This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Adani Enterprises Planning Stock Offering

May 11, 2023

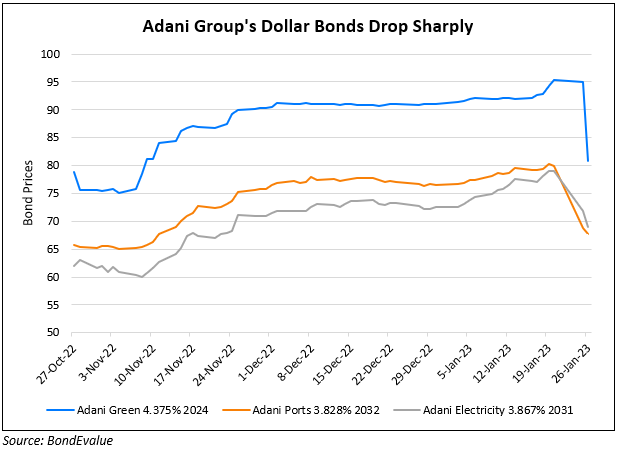

Adani Enterprises, the flagship unit of the Adani Group said in a statement that it will hold a board meeting on May 13 to consider a share offering. Details regarding the size of the potential issuance and the bankers it plans to hire were not revealed. None of Adani Group’s entities have tapped the public equity markets since the Hindenburg report in late January. However, the Adani family trust did raise $1.87bn via selling shares in the conglomerate to US boutique investment firm GQG Partners in early March. Brian Freitas, an equities analyst said, “The company appears to need the cash now”…the discount in the new offering “would have to be in the 10-15% range for investors to take a look at it, though it also depends on the offer size”. Adani Group’s units have tried to signal confidence to the markets of late via bond buybacks.

Adani group companies’ dollar bonds were trading steady – Adani Ports’ 3.375% 2024s were at 96.33, yielding 6.63%.

For more details, click here

Go back to Latest bond Market News

Related Posts: