This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

ABS Funding Drops for Chinese Developers, Adding to Sectoral Weakness

March 10, 2022

Asset Backed Securities (ABS) funding in the Chinese property sector has dropped by almost 50% to RMB 47.5bn ($7.5bn) in the first two months of 2022, according to data from Chinese information provider Heyi Fintech. This was the slowest annual start since 2018 and indicates the weak sentiment in the sector, given existing concerns in the debt capital markets and lack of willingness of banks to issue loans. The news adds to liquidity concerns of developers and weakens their ability to repay debt. For example, Shimao Group has $2.5bn in bond payments due in 2022 – $205mn due in Q1, $111mn in Q2, a massive $1.5bn in Q3, and $669mn in Q4. Besides, it also has to repay more than RMB 12bn ($1.9bn) in trust products this year, with Citic Trust and China Credit Trust being major creditors.

Go back to Latest bond Market News

Related Posts:

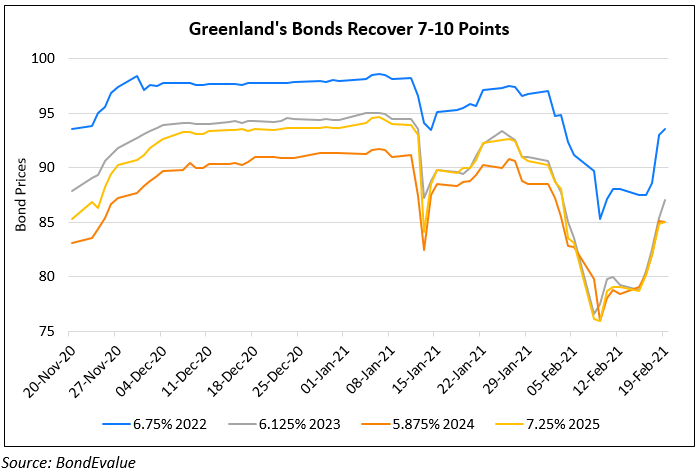

Greenland’s Dollar Bonds Recover 7-10 Points from Lows

February 19, 2021

Fantasia Downgraded to B3 by Moody’s

September 27, 2021