This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

CPI Expected at 6.2%; Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

February 14, 2023

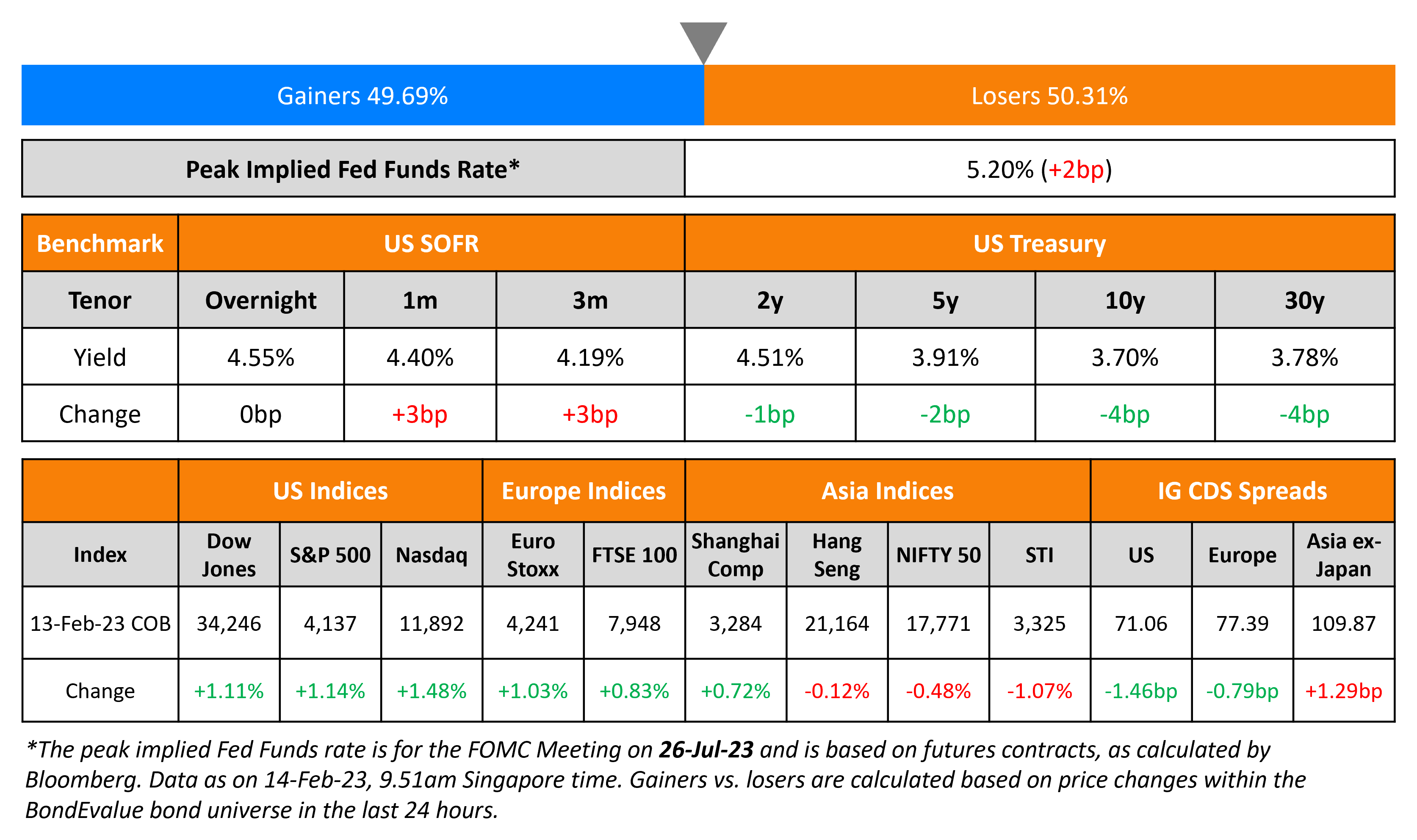

US Treasury yields were marginally lower by 2-4bp across the curve. The peak Fed funds rate widened 2bp to 5.20% for the July 2023 meeting. All eyes now focus on the Jan CPI inflation report, out later today, with estimates of a 6.2% print. Markets are currently pricing in a 91% probability of a 25bp hike at the March meeting and a 73% probability of another 25bp hike in May. US IG CDS spreads tightened by 1.5bp while HY spreads were 10.3bp tighter. Equity indices were higher with the S&P and Nasdaq higher by 1.1% and 1.5% respectively.

European equity markets ended higher. The European main CDS spread tightened 0.8bp while crossover CDS spreads tightened 8.7bp. Asian equity markets have opened with a negative bias today. Asia ex-Japan CDS spreads were 1.3bp wider.

.png)

New Bond Issues

Intesa Sanpaolo raised €1bn via a 11NC6 bond at a yield of 6.184%, 25bp inside initial guidance of MS+350bp area. The subordinated Tier 2 notes have expected ratings of Ba1/BB+/BB+, and received orders over €2.25bn, 2.3x issue size. Proceeds will be used for general corporate purposes. The issuer has the option to redeem the bonds on any day between 20 November 2028 to 20 February 2029 and if not redeemed, the current coupon of 6.184% will be reset to 5Y MS+325bps.

ING Groep raised ~€1.35bn via a two-tranche multi-currency deal. It raised:

- €500mn via a 12NC7 bond at a yield of 5.114%, 20bp inside initial guidance of MS+240bp area. The new notes received orders over €800mn, 1.6x issue size. The bonds are callable from 20 November 2029 until 20 February 2030 at par and if not called, the coupon of 5% will be reset at 5Y MS+220bps.

- £750mn via a 10.25NC5.25 bond at a yield of 6.263%, 20bp inside initial guidance of UKT+300bp area. The new notes received orders over £1.1bn, 1.5x issue size. The bonds are callable from 20 February 2028 until 20 May 2028 at par, and if not called, the coupon of 6.25% will be reset at 5Y UKT +280bps.

The subordinated Tier 2 notes have expected ratings of Baa2/BBB/A-. Proceeds will be used for general corporate purposes.

CVS Health raised $6bn via a four-tranche deal as shown in the table below.

The senior unsecured bonds have expected ratings of Baa2/BBB. Proceeds will be used for general corporate purposes, which may include working capital, capital expenditures, repayment of indebtedness and acquisitions. The issuer may use net proceeds to fund a portion of the purchase price of its pending acquisition of Signify Health.

Huzhou Economic Development Group raised $200mn via a 3Y bond at a yield of 7.3%, 20bp inside initial guidance of 7.5% area. Huantaihu International Investment is the issuer of the unrated notes with a guarantee from the parent. Proceeds will be used for refinancing.

New Bonds Pipeline

- Chindata $ bond

Rating Changes

- Coty Inc. Upgraded To ‘BB-‘ On Continued Deleveraging, Outlook Stable

- Moody’s downgrades Gol’s CFR to Caa2; assigns Caa2 rating to new notes; negative outlook

Term of the Day

Kangaroo Bonds

Kangaroo bonds are bonds issued in Australia by non-Australian issuers denominated in Australian Dollars. These bonds give foreign issuers access to another country’s capital markets and helps them diversify their capital base and could reduce borrowing costs. Although, the currency risk is borne by the issuer.

Emirates NBD Bank has launched a 10Y Kangaroo bond offering.

Talking Heads

On Urging Investors to Ditch Stocks for Bonds – JPMorgan’s Kolanovic

“A recession is currently not priced into equity markets… With equities trading near last summer’s highs and at above-average multiples, despite weakening earnings and the recent sharp move higher in interest rates, we maintain that markets are overpricing recent good news on inflation and are complacent of risks”

On Global Liquidity Drain Is Coming for Markets – Citi’s Matt King

“he origins of this year’s risk rally lie in obscure technicals driving central bank liquidity. At this point we think most of the boost to reserves is done. This implies that the story for the rest of this year should return to being one of liquidity drainage and risk weakness.”

On more interest rate hikes needed to tame inflation – Fed’s Michelle Bowman

“I expect we’ll continue to increase the federal funds rate because we have to bring inflation back down to our 2% goal and in order to do that we need to bring demand and supply into better balance

Top Gainers & Losers – 14-February-23*

Go back to Latest bond Market News

Related Posts: