This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

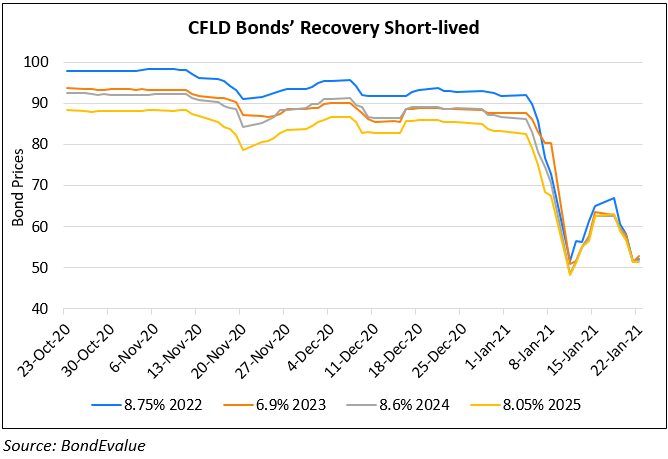

CFLD’s Dollar Bonds Plummet Again; 2022s-2025s Now Trade In the 50’s

January 22, 2021

China Fortune Land Development’s (CFLD) bonds crashed another 9-11% yesterday as most of their bonds now trade around $50. CFLD, whose bonds fell over 40% in the first week of the new year, has been hit with not meeting Ping An’s (their second biggest shareholder) targets, lack of government support for Chinese state owned enterprises and stricter regulations (three-red lines). The bonds had recovered somewhat after the fall in the first week, but are now back in the red as investor concerns grow. CFLD’s 8.75% 2022s, 8.6% 2024s and 8.05% 2025s are currently trading at 52.1, 51.8 and 51.5 cents on the dollar respectively.

Go back to Latest bond Market News

Related Posts: