This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

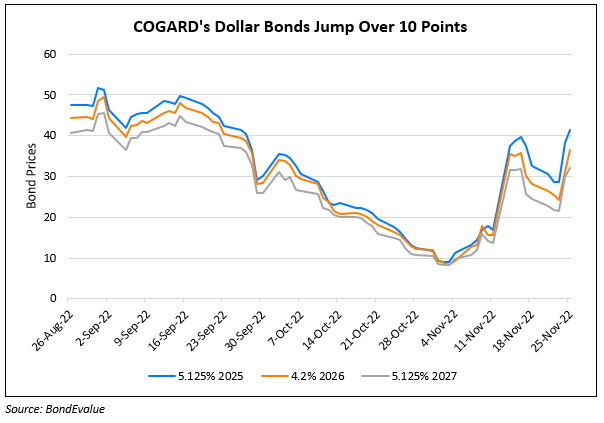

COGARD Said to Have Prepared Funds for Dollar Bond Payments in the Coming Weeks

January 11, 2023

Country Garden (COGARD) is said to have told investors that it has readied funds to repay its dollar debt due in January, as per sources. The developer has a $617mn maturity due on its 4.75% bonds due January 17, apart from six coupons due in next few weeks, overall totaling to ~$700mn in payments. The developer has already raised over $1.4bn via share sales since July 2022 besides issuing ~$516mn in state-backed bonds, securing a $280mn loan from ICBC and $650mn interest-free loan from its co-chairman.

Its 4.75% bonds due next week were trading 0.1 points higher at 99.63, whilst its other dollar bonds were down over 0.5 points. Many Chinese developers’ dollar bonds filled the losers list, with the likes of Greenland, Seazen, Sino-Ocean, South City etc. down 3-7%. This comes after a broad rally across their bonds since last week on reports that China is considering further easing of financial stress for developers.

Go back to Latest bond Market News

Related Posts:

Country Garden Downgraded to B+ by S&P and Withdraws Ratings

November 9, 2022