This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

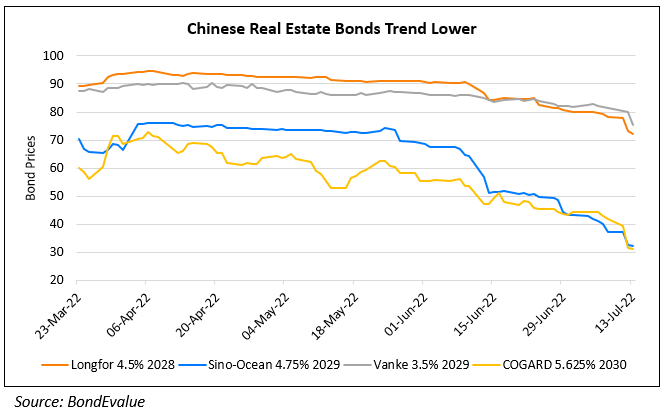

China Property Developers Bonds Rally; COGARD to Raise $500mn via Share Placement

November 15, 2022

Chinese property developers saw their stocks and bonds rally on Monday following Beijing’s new 16-point relief package for the distressed sector, announced on Friday. Among the names that rallied were Longfor, Country Garden (COGARD), Agile, Central China and Greenland. The upmove was more pronounced for Longfor, which received regulatory approval to issue $2.8bn worth of state-backed debt on Friday – its 3.95% 2029s rose ~17 points to 64.26 cents on the dollar. Adding to the cheer of the relief package, COGARD announced that it is raising HKD 3.9bn ($500mn) via a share placement. The company said that the capital raise, at an 18% discount, will be used for offshore debt repayment, pushing its dollar bonds higher. COGARD’s 2.7% 2026s rose over 20 points over the past two trading sessions to currently trade at 36.35 cents on the dollar.

Go back to Latest bond Market News

Related Posts: