This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

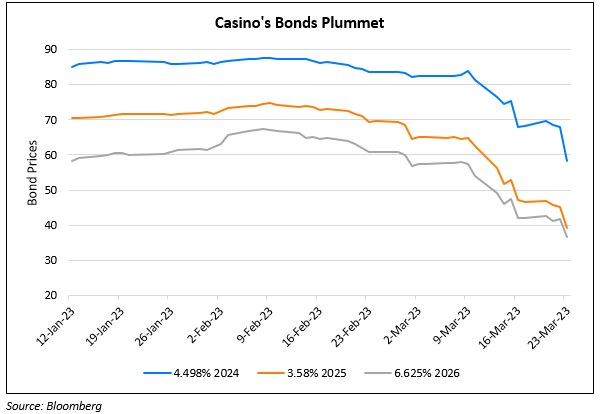

Casino Guichard’s Bonds Drop Post Downgrade to Caa1

March 24, 2023

Casino Guichard’s bonds were down by over 4 points across the curve after its downgrade to Caa1 from B3 by Moody’s. The downgrade came on the back of continued market share losses, a reduction in French retail margins in 2022 and weak liquidity. Moody’s said that Casino’s leverage was “very high” with adjusted debt-to-EBITDA above 7x. Also, its French operations saw a cash burn of €900mn in 2022. The rating agency notes that the above partly offsets the progress Casino has made with recent asset disposals. Casino has to rely on asset disposals to repay its bond maturities and Moody’s expects it will do the same in order to repay its bonds due 2024. Moreover, with the sale of a controlling stake in Brazilian subsidiary Assai, Casino is reducing its geographical diversification – this increases the risk of exposure to the French market.

Go back to Latest bond Market News

Related Posts:

R&F Properties Upgraded to CC by Fitch following Exchange Offer

January 25, 2022

China SCE Downgraded to B3 by Moody’s

February 20, 2023