This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

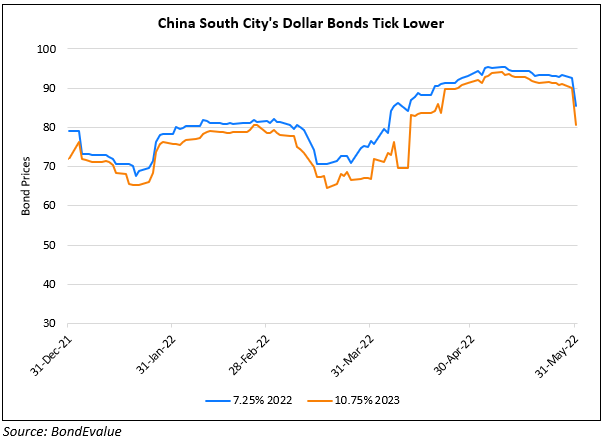

China South City’s Dollar Bonds Drop by 7-9 Points

June 1, 2022

Dollar bonds of China South City dropped by 7-9 points on Tuesday over continued concerns regarding the Chinese property sector. While there is no specific news on the developer, the fall in bond prices come after its peer Greenland Holding saw its dollar bonds drop to distressed levels on the back of liquidity issues, leading them to propose an extension of its $488mn 6.75% dollar bond due June 25 by a year. Another Chinese developer, China SCE also saw its dollar bonds drop over 4 points.

Go back to Latest bond Market News

Related Posts: