This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

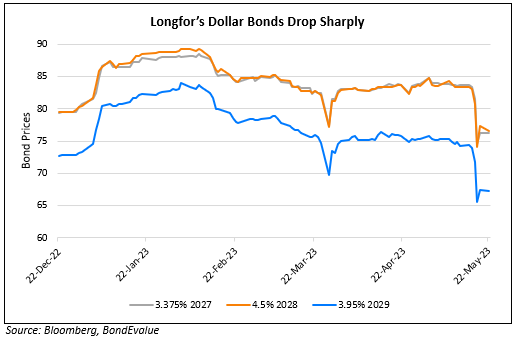

Chinese Property Sector Worries Hit IG-Rated Names like GLP and Longfor

May 22, 2023

GLP China offers one of the highest yields among IG-rated Chinese dollar bonds. GLP is primarily a real estate logistics company that has also expanded to investment management, data centers and renewable energy. The company, while rated BBB- by S&P and Fitch, was placed on Rating Watch Negative by Fitch on 9 May. GLP’s dollar bonds are down over 25% YTD which Bloomberg notes is the biggest drop in its index of Asian IG-bonds. They add that a downgrade to junk would likely have a long-term impact on its debt refinancing abilities. While concerns linger, GLP’s finance head has said that the company has a “robust liquidity situation” with cash and undrawn credit of over $3bn. He added that they do not need to rely on new onshore/offshore issuances to service any immediate debts. At end-2022, GLP had $11.5bn of net debt, up 19% YoY and last issued a dollar bond in June 2021, raising $300mn via a PerpNC6 at 4.6% which is now trading at deep distress levels of 32.6 cents on the dollar. GLP’s 4.974% 2024s are trading at 78 cents on the dollar, yielding 41% while its 2.95% 2026s are at 53.5, yielding 27%.

For more details, click here

Besides, worries about the Chinese property bond market has spread over to IG-rated Longfor Group, whose dollar bonds have sold-off. Longfor is rated Baa2/BBB-/BBB (Moody’s/S&P/Fitch) and its dollar bonds were among the biggest losers last week, down as much as 10%.

Go back to Latest bond Market News

Related Posts:

Alibaba Fined Record $2.8bn by Chinese Regulators

April 12, 2021

Tencent Raises $4.15bn via Four Trancher

April 16, 2021