This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

April 29, 2022

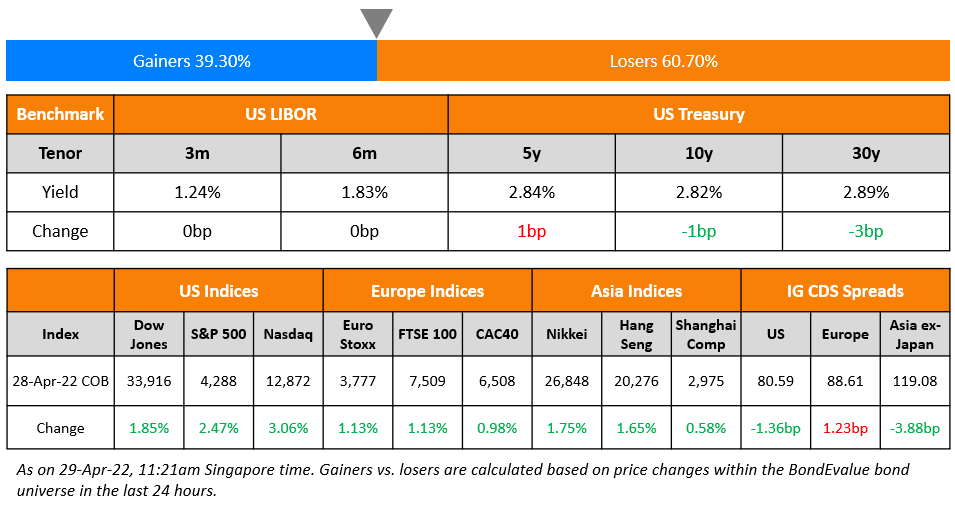

US equity markets recovered after a poor start to the week, with the S&P up 2.5% and Nasdaq up 3.1%. All sectors were in the green, led by IT and Communication Services up over 3.9% each. US 10Y Treasury yields were 1bp lower at 2.82%. European markets were also higher – DAX, CAC and FTSE were up 1.4%, 1% and 1.1% respectively. Brazil’s Bovespa closed 0.5% higher. In the Middle East, UAE’s ADX was up 0.8% while Saudi TASI was up 0.7%. Asian markets have opened higher too – Shanghai, HSI, STI and Nikkei were up 0.4%, 1%, 0.8% and 1.8% respectively. US IG and HY CDS spreads tightened 1.4bp and 3.9bp respectively. EU Main CDS spreads were 1.2bp wider and Crossover spreads were 3.7bp wider. Asia ex-Japan CDS spreads were 3.9bp tighter.

US GDP contracted by 1.4% on an annualized basis in Q1 2022, the first since mid-2020. German inflation jumped 7.8% YoY, its fastest pace since early 1990s, and higher than forecasts of 7.6%.

New Bond Issues

Korea East-West Power raised $500mn via a 3Y green bond at a yield of 3.752%, 35bp inside initial guidance of T+130bp area. The bonds received orders over $2.75bn, 5.5x issue size. The bonds are sold under its green and sustainability bond framework which aims to reduce GHG scope 1 and 2 emissions by 50% by 2035 from a 2018 baseline. Proceeds will be used to refinance or finance new and existing renewable energy and energy efficiency projects.

Korea East-West Power raised $500mn via a 3Y green bond at a yield of 3.752%, 35bp inside initial guidance of T+130bp area. The bonds received orders over $2.75bn, 5.5x issue size. The bonds are sold under its green and sustainability bond framework which aims to reduce GHG scope 1 and 2 emissions by 50% by 2035 from a 2018 baseline. Proceeds will be used to refinance or finance new and existing renewable energy and energy efficiency projects.

American Express raised $3.5bn via a three-trancher. It raised:

- $2bn via a 2Y bond at a yield of 3.38%, 23bp inside initial guidance of T+100bp area

- $500mn via a 2Y FRN at SOFR+72bp vs. initial guidance of SOFR equivalent

- $1bn via a 7Y sustainability bond at a yield of 4.081%, 15bp inside initial guidance of T+135bp area

The bonds are rated A2/BBB+/A. An amount equivalent to the net proceeds from the sale of the sustainability notes will be used for new and/or existing eligible projects.

Chongqing Nan’an Urban Construction Development (Group) has raised $260mn via a 3Y bond at a yield of 5%, unchanged from initial guidance. The bonds are rated BBB. The Chinese local government financing vehicle (LGFV) (Term of the Day, explained below) of the Chongqing Nan’an district government plans to use the proceeds to refinance its $300m 5.88% bonds due June 18, 2022.

New Bonds Pipeline

- Busan Bank hires for $ Social bond

- Kookmin Card hires for $ Sustainability bond

- Continuum Energy Aura hires for $ Green Bond

- Jubilant Pharma hires for $ bond

- Sael Limited hires for $ 7Y Green bond

Rating Changes

- Delhi International Airport Ltd. Upgraded To ‘B’ On Passenger Traffic Recovery; Outlook Stable

- Moody’s downgrades Zhongliang’s corporate family rating to Caa2; outlook remains negative

- Moody’s downgrades Aveanna Healthcare’s CFR to B3; outlook stable

- GMR Hyderabad Airport Outlook Revised To Stable From Negative On Passenger Traffic Recovery; ‘BB-‘ Rating Affirmed

Term of the Day

Local Government Financing Vehicles (LGFV)

Local Government Financing Vehicles or LGFVs are debt-issuing entities set up by local governments in China to fund infrastructure and related projects. LGFVs came into existence because local governments were prohibited from raising debt directly. Hence, these local governments set up off-balance sheet entities known as LGFVs. LGFVs have become popular over the past decade and are regular issuers of Chinese yuan and US dollar bonds. While these issuers are backed by local governments, there were concerns among investors about their ability and willingness to repay debt driven by events in the past when LGFVs defaulted on their bonds.

Talking Heads

Bonds, Pounded by Inflation Concerns, Get a Lift—From Inflation

Rajeev De Mello, a portfolio manager at GAMA Asset Management

“The dominant factor driving yields right now is the more aggressive Fed”

Mark Haefele, CIO at UBS Global Wealth Management

“Rising yields, all else equal, reduce the relative attractiveness of equities compared with bonds”

Jan Hatzius, chief economist at Goldman Sachs Group

“The Fed faces a hard path to a soft landing”

On Corporate Bonds Seeing Wild Swings as Bank Inventories Shrink

Matt Brill, head of North American IG and Senior PM at Invesco Ltd

The impact of low inventories has been clear: In March, Asian investors sought to buy more than $1 billion of bonds overnight, and dealers didn’t have enough securities on their books to handle the demand. That pushed risk premiums on high-grade corporate bonds about 10 basis points, or 0.1 percentage point, tighter in one day last month, he said, an unusually sharp move. “We’re seeing moves like that, that didn’t historically happen, where dealers would have had the balance sheet to supply the bonds.”

Nicholas Elfner, co-head of research at Breckinridge Capital Advisors

“Dealers are facilitating trades, but not necessarily holding large inventories”

Elaine Stokes, PM and co-head of the full discretion team at Loomis Sayles & Co.

“Especially in high yield, low dealer inventory has made it harder to execute trades. We’ve had to get creative to build positions, using other methods like portfolio trading and ETFs… Back when I was trading we used to joke that the dealers would just stop answering the phones, and there are days now that it almost feels that way”

On US Economy Posting a Surprise Contraction, Belying Solid Consumer Picture

Bill Adams, chief economist at Comerica Bank

“With strong growth of consumer spending, business investment and employment in the first quarter, the U.S. economy was not in a recession at the beginning of the year. Growth should resume in the second quarter as the trade deficit and inventories become smaller headwinds.”

Yelena Shulyatyeva, economist at Bloomberg

“A substantial drag from trade — a result of weak exports amid a global growth slowdown, coupled with robust imports due to strength in both domestic demand and the dollar — will prove temporary, with trade flows normalizing as the year progresses.

Top Gainers & Losers – 29-Apr-22*

Other Stories

Go back to Latest bond Market News

Related Posts: