This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Adani Said to Have Approached Pimco, BlackRock, Blackstone for $1bn Private Bond Placement

March 30, 2023

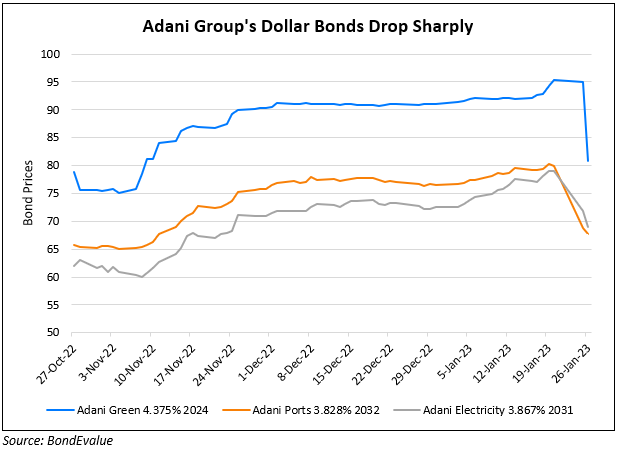

Adani Group is said to have reached out to major asset managers Pimco, BlackRock and Blackstone for a potential $1bn two-tranche private placement of bonds, as per sources. They said that it was part of Adani Group’s global roadshows that in US cities like New York, Boston, Los Angeles and San Francisco. In February, Bloomberg had reported that the conglomerate was considering issued privately placed bonds for at least three of its group companies. Sources say that the the first tranche would possibly be launched by September, to the tune of $450mn with a coupon of around the 8% area and a tenor of 10-20 years. They added that two of the group companies – Adani Transmission and Adani Green may sell these proposed bonds.

Adani Group’s dollar bonds were flat – Adani Transmission’s 4.25% 2036 is currently trading at 70.5, yielding 7.9%

For more details, click here

Go back to Latest bond Market News

Related Posts: