This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Colombia Planning More Shorter Term Debt

June 7, 2021

Colombia signaled that it might rely more heavily on short-term debt to cover budgetary shortfalls in a move to decrease interest costs after the failed tax-reform push increased bond yields and caused social unrest. Colombia’s Ministry of Finance official, Public Credit Director Cesar Arias, announced that he will commence discussions with investors on the possibility of scaling back the maturities on some of Colombia’s bonds that will be sold at auctions. “We plan to continue with what we have in terms of the amount,” said Cesar Arias. “What we are beginning to discuss with the market is the optimal duration, given the steepness of the curve and overall investor appetite. My sense is that the duration will probably be shorter.” This potential move was triggered by the jump of long-term yields and alongside the introduction of the tax-hike plan of President Ivan Duque in May, which set-off national protests and forced the finance minister to resign.

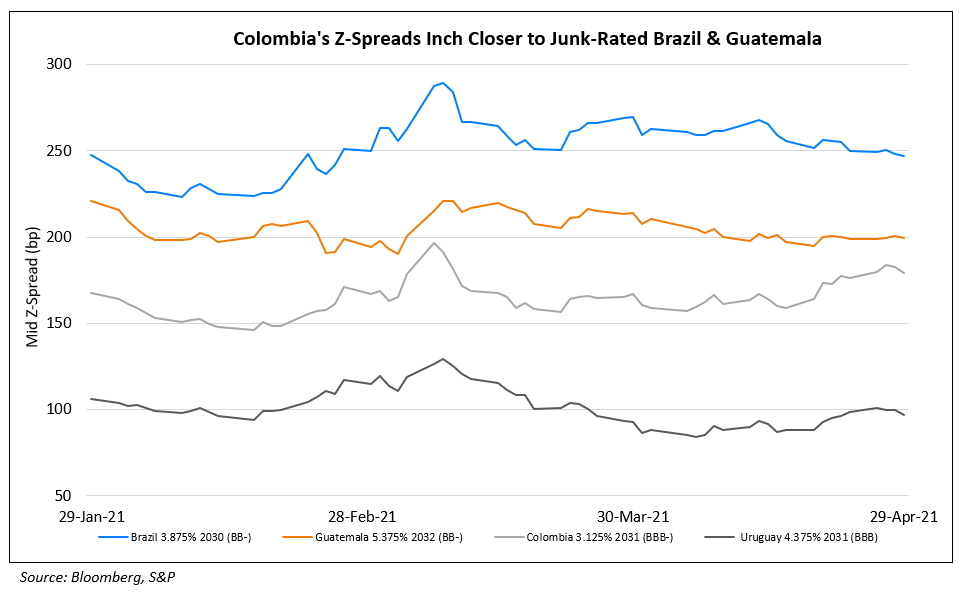

The nation’s foreign-currency debt rating was cut to junk last month by S&P Global Ratings as Colombia faces climbing deficits. The new Finance Minister of Colombia Jose Manuel Restrepo is seeking to secure a wide consensus prior to introducing new tax proposals. Colombia’s USD bonds were up. Its 4.125% 2051s up 1.12 to 92.752, yielding 4.57% and its 3.875% 2061s up .86 to 86.957, yielding 4.59%

For the full story, click here

Go back to Latest bond Market News

Related Posts: