This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

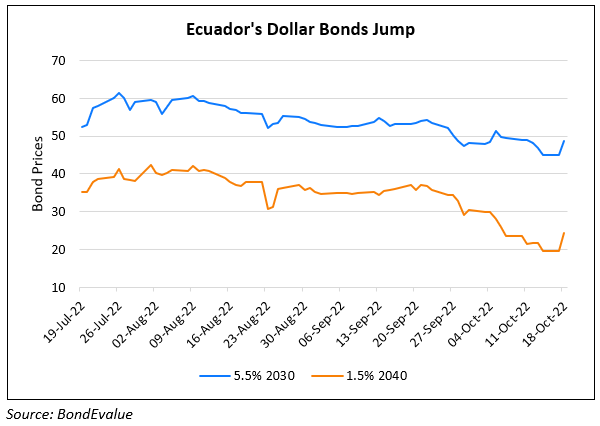

Ecuador’s Dollar Bonds Jump 3-5 Points on Debt-For-Nature Swap

May 8, 2023

Dollar bonds of Ecuador rallied by 3-5 points on news regarding its debt-for-nature swap bond buyback. Credit Suisse assisted the buyback totaling $1.63bn of bonds at discounted prices. The buyback saw:

- $202mn of its 5.5% 2030s repurchased at 53.25 cents on the dollar. Its 2030s are currently trading at ~55 cents on the dollar

- Over $1bn of its 2.5% 2035s repurchased at 38.5 cents on the dollar. Its 2035s are currently trading at ~40 cents on the dollar

- $420mn of its 1.5% 2040s repurchased at 35.5 cents on the dollar. Its 2040s are currently trading at ~36 cents on the dollar.

The debt-for-nature swap will see Ecuador buyback the above notes and issue a new blue bond with an estimated yield of 6% to fund the above discounted purchases of its old notes. The cost savings due to the purchase will be used to protect the Galapagos Islands. The new bond will be given credit guarantees by the Inter-American Development Bank (IADB) and US International Development Finance Corporation (DFC). Thus they are expected to be rated Aa2 by Moody’s, 16 notches above the nation’s issuer rating of Caa3. Katrina Butt, an EM economist at AllianceBernstein said, “The results of the tender indicate that the market believes Ecuador’s bonds are underpriced. Prices today are adjusting to reflect that shift in sentiment”.

For more details, click here

Go back to Latest bond Market News

Related Posts: