This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Boeing Raises $9.825 Billion via New Bond Deal for Refinancing

February 3, 2021

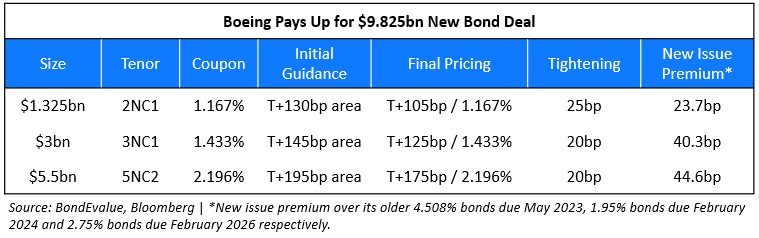

American planemaker Boeing tapped the bond markets on Tuesday, raising $9.825bn via a jumbo three-trancher. Details of the issuance are as follows:

The bonds are expected to be rated Baa2/BBB-/BBB- with proceeds to be used to repay a portion of its debt drawn under its delayed draw 2Y term loan facility of $13.8bn. Boeing offered a new issue premium of ~24-45bp on all the three tranches over its older bonds issued in late April and October.

All bonds under the three tranches carry a coupon step-up of 25bp per credit rating notch downgrade below investment grade per agency (Moody’s and S&P), capped at 200bp. The issuance comes about a week after Boeing reported a record annual loss of $12bn for 2020. This is the third issuance since March last year, after the company raised $25bn via 2020’s largest bond deal in April, followed by a $4.9bn issuance in late October. Boeing’s 3.25% bonds due 2028 traded stable at 106.2 while its 5.705% bonds due 2040 traded 0.5 points lower at 126.2.

For the full story, click here

Go back to Latest bond Market News

Related Posts: