This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

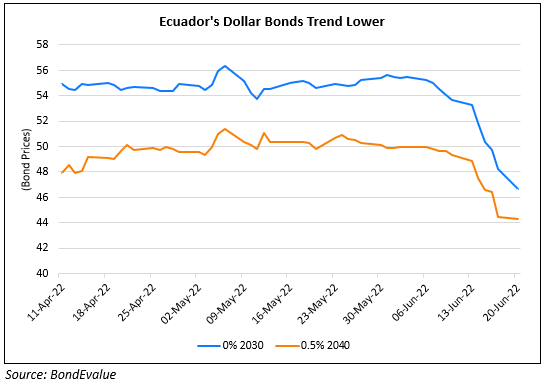

Ecuador’s Dollar Bonds Drop over 10% Last Week

June 20, 2022

Ecuador’s dollar bonds have fallen over 10-12% in the past week as protests by indigenous groups have erupted. In 2020, the country defaulted on debt and faced a similar political chaos. These groups are demanding more energy subsidies and price controls of basic goods. Bloomberg notes that the agriculture and tourism industry has suffered millions of dollars lost in revenue due to protests. Ecuador’s Finance Ministry official said, “While the global market backdrop is challenging, Ecuador’s government can deal with this year’s obligations without having to sell new bonds.” For a long time, Ecuador has struggled with political and social instability and only recently, defaulted in 2020.

Go back to Latest bond Market News

Related Posts: