This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

CK Infra, Ping An Launch $ Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

July 22, 2021

US markets extended the rebound rally for a second day amid strong corporate earnings – S&P and Nasdaq gained 0.8% and 0.9% respectively. Energy zoomed 3.9% with Brent Crude going back above $70/bbl, Financials and Industrials were up more than 1%. Corporate earnings continued with Coca Cola, J&J, Verizon and Julius Baer reporting strong numbers (scroll down for details). US 10Y Treasury yields rose 8bp to 1.29%. European bourses also extended their gains – CAC, FTSE and DAX were up 1.9%, 1.7% and 1.4% respectively. US IG CDS spreads tightened 1bp and HY tightened 8bp. EU Main and Crossover spreads tightened 1.6bp and 8.1bp respectively. Brazil’s Bovespa was up 0.4%. Gulf markets remained closed for Eid. Asian markets continued the strong momentum and opened higher – HSI was up 1.9%, Nikkei and Singapore’s STI were up 0.6% and Shanghai was up 0.2%. Asia ex-Japan CDS spreads were 0.4bp tighter.

Navigating The Bond Markets by Leveraging the BEV App | July 28

New to the BondEvalue App? We will be conducting a complimentary session on Navigating The Bond Markets by Leveraging the BEV App on July 28, 2021. This session is aimed at helping bond investors in tracking their investments using the BondEvalue App. Click on the banner below to register.

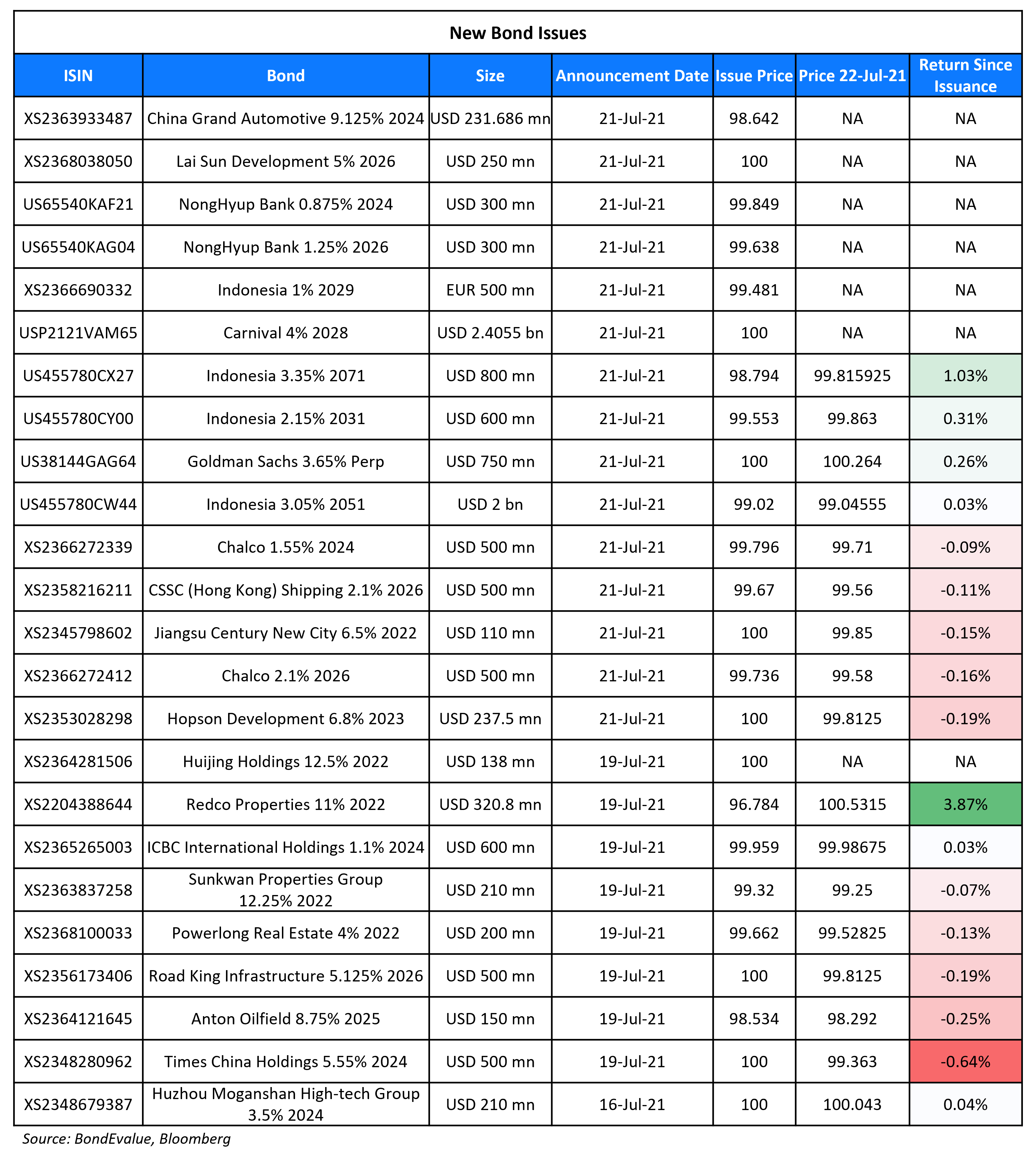

New Bond Issues

-

CK Infrastructure capped $300mn PerpNC5 fixed-for-life at 4.2% area

-

Ping An Real Estate $ 3Y/5Y green bonds at T+285bp/T+315bp areas

-

China Citic Bank International $ PerpNC5 AT1 at 3.75% area

-

Shandong Iron & Steel Group $ 3yr unrated bonds at 5.35% area

-

Guangzhou Industrial Investment Fund $ 5Y at 3.35% area

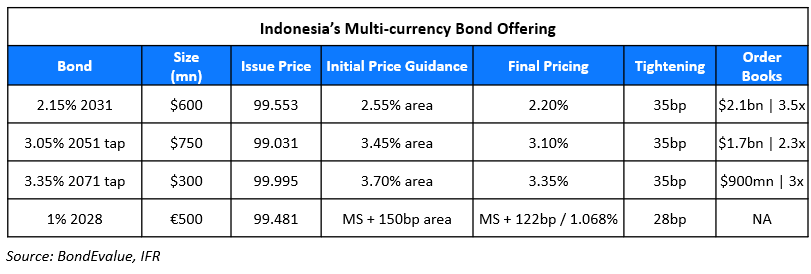

Indonesia raised ~$2.24bn via a multi-currency bond offering. As part of its USD offering it raised:

The bonds have expected ratings of Baa2/BBB/BBB. The tapped issuances are immediately fungible with the original notes. The new 10Y was priced largely in-line with its older 2.15% 2031s that yield 2.17%. Similarly, the tapped dollar bonds were priced in-line with the original 2051s and 2071s that yield 3.1% and 3.35% respectively in secondary markets. Allocations for the dollar bonds are given below:

- The new 10Y saw APAC take 58%, EMEA 23% and US 19%. Fund/asset managers took 57%, PFs/Insurers/sovereign wealth funds/central banks took 21% banks 21% and private banks and others 1%.

- The tapped 2051s saw APAC take 51%, EMEA 21% and US 28%. Fund/asset managers took 46%, PFs/Insurers/sovereign wealth funds/central banks took 49% banks 4% and private banks and others 1%.

- The tapped 2071s saw APAC take 22%, EMEA 32% and US 46%. Fund/asset managers took 88%, PFs/Insurers/sovereign wealth funds/central banks took 10% banks 1% and private banks and others 1%.

Goldman Sachs raised $750mn via Perpetual non-call 5Y (PerpNC5) depositary shares at a yield of 3.65%,~28.75bp inside initial guidance of 3.875%-4%. The bonds have expected ratings of Ba1/BB/BBB-. The depositary shares each represent a 1/25th interest in a share of perpetual non-cumulative preference shares, Series U $0.01 par value, with a liquidation preference of $25,000 per share as per Bloomberg. Proceeds will be used to provide additional funds for the company’s operations and for other general corporate purposes. The shares may be redeemed (a) in whole or in part, on any dividend payment date on or after the First Reset Date or (ii) in whole but not in part at any time within 90 days following a Regulatory Capital Treatment Event. The bonds are callable on the first call date of August 10, 2026, and if not called, the coupon resets to the 5Y US Treasury yield + 291.5bp.

Carnival Corp raised $2.4055bn via a 7Y bond at a yield of 4%, ~12.5bp inside initial guidance of 4-4.25% area. The new bonds are secured and have expected ratings of Ba2/BB-, callable three months prior to the maturity date. Proceeds will be used to refinance existing first lien notes. The bonds were priced tighter to its lower rated (B-/B2) unsecured 6.65% 2028s that currently yield 5.52% in secondary markets.

Lai Sun Development raised $250mn via a 5Y bonds at a yield of 5%, 10bp inside initial guidance of 5.1% area. The bonds are unrated and received orders over $500mn, 2x issue size. Asia took 98% and the rest went to EMEA. Private banks bought 76% and fund managers and asset managers 24%. The bonds have a change of control put at 101. Wholly owned subsidiary Lai Sun MTN is the issuer with a guarantee by the Hong Kong developer parent. Proceeds will be used for general corporate purposes. This is Lai Sun’s first dollar offering since 2017 when it raised $400mn via a 5Y at 4.6%.

China Grand Automotive raised $231.686mn via a 2.5Y bond at a yield of 9.75%. The bonds have expected ratings of B+. Proceeds will be used for offshore debt repayment and refinancing of onshore debt including a concurrent tender offer for its $400m 9.109% Perps. Under the tender offer, only those who subscribe to and are allocated the new bonds will be entitled to tender the Perps. Under the amended terms announced on July 16, each eligible holder will be entitled to tender the Perps for not more than 60% of the new bonds to be allocated to them. Wholly-owned subsidiary China Grand Automotive Services is the issuer, with a guarantee by the parent.

Chalco raised $1bn via a two-trancher. It raised $500mn via a 3Y bond at a yield of 1.62%, 45bp inside initial guidance of T+170bp area. It also raised $500mn via a 5Y bond at a yield of 2.156%, 40bp inside initial guidance of T+185bp area. The bonds have expected ratings of A- and received orders over $5.9bn, 5.9x issue size. Proceeds will be used for offshore debt refinancing.

Vertex Venture raised S$450mn ($329mn) via a 7Y at a yield of 3.3%, 20bp inside initial guidance of 3.5% area. The bonds received orders over S$1.1bn, 2.4x issue size. Fund managers, banks and public sector agencies bought 65% of the notes, with private banks and other investors taking 35%. Singapore accounted for 96% and Hong Kong and other countries took 4%. The issuer is owned by Singapore’s state-owned Temasek Holdings.

CSSC (Hong Kong) Shipping raised $500mn via a 5Y green bond at a yield of 2.17%, 40bp inside initial guidance of T+185bp area. The bonds have expected ratings of A-/A and received orders over $1.8bn, 3.6x issue size. Asia took 97% and EMEA 3%. Banks and financial institutions received 81%, fund/asset managers/central banks 14% and private banks 5%. Wholly-owned subsidiary CSSC Capital 2015 is the issuer and the bonds are guaranteed by the parent. Proceeds will be used to develop the group’s leasing business, including to finance or refinance expenditure on eligible green and blue projects to generate positive environmental benefits in accordance with its green finance framework, and for debt refinancing and general corporate purposes.

NongHyup Bank raised $600mn via a two-tranche social bond offering. It raised $300mn via a 3Y social bond at a yield of 0.926%, 25bp inside initial guidance of T+80bp. It also raised $300mn via a 5Y social bond at a yield of 1.325%, 60bp inside initial guidance of T+90bp area. The bonds have expected ratings of A1/A+ and received orders over $2.15bn, 3.6x issue size. For the 3Y tranche, US took 46%, Asia 35% and EMEA 19%. Asset/fund managers bought 71%, central banks/sovereigns/supranationals and agencies/insurers 18% and banks and others 11%. For the 5Y, Asia bought 73%, the US 26% and EMEA 1%. Asset/fund managers took 58%, central banks/ sovereigns/supranationals and agencies/insurers 20% and banks and others 22%. Proceeds will be used to finance and/or refinance projects from social eligible categories in accordance with the bank’s green, social and sustainability bond framework.

Jiangsu Century New City Investment Holding raised $110mn via a 364-day note at a yield of 6.5%. Xinzhan Limited is the issuer and Jiangsu Century New City Investment is the guarantor. Proceeds will be used for debt refinancing and general corporate purposes.

New Bonds Pipeline

- Adani Ports SEZ hires for $ 10Y and/or 20Ybond

- Medco Energi plans up to $800mn Yankee offering

Rating Changes

- AstraZeneca Upgraded To ‘A-‘ By S&P On Finalization Of Alexion Acquisition; Outlook Stable; Removed From CreditWatch Positive

- Moody’s upgrades Bank of Cyprus’ and Hellenic Bank’s deposit ratings to B1, from B3, with positive outlooks

- Fitch Downgrades Talen’s IDR to ‘B-‘; Outlook Revised to Negative

- Adani Electricity Mumbai Ltd. Outlook Revised To Negative By S&P On Parent’s Weakening Credit Quality; ‘BBB-‘ Rating Affirmed

- Fitch Revises Rwanda’s Outlook to Negative; Affirms at ‘B+’

- Fitch Revises Barclays plc’s Outlook to Stable; Affirms at ‘A’

- Fitch Revises Toledo, OH Outlook to Stable; Affirms Sewer Revenue Bonds at ‘A+’

-

Moody’s withdraws Puerto Rico’s general obligation and related ratings for business reasons

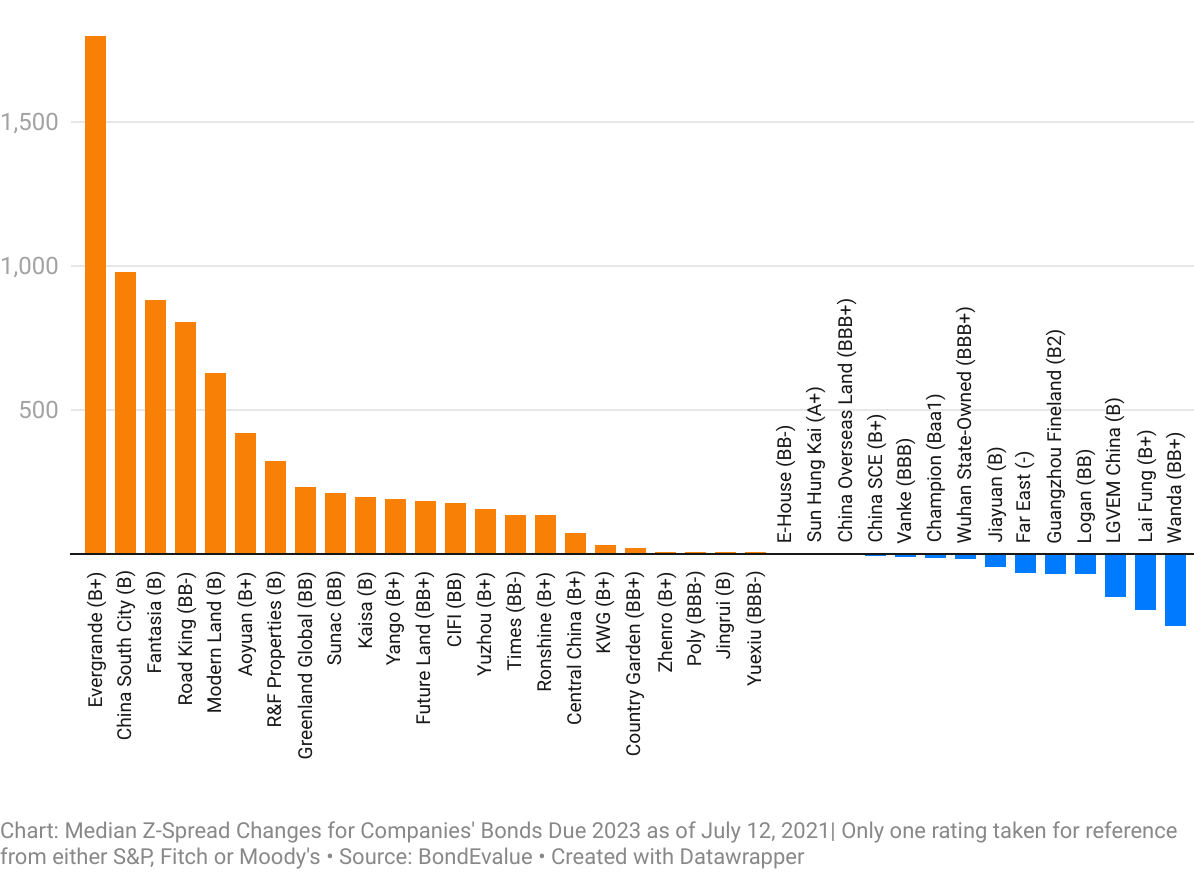

Chinese Developers’ Bond Spreads Widen as Focus on Three Red Lines Increases

China’s real estate developers’ high yield Index underperformed its peers witnessing a sharp drop of 6% in June and down 3.7% YTD. Investor concerns were apparent since the start of Q2 with Z-Spreads widening across certain Chinese real estate developers. China Evergrande’s Z-Spread widened by a massive 1,800bp since April, the highest in the sector as investor concerns grow over its liquidity position. The ‘three red-lines’, a key regulatory threshold for property developers set by Beijing has become an important factor that separates the winners and the losers.

In this editorial piece, we detail the widening Z-Spreads across companies in the Chinese property sector, the sector’s underperformance, and the three red-lines calculations of the key players.

Term of the Day

Lien

A lien refers to a legal right of the creditor to claim a security interest or seize control in an asset provided by the asset’s owner. It gives a type of a legal guarantee to the lender for obligations like loan or debt repayments. Bonds typically can be either first lien, which consist of senior secured debt, or second lien, which consists of junior or subordinated debt that rank below first lien debt in the capital structure. A bondholder of a ‘first lien bond’ gets repaid before all other liens and bondholders in the event of a default. Second lien holders get repaid only after the first lien holders get paid back. But it is important to note that even first lien holders may not get repaid if the borrower is unable to raise enough funds from the collateral sale to pay them back in an event of default.

Carnival Corp raised $2.4055bn via a 7Y bond with proceeds being used to refinance existing first lien notes.

Talking Heads

Aneta Markowska, chief financial economist at Jefferies

“The market is trading on the stagflation theme.” “There’s the idea that these price increases are going to cause demand destruction, cause a policy mistake and ultimately that slows growth.” “Consensus is projecting 3% growth. I think we could grow 4% to 5% next year,” Markowska said. “Not only is the consumer still very healthy, but you’re going to have massive inventory restocking at some point. Even if demand comes down, supply has so much catching up to do. You’re going to see the mother of all restocking cycles.”

Michael Collins, senior portfolio manager at PGIM Fixed Income

“Our view is growth and inflation moderate.” “I don’t care what growth and inflation looks like this year, what matters to our forecast of the 10-year Treasury is what it’s going to be like over 10 years. And I think it’s going to go back down. That’s the world we live in.” “The US is going to continue to be a leader in global growth and economic dynamism,” he said. “But 1.5% to 2% is our speed limit on growth unless we have some productivity miracle.”

Elga Bartsch, head of economic and markets research at the BlackRock Investment Institute

“The ECB has materially reduced the chances of premature tightening.” “It is now, when the new strategic framework is implemented, that we could get dovish surprises.”

Robert Tipp, head of global bonds at PGIM Fixed Income

“Beyond the PEPP there’s going to be a serious buying programme, and it’s hard to imagine they won’t emphasise that message.” “This is ultimately bond supportive.”

“Beyond the PEPP there’s going to be a serious buying programme, and it’s hard to imagine they won’t emphasise that message.” “This is ultimately bond supportive.”

Krishna Guha, vice-president at Evercore ISI

“The ECB opened the door to a more dovish strategy with the release of its new strategic framework.” “Now it has to walk through it.”

“The ECB opened the door to a more dovish strategy with the release of its new strategic framework.” “Now it has to walk through it.”

Silvia Ardagna, an economist at Barclays

“The key message of the ECB’s revised forward guidance will be ‘loose for longer’.”

Andrew Bosomworth, a managing director at Pimco

“The ECB invites the question of how it will achieve this more ambitious goal from such a low starting point while using the same old tools.” “This creates a credibility issue that we think will leave inflation expectations subdued.”

“The ECB invites the question of how it will achieve this more ambitious goal from such a low starting point while using the same old tools.” “This creates a credibility issue that we think will leave inflation expectations subdued.”

“Since March 2020, governments have spent $16 trillion (Dh58.72 trillion) providing fiscal support amid the pandemic, and global central banks have increased their balance sheets by a combined $7.5 trillion (Dh27.5 trillion). This was absolutely necessary — IMF research indicates that if policymakers had not acted, last year’s recession, which was the worst peacetime recession since the Great Depression, would have been three times worse.”

“Seizing the opportunity could deliver years of solid post-Covid-19 growth and progress in living standards. The IMF estimates that comprehensive growth-enhancing reforms cutting across product, labour, and financial markets could raise annual growth in GDP per capita by over one percentage point in emerging market and developing economies in the next decade. These countries would be able to double their speed of convergence to advanced economies’ living standards relative to the pre-pandemic years.”

Top Gainers & Losers – 22-Jul-21*

Other Stories

Go back to Latest bond Market News

Related Posts: