This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

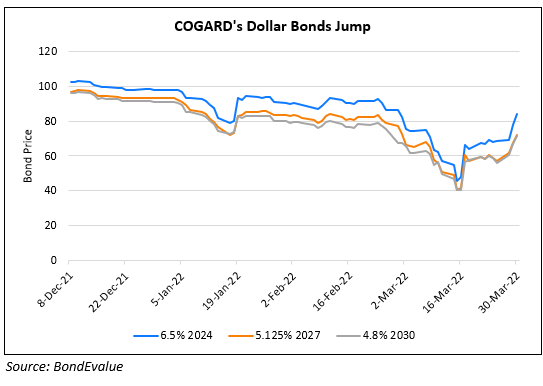

Country Garden’s Dollar Bonds Rally after Improved Leverage Metrics

March 31, 2022

Leading Chinese property developer Country Garden (COGARD) reported its results yesterday. Its dollar bonds jumped as much as 6 points after its results. Below are some highlights of its earnings release:

- 17% YoY drop in its 2021 core net profits to RMB 26.9bn ($4.2bn)

- Revenues rose 13% to RMB 523.1bn ($82.4bn)

- Contracted sales were down 2% to RMB 558bn ($87.9bn) in 2021. COGARD also added that in the first two months of 2022, it achieved attributable contracted sales of RMB 69.1bn ($10.9bn)

- Cash collection ratio of higher than 90% for the sixth consecutive year. Cash collection of RMB 65.7bn ($10.4bn) in January and February 2022 and a rolling cash collection ratio above 90% during the same period

- Net gearing ratio improved to 45.4% in 2021 from 55.6% in 2020.

- Total debt fell 2.6% YoY to RMB 317.9bn ($50.1bn)

- Borrowing costs dropped by 36bp YoY to 5.2%. It has seen a significant decrease of 114bp from 2019 levels

- Cash and cash equivalents were stable at RMB 181.3bn ($28.6bn).

- The Board recommended payment of a final dividend of RMB 10.12 cents per share

Go back to Latest bond Market News

Related Posts:

Country Garden Plans to Raise $1.03bn via Share Sale

November 19, 2021

Country Garden Raises ~$500mn via HKD Convertible Bond

January 21, 2022

Country Garden’s Bonds Drop Over 4-5 Points

March 1, 2022