This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

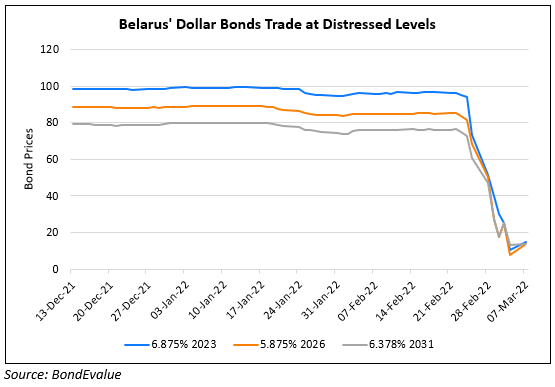

Belarus Downgraded to C from CCC

July 8, 2022

Belarus was downgraded to C from CCC by Fitch on the back of the announcement by the Ministry of Finance (MoF) that dollar and eurobond payments due will be transferred in Belarussian rubles (BYN). The MoF made this announcement on June 29 and made the payment in local currency for a 2027’s dollar bond interest payment. The bond prospectus does not allow for payment in alternate currencies. The grace period on the bond ends on July 13 and non-fulfilment in the original currency would see them fall into default. Due to this, the MoF could replace debt obligations on these offshore bonds with debt obligations on government securities placed on the domestic financial market. This comes on the back of sanctions.

Go back to Latest bond Market News

Related Posts:

Belarus Downgraded to CCC by S&P

March 7, 2022

Belarus Downgraded by 4 Notches to Ca from B3

March 11, 2022