This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Citic Group Asked to Inspect Huarong’s Finances; Huarong Bondholders May Face Haircut

June 29, 2021

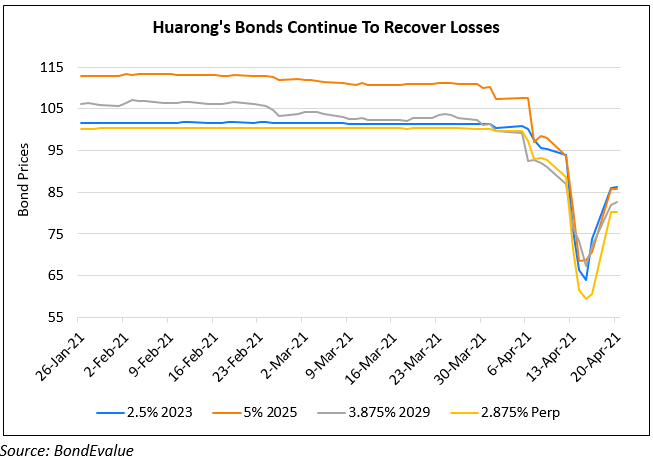

State-owned investment company China Citic has been asked by Beijing to examine China Huarong’s finances according to sources familiar with the matter. Bloomberg reports that while the result of Citic’s involvement cannot yet be determined, but, the extra layer of scrutiny may reduce chances of a full bailout, in which case Huarong’s bondholders may need to brace for a bigger haircut. Bloomberg Intelligence analyst Dan Wang said, “A takeover is unlikely but Citic may be considering buying stakes or assets in subsidiaries.” In 2019, Citic and China Everbright were asked to examine books of Baoshang Bank that ultimately got taken over by regulators. Goldman Sachs analysts wrote, “Whilst we believe full government bailouts are less likely now than compared with the past, we do expect there will be government support if any pickup in credit stresses leads to systemic concerns emerging.”

Huarong’s dollar bonds were stable – its 2.875% Perps were at 81.4.

For the full story, click here

Go back to Latest bond Market News

Related Posts: