This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

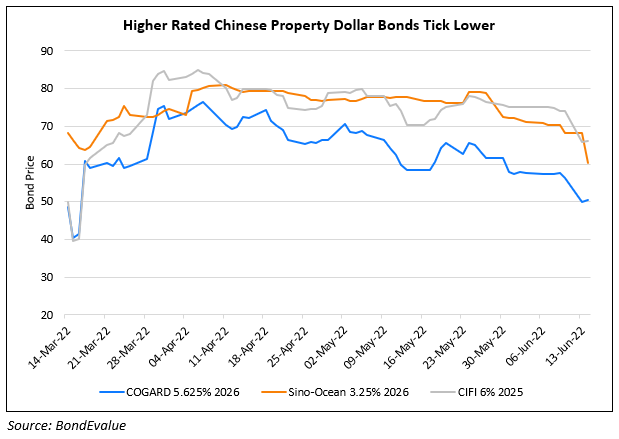

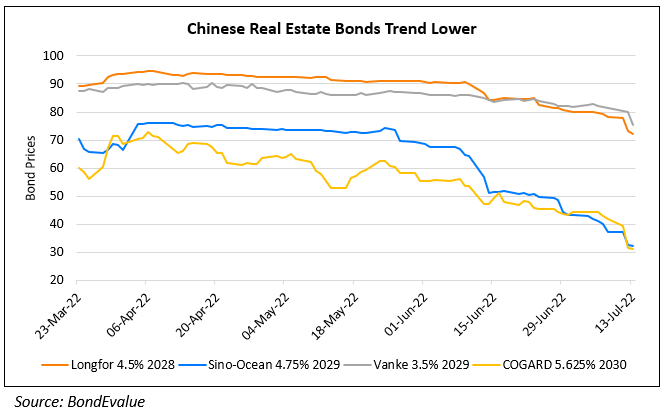

China South City’s Dollar Bonds Plummet over 20%; COGARD, Sino-Ocean Bonds Now Below 30

July 20, 2022

Chinese real estate dollar bonds have slid across the board led by China South City, with relatively higher rated developers like Country Garden (Ba1/BB+/BBB) and Sino-Ocean (Baa3//BBB) in tow. Bloomberg notes that the most recent bond selloff in the sector is a reflection of investors’ concerns following mortgage boycotts happening all across China. While the government has stepped in to help, there are mounting fears that the current situation reflects deeper problems within the Chinese property sector that cannot be resolved with traditional policy adjustments. In particular, South City’s dollar bonds fell the most amid reports that it is mulling a maturity extension for all its offshore bonds totaling $1.59bn, despite receiving state support.

Go back to Latest bond Market News

Related Posts: