This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Beijing Properties & E-House Launch Taps of $ Bonds; Casino, PizzaExpress, Gol Downgraded

August 7, 2020

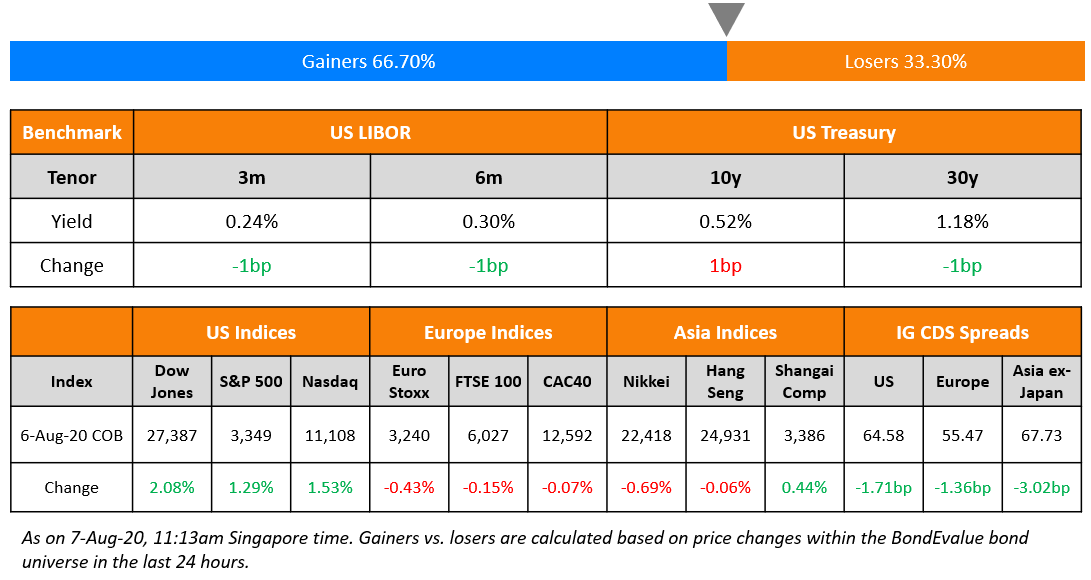

Wall Street had another positive overnight session as expectations of a deal on the next US stimulus package will be reached soon. Recent economic data has been mixed so investors will be watching out for today’s payrolls number. Nasdaq gained around 1% helped by Apple and Facebook, which rallied 3.5% and 6.5% respectively. European shares did not do well as major indices were pulled down by energy and mining stocks. The US Treasury curve flattened by 1-2bp. Asian dollar bond spreads are set to close lower again this week but deals have slowed down. Asian markets are opening slightly lower this morning.

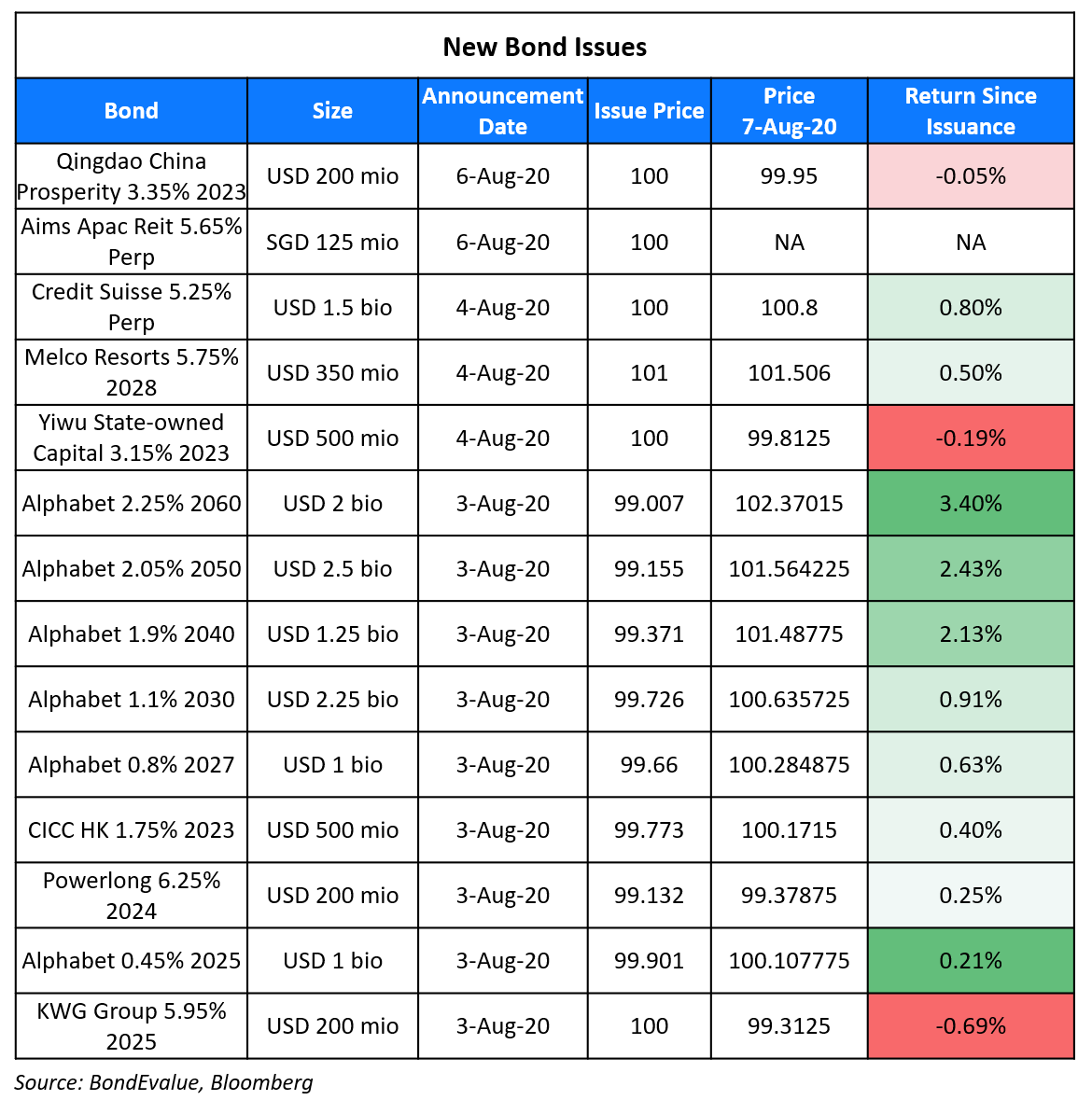

New Bond Issues

- Beijing Properties $ 150 mio tap 5.95% 2023 final @ 6%

- E-House China $ 100 mio tap 7.625% 2022 @ 7.25% area

Qingdao China Prosperity State-owned Capital Operation (Group) raised $200mn via 3Y bonds to yield 3.35%, 55bp inside initial guidance of 3.9% area.The bonds, with expected ratings of BBB, received orders over $1.7bn when the final guidance was announced, 8.5x issue size. The bonds will be issued by Huatong International Investment Holdings and guaranteed by the group.

AIMS APAC REIT raised S$125mn ($91.3m) via perpetual non-call 5Y (PerpNC5) bonds to yield 5.65%, 10bp inside initial guidance of 5.75% area. There will be a reset at the end of year five and every five years thereafter to the prevailing Singapore dollar SOR plus the initial spread of 520.7bp. This is the industrial REIT’s first perpetual bond. It has two outstanding bonds – a S$50mn 5Y 3.6% bond due in 2022 and a S$100m 5Y 3.6% bond due November 2024.

Rating Changes

Moody’s downgrades Casino’s ratings to B3; stable outlook

Moody’s downgrades ratings of PizzaExpress Financing 2 plc’s senior secured notes to Ca from Caa3

PizzaExpress Downgraded To ‘D’ After Missing Interest Payment

Mallinckrodt PLC Downgraded To ‘CCC-‘, On CreditWatch Negative On Possible Restructuring

Distressed Airlines: Garuda Seeks Covenant Waiver & Bridge Loan; Virgin Australia’s Bondholders Brace for Massive Haircut; Brazil’s Gol Downgraded to CCC-

Indonesian state-owned carrier Garuda Indonesia is scrambling for cash after it reported a huge loss of $713mn for the first half of 2020. This adds to the series of bad news for the carrier after it missed a payment on an asset-backed security in late July and is facing a lawsuit in London over aircraft rental fees. While the government had pledged to extend IDR 8.5tn ($580mn) as part of a $10bn package to distressed state-owned companies in May, the funds have not come through yet. In the latest update, Garuda is said to be in talks with creditors to get covenant waivers after it breached certain financial covenants with its latest earnings release. It is also in talks with Bank Mandiri, Bank Rakyat

Indonesia and Bank Negara Indonesia to obtain a bridging loan to fund its operations. Garuda’s 5.95% sukuk due 2023 traded unchanged at 67.7 cents on the dollar. The maturity on this security was extended by three years after it missed a payment in June.

For the full story, click here

Virgin Australia announced a restructuring plan on Wednesday that includes laying off 3,000 of its workers, getting rid of some of its planes and shutting down its budget carrier, Tigerair Australia. Virgin will be focusing on domestic and short-haul international flights, given the fall in demand for international travel because of the pandemic. “Making these changes now will secure approximately 6,000 jobs once market demand recovers, with potential to increase to 8,000 jobs in the future,” the airline added in a statement. However, missing from the restructuring plan announcement was details of the haircut that new owner Bain Capital would impose on bondholders. Virgin plans to release a detailed report on August 25, ahead of the second creditors’ meeting on September 4. According to IFR, Bain’s restructuring plan requires the approval of 50% of creditors by number and value. The largest creditor group by number is its workforce of ~9,000 (including the 3,000 to be laid off), followed by bondholders with ~6,000 holders. Bain is likely to push through with its plan without bondholders on board if it manages to get employee creditors approval and the administrator’s deciding vote. Based on the secondary markets, bondholders seem to be expecting an 80% plus haircut, given that its Aussie and dollar bonds are currently trading between 10-20 cents on the dollar.

Brazilian carrier Gol was downgraded by S&P to CCC- from CCC+ on increased likelihood of it missing an upcoming $300mn term loan payment due on August 31. S&P said in its ratings release, “We believe Gol will not be able to complete long-term financings, which have been under discussions in the past several months, in the next few weeks. These include the roughly R$2 billion capitalization package sponsored by BNDES (the Brazilian Development Bank) and new debts secured by unencumbered assets.” Gol’s bonds have been trading at distressed levels with its 7% bonds due 2025 and its 8.75% Perpetual trading at 57 and 53 cents on the dollar on the secondary markets.

For the full story, click here

Pacific Century Seeks Bondholder Approval to Amend Change of Control Clause

Hong Kong-based Pacific Century Premium Developments (PCPD) has launched a consent solicitation to amend the change of control on its $700mn 4.75% bonds due 2022. As per the current terms, the Change of Control clause will be triggered if PCCW ceases to directly or indirectly to hold or own at least 40% of the issuer’s outstanding shares. PCCW is the majority owner of telecom company HKT Limited. With the consent solicitation, PCPD proposes:

- To include Richard Li’s (and affiliates) shareholding in the 40% threshold and in the clause that requires PCCW to be the largest shareholder

- That the Change of Control clause be only triggered if the collective voting rights of PCCW, Richard Li and his affiliates drop below 40% instead of the current 50% in the event that PCPD merges or sells a stake to a third-party

Richard Li is the son of Li Ka-shing, Hong Kong’s richest man. Pacific Century is offering an early bird offer of 0.25% of principal if they give consent by August 17 and 0.05% to the holders that give consent between August 18 and 26. PCPC’s 4.75% bonds due 2022 are currently trading at 100.6 on the secondary markets.

Morocco Plans to Raise $2 Billion via International Bonds

Finance Minister Mohamed Benchaaboun announced that the Kingdom of Morocco is looking to tap the international bond markets as early as September without giving the further details. According to unnamed sources, the Kingdom could raise ~$2bn through a dual-tranche bond offering consisting of a €1bn and $1bn issue with a maturity of at least 5Y. The Finance Minister projected that the debt to GDP ratio for the sovereign is likely to increase to 75% in 2020 from 65% in 2019. Morocco is the only investment grade issuer and its dollar bonds have returned 4% to investors against 2.8% for the Bloomberg-Barclays EM Sovereign Bond Index. Last week, the central bank had also indicated the need to issue international bonds to maintain a buffer of foreign currency to cover a minimum of 5 months of import.

For the full story, click here

S&P Downgrades Pizza Express to Default on Missed Coupon Payment

S&P downgraded UK-based restaurant chain PizzaExpress from CC to D as the credit rating agency does not expect the company to make coupon payments within the 30-day grace period on its 6.625% and 8.625% sterling bonds due 2021 and 2022. PizzaExpress has entered into a lock-up agreement with its lenders and its main shareholder, Hony Capital, and is in discussions with its key stakeholders regarding a debt restructuring and a company voluntary arrangement (CVA). The rating agency said, “Once the group emerges from its restructuring or other form of reorganization, we will reassess the credit profile of the group, taking into account its U.K. focused business, new capital structure, and balance sheet. We will also review the factors that precipitated the default, along with any benefits from the reorganization process.” The two bonds expected to miss the payment were also downgraded by Moody’s to Ca from Caa3 yesterday.

PizzaExpress’ 6.625% GBP bonds due 2021 have fallen ~5 points over the past week to 60 pence on the pound on the secondary markets.

For the full stroy, click here

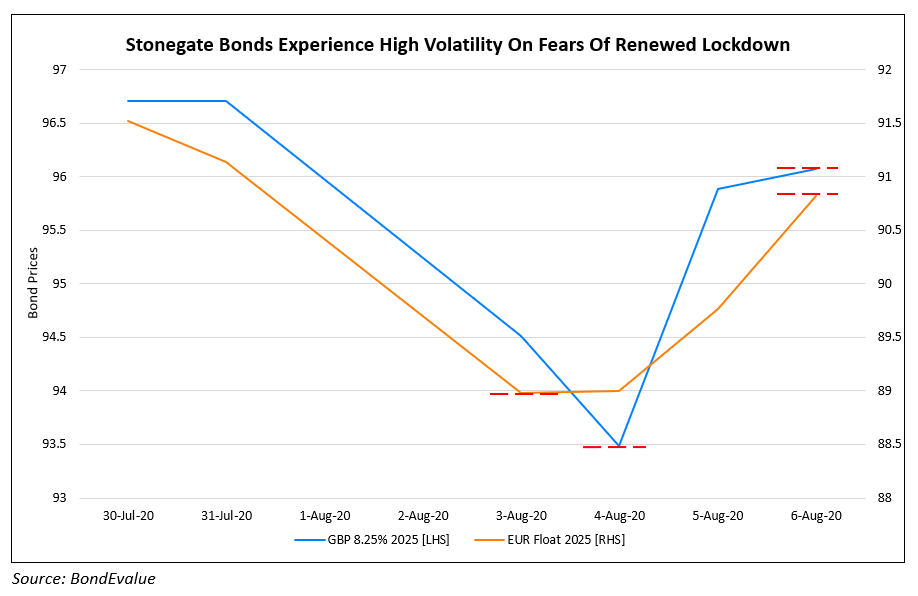

Stonegate’s New Sterling & Euro Bonds Face Volatility Just Weeks After Issuance

Stonegate, which owns the Yates and Slug & Lettuce pubs, sold high yield Sterling and Euro denominated bonds worth £1.2bn on July 24 to fund its takeover of Ei Group, which is the UK’s largest pubs operator. However, the bonds faced high volatility in the second week of issuance on fears of closure of pubs and bars in the UK as the count of positive coronavirus cases continued to rise. The bonds initially priced at 100 for the sterling and 93 cents for the euro tranche slipped to 93.5 pence on the pound on Aug 4 and 89 cents on the euro on Aug 3, before recovering to the current levels of 96 pence and 90.8 cents respectively. The volatility is as a result of speculation that the pubs would be the first to shut down in case any further lockdowns are implemented to tackle the spread of the pandemic. The bonds saw the drop after Downing Street announced on Aug 3 that there could be further restrictions imposed in case there was a resurgence in positive Covid-19 cases. The UK has seen a total of 308,134 positive cases as of Aug 6.

For the full story, click here

Term of the Day

Cross Default

Cross default is a covenant included in bond and loan documents that puts an issuer in default if it has defaulted on another debt instrument. To understand this better, let’s take the recent default of Chinese oil equipment company Hilong. After failing to get bondholders’ approval to exchange its $165.114mn 7.25% bonds due for maturity on June 22, the bonds were considered to be in default. This triggered a cross default on its $200mn 8.25% bonds due 2022. The cross default clause in this case would be for the 2022s. While the issuer did not actually default on the 2022s (currently trading at 41.5 cents on the dollar), they are considered to be in default because of the cross default clause. Thus, cross defaults tend to have a domino effect, which puts the issuer under further pressure of making repayments and reduces its ability to refinance.

Talking Heads

On BOE’s economic outlook – Andrew Baily, Governor of Bank of England

Bailey said that he would “really lean back on people who think the Bank of England is optimistic,” since the Monetary Policy Committee is “not taking any strong message from that going forwards.”

The “X factor,” Bailey said, will be the evolution of the Covid-19 outbreak, with the Bank’s forecasts including the “largest ever degree of uncertainty in any forecast the MPC has done.”

“Closely related to that is people’s natural caution in response to their perceptions and understanding of the evolution of Covid, and how people are cautious about re-engaging in economic activity,” Bailey said.

“The third thing … is to what extent there will be structural change in the economy, because there will be parts of the economy which are not viable, if you like, going forward,” Bailey added.

On the Indian economy at the monetary policy meet – Shaktikanta Das, Governor of the Reserve Bank of India (RBI)

“… the MPC is conscious of its medium term inflation target…Given the uncertainty surrounding the inflation outlook and extremely weak state of the economy in the midst of an unprecedented shock from the ongoing pandemic, the MPC decided to keep the policy rate on hold, while remaining watchful for a durable reduction in inflation to use available space to support the revival of the economy,” Das said.

“Accommodative stance of the monetary policy will continue as long as necessary to revive growth and mitigate the impact of COVID19 pandemic while ensuring that inflation remains within target going forward.”

“It is also important to convince both domestic and international investors that after the crisis associated with the pandemic is over, we will return to fiscal responsibility over the medium term, and the government should do more to convince them of that,” Rajan told the Global Markets Forum.

“The RBI and government have certainly been cooperating, but it seems like it is elsewhere, the ball is in the government’s court to do more.” He said the RBI needs to focus on whether credit is reaching the stressed areas of the economy and also if the viable firms were able to access credit and not the unviable ones. “And I think that’s where it has to focus its attentions, because resources, as you well know, are limited in India today.”

“What India should focus on at this point is protecting its economic capabilities, so that when it has dealt with the virus it can go resume activity in a reasonable way. That should be the focus. And if it does that, there is no reason why the rating agencies will not see that as an appropriate policy”.

On the Fed’s intervention to avoid economic shutdown – Oaktree Capital Group Co-Founder Howard Marks

“If they had not done the things they did, we would be talking about a much more serious economic event, we may even be using the word depression,” or perhaps global recession, Marks said.

As successful as the Fed has been in propping up corporate debt prices, the support is only temporary, and its inevitable withdrawal could put more companies at risk, Marks said. Having so much liquidity in the economy will likely lead to inflation, he said, “but that does not mean that it was a mistake. While the Fed and U.S. government have helped keep many businesses afloat, not all are appropriate candidates for relief, Marks said. Supporting companies that were otherwise doomed to fail, dubbed zombies, is taking away resources from others who are better positioned to recover, he said. The central bank can provide liquidity, but not solvency, he added.

“Companies that are unsuccessful should perish,” Marks said. “Let the chips fall.”

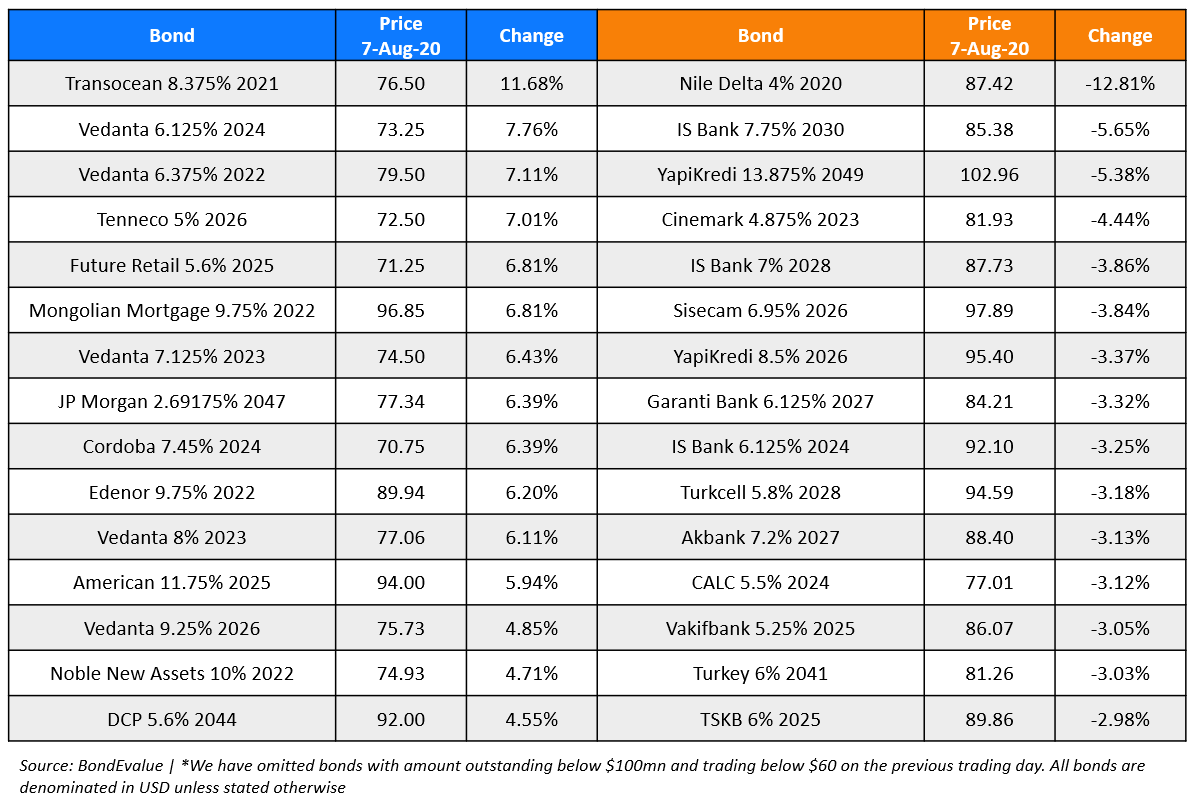

Top Gainers & Losers – 7-Aug-20*

Go back to Latest bond Market News

Related Posts: