This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

BOC Aviation Launches $ Bond; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

April 25, 2023

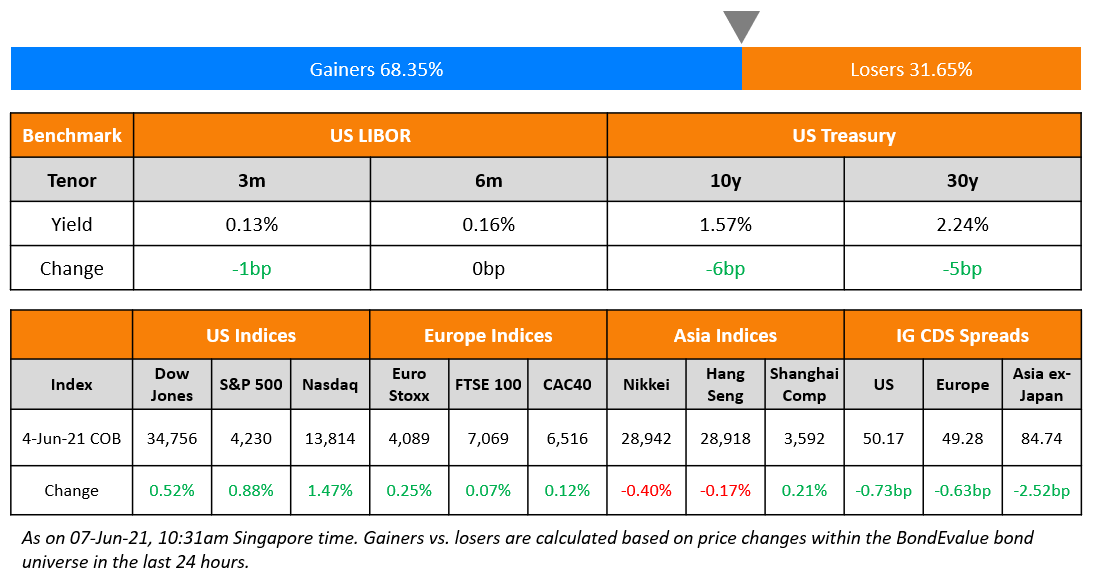

US Treasury yields dropped by 9-10bp across the curve on Monday. As per reports, the US Treasury is expected to hit its debt ceiling by July-August, which led to investors flocking to the very near-end of the curve. This led to the spread between 1-month (currently at 3.47%) and 3-month T-Bills (4.94%) widening to its highest level since 2001. Despite the sharp move in Treasuries, CME probabilities continue to indicate a 25bp hike in the Fed’s May meeting with the hike probability currently at 85%. The peak Fed funds rate was also 1bp lower to 5.10% for the June meeting. US IG and HY CDS spreads were were tighter by 0.4bp and 0.1bp respectively. US equity indices were mixed with the S&P up 0.1% and Nasdaq down 0.3%.

European equity markets ended slightly lower. European main CDS spreads were tighter by 0.4bp and Crossover spreads were tighter by 0.7bp. Asia ex-Japan CDS spreads widened by 1bp. Asian equity markets have opened with a negative bias this morning.

.png)

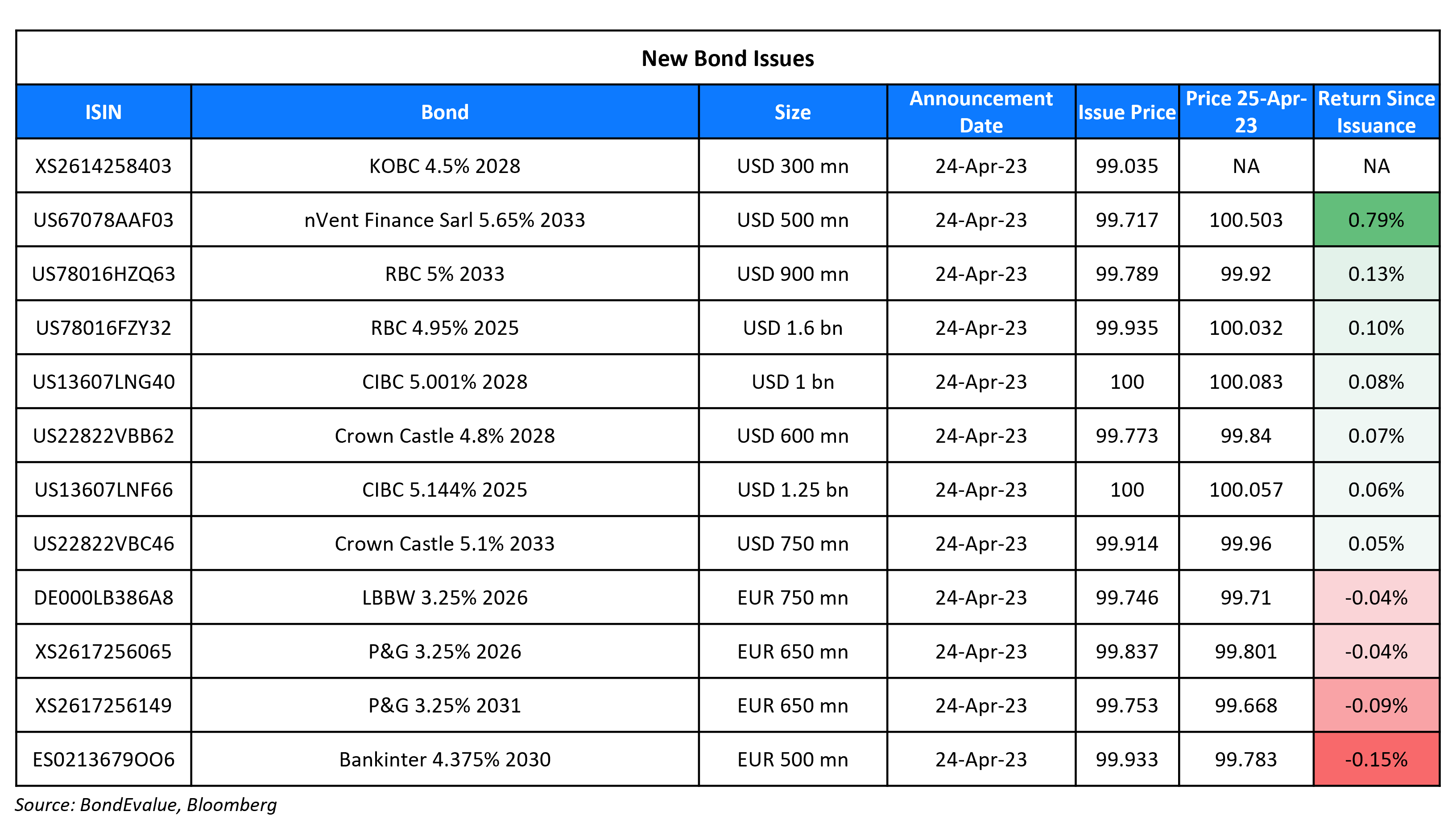

New Bond Issues

- BOC Aviation $ 10Y at T+195bp area

RBC raised $2.5bn in a two-tranche deal. It raised:

- $1.6bn via a 2Y bond at a yield of 4.985%, 25bp inside initial guidance of T+110bp area. The new bonds have a new issue premium of 19.5bp compared to its existing 3.375% 2025s that yield 4.79%.

- $900mn via a 5Y bond at a yield of 5.027%, 18bp inside initial guidance of T+170bp area. The new bonds have a new issue premium of 8.7bp relative to its existing 5% 2033s that yield 4.94%.

The senior unsecured bonds have expected ratings of A1/A/AA-.

Korea Ocean Business Corp raised $300mn via a 5Y bond at a yield of 4.719%, 30bp inside initial guidance of T+140bp area. The bonds have expected ratings of Aa2/AA-. Proceeds will be used for general corporate purposes, including repayment of existing indebtedness.

New Bonds Pipeline

- SBI hires for $ 5Y bond

- SMBC Aviation Capital hires for $ senior bond

- Banco BTG hires for $ bond

Rating Changes

- Fitch Upgrades SABIC to ‘A+’; Outlook Stable

- Lumen Technologies Inc. Senior Unsecured Debt Rating Lowered To ‘CCC+’; Other Ratings Actions Taken

- Hopson Development Holdings Ltd. Outlook Revised To Stable From Negative On Improving Sales; ‘B’ Rating Affirmed

Term of the Day

Sovereign Risk Premium

Sovereign risk premium refers to the additional implied spread that a country’s sovereign bonds offer vs. a benchmark for a particular currency. Put differently, it is the incremental return (or yield) that investors demand from a country to buy its sovereign bonds vs. the benchmark.

Talking Heads

On BlackRock Saying Emerging Markets Have an Edge Over Rest of World

“EM assets have the edge – for now. We’ve seen a clear resilience in EM economic activity even as rising rates have slowed DM activity.”

On Vanguard buying large banks’ bonds cheap during March turmoil

“The banking troubles offered a brief window to add large banks at compelling valuations. We had little exposure to troubled banks and do not see evidence of a systemic risk to the financial system… The time for a full risk-on moment has not yet arrived… Barring a major economic surprise, we think the Fed will hold policy rates high (above 5%) for longer than the market currently expects.”

On Egypt Bonds Slumping After S&P’s Cutting Its Outlook on Grim Forecasts

“Egypt’s funding sources may not cover its high external financing requirements”

Deutsche Bank analysts

“While Eurobonds now appear attractive from a valuations perspective, particularly in the short end, we maintain our marketweight stance due to the uncertainty around policy direction”

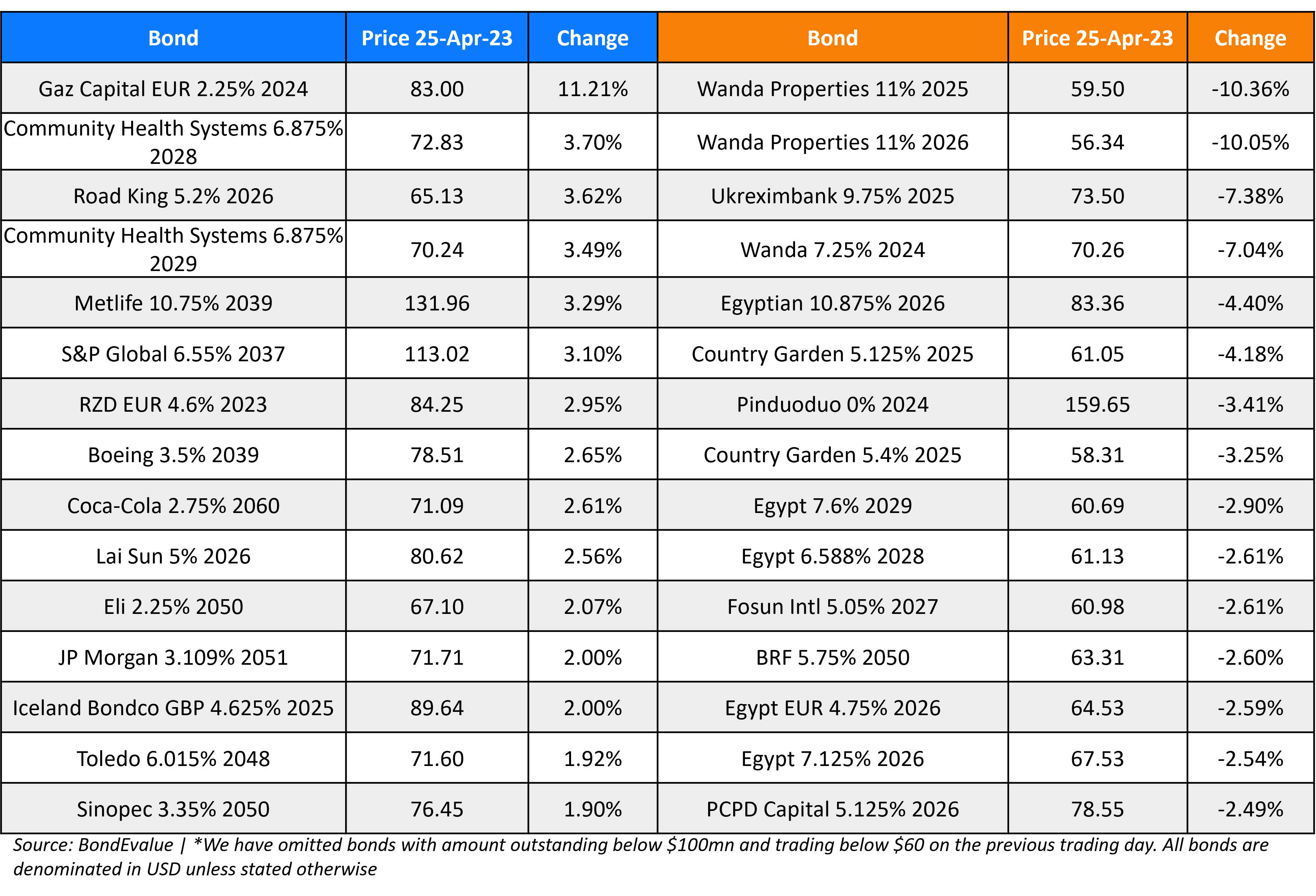

Top Gainers & Losers – 25-April-23*

Go back to Latest bond Market News

Related Posts: