin of 586.7bp. The AT1s will convert to equity if common equity Tier 1 ratio drops below 7%.

CMB Financial Leasing raised a total of $1.2bn from a dual-tranche bond offering. It raised $800mn via 5% bonds to yield 1.920%, 170bp over Treasuries and 55bp inside initial guidance of T+225bp area. It also raised $400mn via 10Y to yield 2.828%, 228bp over Treasuries and 52bp inside initial guidance of T+280bp area. The bonds, with an expected rating of Baa1, received orders over $8.5bn before the final guidance was announced, 7.08x issue size.

Hong Kong-listed real estate company Central China Real Estate raised $300m via 4Y non-call 2Y (4NC2) bonds to yield 7.35%, 30bp inside initial guidance of 7.65% area. The bonds, with expected ratings of B1/BB–, drew final orders over $3.5bn, 11.7x issue size.

Another Hong Kong-listed Chinese real estate company Yuzhou Group Holdings raised $300mn via 6Y non-call 4Y (6NC4) green bonds to yield 7.85%, 50bp inside initial guidance of 8.35% area. The bonds, with expected ratings of B1/BB–, drew final orders over $1.45bn, 4.83x issue size. Yuzhou Group plans to use the proceeds to fund a concurrent tender offer capped at $300mn for its $375m 6.375% notes due 2021. The purchase price is $1,005 per $1,000 in principal amount plus accrued and unpaid interest.

Zhongtai Financial International raised $300mn via 3Y bonds to yield 3.85%, 40bp inside initial guidance of 4.25% area. The bonds received orders over $1.05bn when final guidance was announced, 3.5x issue size. Wholly owned subsidiary Zhongtai International Finance (BVI) Co is the issuer and parent company Zhongtai Financial International is the guarantor.

Rating Changes

Fitch Upgrades Gansu Provincial Highway to ‘BBB+’; Outlook Stable

Moody’s upgrades Forum Energy’s CFR to Caa2; outlook stable

Fitch Revises Outlook on Nomura’s IDRs to Negative; Affirms Ratings

Boeing Co. Outlook Revised To Negative From Stable On Weaker Aircraft Demand; Ratings Affirmed

Fitch Affirms Hilong at ‘RD’; Withdraws Ratings

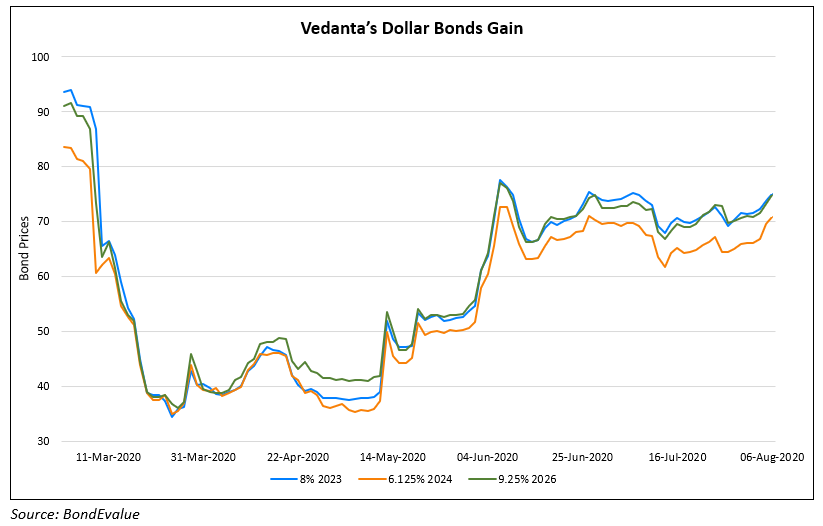

Vedanta to Raise $1.5 Billion via Offshore Bond

Vedanta Resources plans to raise up to $1.5bn via an offshore bond sale as the group is in the process of arranging funds for the buyout of Vedanta Ltd. The proceeds of the proposed bond sale are likely to fund the financing requirements to delist the holding company, which is currently listed in India. Vedanta’s board had approved the delisting on May 18. The bonds, which are expected to be sold through an offshore special purpose vehicle within the next few weeks, are likely to have a tenor between 1Y and 5Y. The proposed deal, led by Barclays, JP Morgan and Standard Chartered Bank, may contain covenants that include ‘Dividend Upstreaming‘ of various group companies. “This is part of the fundraising exercise, which is aimed at supporting the company’s buyback programme,” said one ET source. A senior executive working with the Vedanta group said that “Cash is available cheap and that’s why the conglomerate is interested in leveraging, which should prove fruitful in terms of funding costs over a period of time,”. Vedanta’s dollar bonds have seen an upward trend since the delisting news even though Moody’s lowered its outlook of the company on July 28 to negative, reflecting the company’s weak liquidity and sizeable upcoming refinancing needs. Vedanta’s 8% and 6.125% bonds due 2023 and 2024 traded higher by ~1 point to 75 and 71 cents on the dollar.

For the full story, click here

Boeing’s Outlook Lowered by S&P; CFO Says No Plans to Raise More Debt

S&P lowered its outlook on Boeing from stable to negative while affirming its credit rating of BBB-, just one notch above junk. S&P cited the pandemic’s impact on global air travel leading to weaker aircraft demand as the reason for the change in outlook. However, the rating agency said that Boeing should have sufficient liquidity to cover large cash outflows over the next 6-12 months, and expects free cash flow to turn positive in 2021. Boeing could see a downgrade if funds from operations to debt remains below 20%, or free operating cash flow to debt remains below 10% for the next 12-24 months and if the commercial aircraft market remains depressed for more than 2-3 years.

At a conference conducted by Jefferies, Boeing CFO Greg Smith said that the company is being frugal with its cash to tide through potentially “dire” scenarios as it navigates the current tepid environment caused by the pandemic. He added that he does not intend to tap the bond markets for additional liquidity. He outlined a plan to reap cash from two of its models, the Max and the 777X, which have been a drain on the company over the past few months. Investors seem to have shrugged off the outlook change and focused on the CFO’s commentary as its stock closed up over 5% while its longer-dated bonds traded higher over the last few days. Boeing’s 5.705%, 5.805% and 5.93% bonds due 2040, 2050 and 2060 traded higher by ~2-3 points since Monday’s close to trade at 116, 120 and 123 on the secondary markets.

For the full story, click here

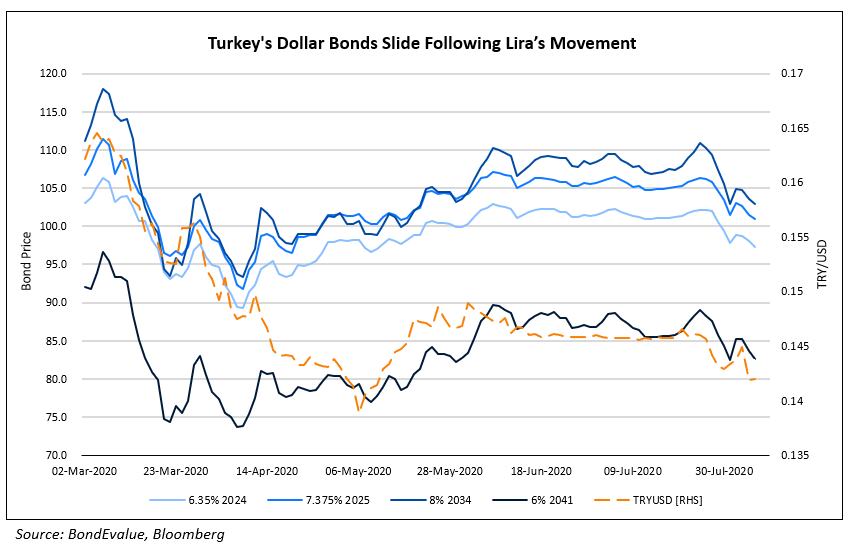

Turkish Dollar Bonds Trend Lower on Heightened Pressure on the Lira

Turkey’s dollar bonds joined the despised ‘Top Losers List’ on Thursday on continued stress on the Turkish Lira (TL). The pressure on the currency heightened despite interventions from the Turkish central bank, which has been actively trying to keep the pin to the dollar less than TL6.85. However, the efforts fell short as the Lira fell to the lowest point since May 12 against the dollar when it traded at TL7.05 against the dollar. The increase in the cost of borrowing the currency has increased to levels last seen in March last year and is seen as the reason for the fall of Lira. According to an economist at Tera Securities, Istanbul, “The extraordinary situation at the start of the week came as Turkish Lira liquidity in international markets dried up” and added that with the swap market effectively frozen, there was “serious” selling in Turkish stocks and bonds as foreign investors scrambled to meet their Lira liabilities. The yield on the 10Y local government bond reached its highest level of 13.4% since March. According to Goldman Sachs estimates, the central bank of Turkey used $65bn reserves to maintain the currency pin in the current year against $40bn spent for the same purpose in the previous year. Depletion of reserves adversely affects the future pinning efforts of the central bank and also reflects poorly on the actions initiated by the central bank. Although the massive offloading of the dollar helped pin the Lira against the dollar, it fell against the other currencies like the Euro. “The Turkish lira could be on the brink of yet another precipitous fall versus the dollar,” said Piotr Matys, strategist at Rabobank. According to estimates by Citi, the dollar could hit a record at TL7.25 in the next three months reaching TL7.75 in a year and could touch TL8.25 in the long term. Turkey’s dollar bonds have been under stress for a week now, as we had reported on Aug 3.

For the full story, click here

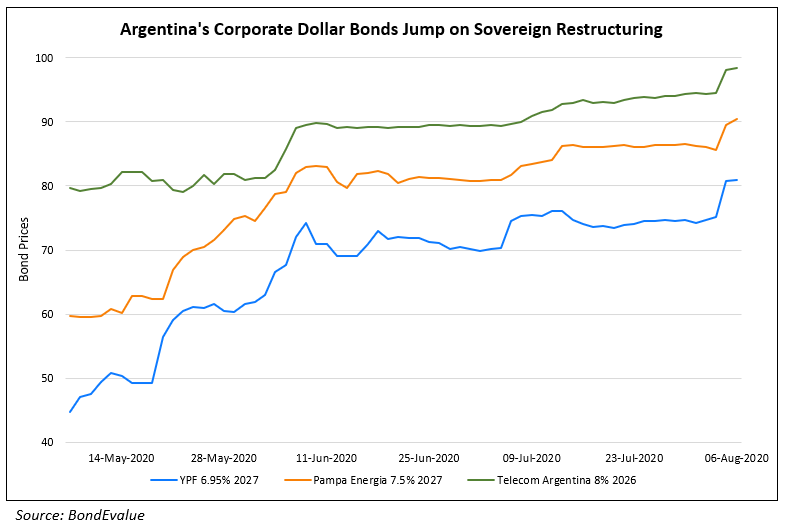

Argentine Corporates’ Dollar Bonds Jump on Sovereign Restructuring Deal

Argentine corporates saw its dollar bonds rally on the secondary markets after the debt-laden Latin American nation reached a deal with creditors to restructure its debt. YPF led the charts with its dollar bonds up 3-8% followed by Pampa Energia’s 7.5% bonds due 2027 up 4.4% and Telecom Argentina’s 8% bonds due 2026 up 3.8%. As reported by S&P, YPF’s chairman Guillermo Nielsen said, “Yesterday was a key step for the country’s economic recovery,” Nielsen said, “Large companies can return to issuing debt on Wall Street.” He added, “The energy sector needs values to invest and continue producing,” he said. “There is something worse than expensive gasoline, which is that there is no gasoline. Investments are needed every year to continue supplying the oil and gas market, and that has certain requirements.” He said that restructuring deal will be key for reviving investment in oil and natural gas production, including in the giant Vaca Muerta shale play, but a recovery in diesel and gasoline demand and prices is as important.

Term of the Day

Dividend Upstreaming

Dividends are a means of distributing a company’s earnings with its shareholders and are generally dispersed to shareholders out of the company’s profits. However, when a subsidiary shares a part of its earnings with its parent company, it is termed as dividend upstreaming. Under dividend upstreaming, earnings apportioned for dividends flow (in part or full) from a first or second tier subsidiary enterprise to its parent company rather than it being paid to the shareholders.

Talking Heads

On US economic recovery in 2020 Q3

Federal Reserve Vice Chairman Richard Clarida

“The economy took a huge hit in the spring,” Clarida said. “My own personal forecast is that we’ll see a rebound in economic activity in the third-quarter data. The course of the economy is going to depend on the course of the virus, and it’s a complex picture. It will take some time I believe before we get back to the level of activity we were at in February before the pandemic hit,” he said. “My baseline view is that we could get back to the level of activity perhaps towards the end of 2021. There are a lot of moving parts with the virus and the global outlook. The longer this drags on, the greater risk there is to long-term damage to the economy,” Clarida said. “I don’t think we’re at that point yet.”

On the US economy clearly needing more fiscal support

Cleveland Fed President Loretta Mester

Mester says it’s “clear that more fiscal support is needed to provide a bridge for households, small businesses, and state and local municipalities that have borne the brunt of the economic shutdown until the recovery is sustainably in place”

“As the economy emerges from the reopening phase and moves into the recovery phase, the focus of Fed policy will expand from supporting market functioning and the flow of credit to ensuring that appropriate monetary policy accommodation remains in place to support the economy’s return to more normal levels of economic activity and employment and inflation’s moving back up,” Mester said.

“Although our policy rate is already at its effective lower bound, the tools that we used to support the recovery from the Great Recession, including forward guidance about the future path of policy and purchases of longer-term Treasuries and agency mortgage-backed securities, can be used to provide additional accommodation”

“Clear communications about our policy strategy, which is part of our current review of our monetary policy framework, can also make the monetary policy actions we take more effective. Higher-frequency data and discussions with regional contacts do indicate that economic activity has slowed in recent weeks. Thus, the reopening phase may be more protracted than many had anticipated when it started”

On the APAC high-yield corporate default rate and escalating credit risks

Clara Lau, Moody’s Senior Vice President and Group Credit Officer

“The second quarter of 2020 is likely to be the worst quarter for global economic contraction since World War II, with no quick recovery in sight. The ability of businesses to recover will depend on the pace of a rebound in consumer demand, which in turn hinges on governments’ ability to restore confidence by reducing fear of contagion. But new widespread outbreaks, if they occur, will cause renewed economic disruptions,” adds Lau.

On extending $25billion payroll aid for US airlines

In a letter by Republican Senator Cory Gardner and other Republican Senators

“With air travel anticipated to remain low in the near future, Congress should also consider provisions to support and provide flexibility for businesses across the aviation industry similarly impacted, such as airport concessionaires and aviation manufacturing,” the letter by Gardner and other Republican Senators said.

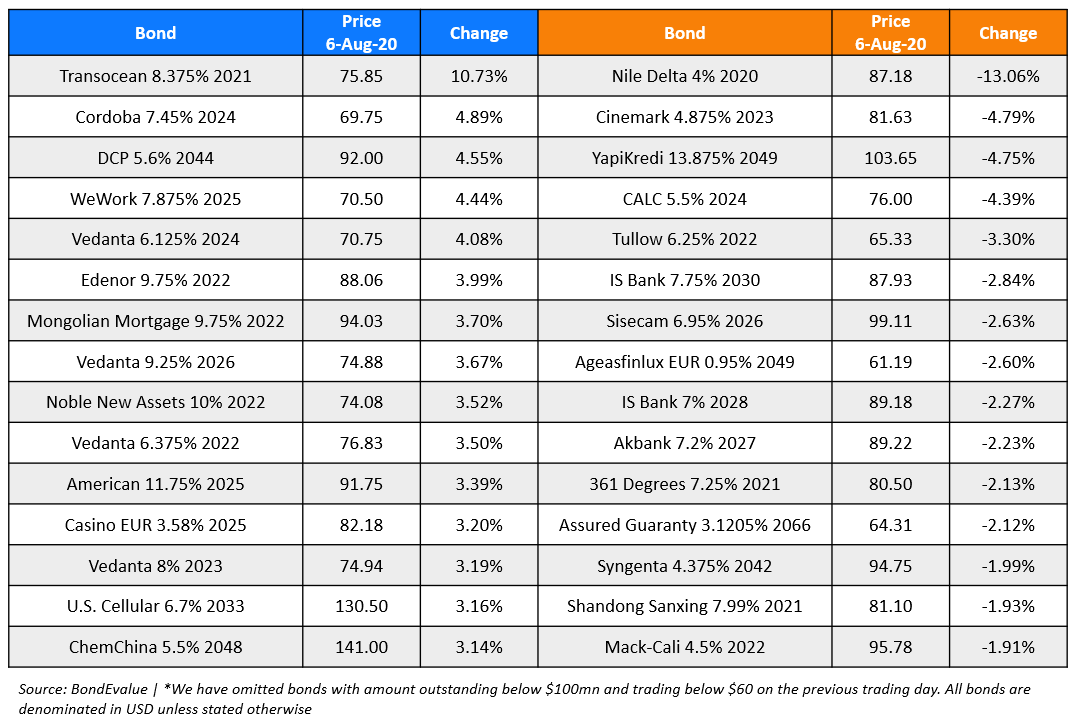

Top Gainers & Losers – 6-Aug-20*

Go back to Latest bond Market News

Related Posts: