This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Banks Lend $1bn to Ghana to Boost Reserves

June 13, 2022

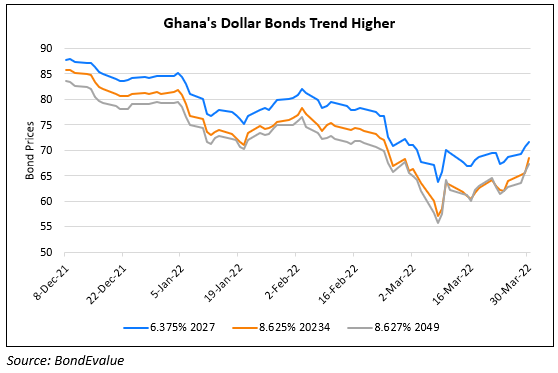

International banks have committed to lend Ghana $1bn. This is so that the African nation can achieve their goals of reducing their fiscal deficit, bolstering their central bank reserves and stabilizing their currency, all of which were unsettled due to the pandemic. Bloomberg notes that Ghana lost access to the Eurobond markets this year and their debt ratio rose to 78% of GDP (11.7% higher YoY) Besides, their currency cedi has depreciated against the dollar by 22% YTD (vs. a 1% appreciation during the same period last year). While this deal is not yet public, Bloomberg’s sources have detailed that $750mn had been raised through syndicated loans from about 8 African and European banks, and $250mn through multilateral institutes. Subsequently, Ghana is said to assess if it needs to raise a second tranche of $1bn after its mid-year budget review.

Despite the positive news, Ghana’s 7.75% dollar bonds due 2029 were trading lower at 51.04 cents on the dollar, down 1.46 points.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Ghana Downgraded to B- by Fitch

January 17, 2022

Ghana Downgraded to Caa1 by Moody’s

February 7, 2022