This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Credit Suisse Clients Could Lose $3bn on Greensill Funds

March 26, 2021

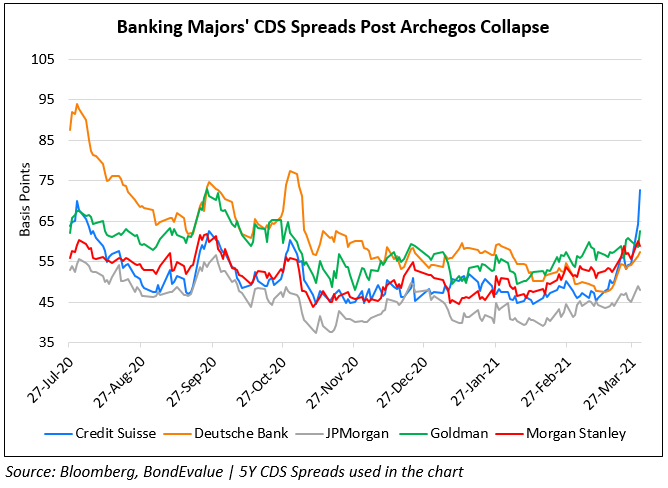

Credit Suisse estimates that clients could lose up to $3bn from the frozen funds linked to Greensill Capital, the collapsed specialist finance firm, more than the bank’s total net income of $2.9bn in 2020. $10bn worth of finance funds, marketed as low-risk products offering higher return than cash deposit, were suspended on March 1 after the collapse. Credit Suisse already paid back $3.1bn to over 1,000 investors and plans to return another $1bn by April.

Amongst the borrowers that owe the funds are GFG Alliance accounting for $1.3bn and Bluestone Resources owing $850m. Several other creditors are showing reluctance on repaying the Swiss bank, bringing a maximum exposure of around $3bn. However, the bank’s executives are confident that losses can be reduced to $1bn-1.5bn. The lender has discussed potential compensations for investors, expected to be up to 50% as per Reuters. The bank also commented that any litigation from investors could result in “material” financial losses, client desertions and falling assets under management.

Credit Suisse’s dollar perps were stable – their 6.25% Perps were at 110, yielding 3.4%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: