This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

China Merchants Ports Launches $ Bond; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

May 25, 2022

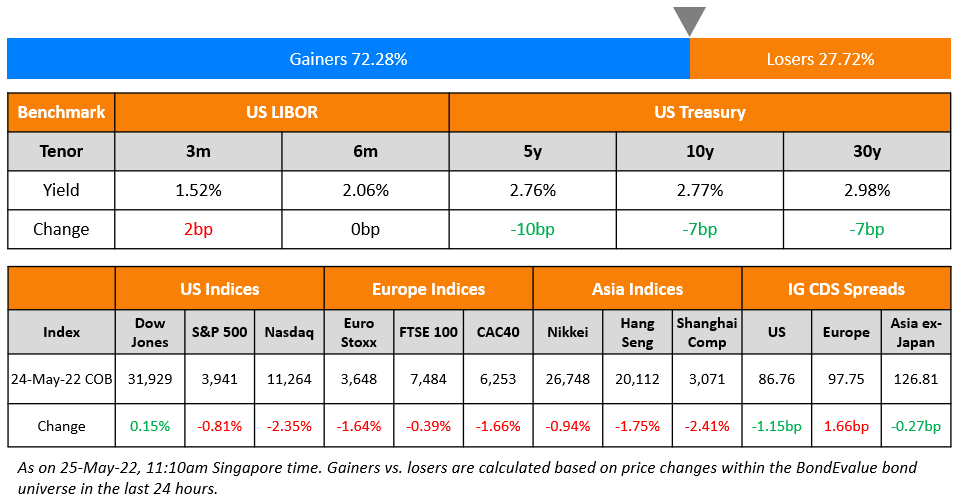

US equity markets reversed its gains yesterday, with the S&P and Nasdaq down 0.8% and 2.4% respectively. Sectoral gainers were led by Utilities, up over 2%, while losers were led by Communication Services, down 3.7%. US 10Y Treasury yields moved 7bp lower to 2.77% as the broad risk-off sentiment continues to weigh on markets. European markets ended lower as well with the DAX, CAC and FTSE down 1.8%, 1.7% and 0.4% respectively. Brazil’s Bovespa closed 0.2% higher. In the Middle East, UAE’s ADX was down 2.5% and Saudi TASI was up 0.5%. Asian markets have opened weaker today – Shanghai, HSI and Nikkei were down 0.9%, 1.5%, 0.5% respectively while STI was up 0.2%. US IG CDS spreads tightened 1.2bp and HY spreads tightened 4.7bp. EU Main CDS spreads were 1.7bp wider and Crossover spreads were 7.2bp wider. Asia ex-Japan CDS spreads were 0.3bp tighter.

Singapore’s GDP grew 3.7% YoY in Q1 2022, better than estimated of a 3.4% print. The Ministry of Trade & Industry said that “the external demand outlook for the Singapore economy has weakened compared to three months ago”, reiterating its earlier 3% to 5% growth expectations for 2022.

Advanced Two-Day Course on Bonds | 7-8 June

Keen to develop a deeper understanding of bonds? Sign up for our upcoming IBF-recognized course on bonds, scheduled for 7-8 June. This course is ideal for finance professionals, with 80/90% IBF funding available to eligible company-sponsored candidates from Singapore. There will be an option to attend virtually as well. Click on the banner below for details about the course modules, instructor profiles, fees and funding.

New Bond Issues

- China Merchants Port $ 5Y at T+175bp area

Indonesia raised $3.25bn via a two-trancher. It raised $1.75n via a 5Y sukuk at a yield of 4.4%, 35bp inside initial guidance of 4.75% area. It also raised $1.5bn via a 10Y sukuk at a yield of 4.7%, 40bp inside initial guidance of 5.1% area. The 5Y sukuk received orders over $5.7bn, 3.3x issue size – Asset/fund managers bought 41%, financial institutions/banks 30%, insurers/pension funds 8%, central banks/other institutions 20% and private banks 1%. Asia accounted for 35%, the Middle East 30%, the US 18% and the EU 17%. The 10Y sukuk received orders over $5.1bn, 3.4x issue size – Asset/fund managers took 49%, financial institutions/banks 30%, insurers/pension funds 13%, central banks/official institutions 7% and private banks 1%. Asia accounted for 38%, the Middle East 27%, the US 20% and the EU 15%. Proceeds will be used for general financing requirements, and the 10-year green proceeds will go toward expenditures that have a green or blue focus. The new 5Y sukuk was priced at a new issue premium of 39bp over its 3.85% bonds due 2027 that yield 4.01%. The new 10Y sukuk was priced at a new issue premium of 44bp over its 3.55% bonds due 2032 that yield 4.26%.

ICBC raised ~$2.21bn via a multi-currency green bond offering across its branches.

- ICBC HK raised $1.2bn via a 3Y bond at a yield of 3.025%, 20bp inside initial guidance of MS+70bp area

- ICBC London raised €300mn via a 3Y bond at a yield of 1.636%, 20bp inside initial guidance of MS+70bp area.

- ICBC Singapore raised $600mn via a 3Y FRN at SOFR+75bp, 40bp inside initial guidance of SOFR+115bp area

All the above bonds are rated A1. Proceeds will be used to finance or refinance eligible green assets under ICBC’s green bond framework. Sustainalytics and Beijing Zhongcai Green Financing Consultant are the external reviewers of the framework.

Visa raised €3bn via a three-tranche deal. It raised

.png)

The bonds have expected ratings of Aa3/AA-. Net proceeds from this offering are to be used for general corporate purposes and the refinancing of existing indebtedness.

New Bonds Pipeline

-

Zhangzhou Transportation Development Group hires for $ Green bond

- Busan Bank hires for $ Social bond

- Kookmin Card hires for $ Sustainability bond

- Continuum Energy Aura hires for $ Green Bond

- Jubilant Pharma hires for $ bond

- Sael Limited hires for $ 7Y Green bond

Rating Changes

- Moody’s upgrades Coty’s CFR to B1; outlook stable

- eHi Car Services Downgraded To ‘B’ From ‘B+’ On Lower Liquidity Buffer; Outlook Negative

- Moody’s downgrades the ratings of seven Ukrainian banks and changes outlook to negative, concluding review for downgrade

- Fitch Affirms ArcelorMittal at ‘BBB-‘; Withdraws Ratings

Term of the Day

Mid Swaps

Mid-Swaps are essentially the mid-rate or the average of the bid-ask rates on a swap corresponding to the maturity of the bond. Whilst bonds are generally priced as a spread over Treasuries, some issuers price them over the Mid-Swaps rate. Many euro denominated bonds are priced as a spread over the Mid-Swaps rate. The ‘swap rate’ is essentially the fixed-rate that the receiver gets in exchange for paying the floating rate in a Swap contract with the Mid-Swaps being the average of the bid-ask swap rates.

Talking Heads

On ECB Shouldn’t Rule Out Half-Point Rate Hikes – Governing Council member Martins Kazaks

A shift in gear to hiking by 50 basis points is “certainly one thing that we could discuss… Do we need to take the step of 50 basis points already in July? Well, we can discuss it, but I think at the current moment, a 25 basis-point step would be appropriate. But, of course, there is still some time till the discussions and we are still to see the new forecast…. I favor two consecutive rate increases one in July, the other one in September”

On a Half-Point Hike to Show ECB’s Resolve in Inflation Fight – ECB member Robert Holzmann

A step of 50 basis points would be “appropriate” in July. A bigger step at the start of our rate-hike cycle would make sense. It would keep people on their toes and signal to markets that we’ve understood the need to act. Everything else risks being seen as soft.”

“As we expeditiously return monetary policy to a more neutral stance to get inflation closer to our 2 percent target, I plan to proceed with intention and without recklessness

On Bill Ackman Doubling Down on Call for Aggressive Fed Rate Hikes

Pershing Square founder Bill Ackman

“By raising rates aggressively now, the Fed can protect and enhance equity markets and the strength of the economy for all, while stymieing inflation that destroys livelihoods, particularly that of the least fortunate… When the fed raises short-term rates, it reduces the value of short-term assets like shorter-term fixed income securities. But if the effect of the increase in fed funds is to subdue inflation and therefore long-term rates, it should increase the value of long-term assets like equities.”

Top Gainers & Losers – 25-May-22*

Go back to Latest bond Market News

Related Posts: