This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Egypt’s Dollar Bonds Trend Lower

February 13, 2023

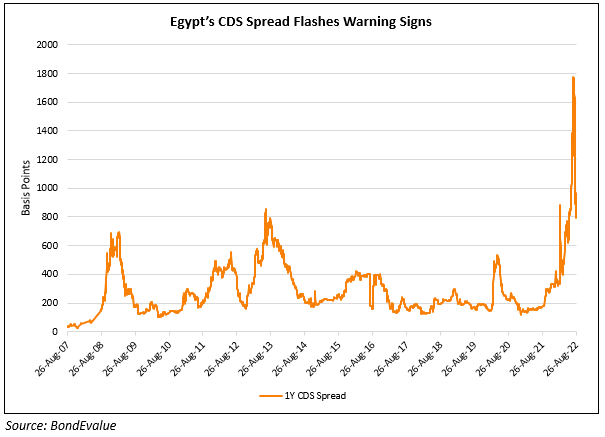

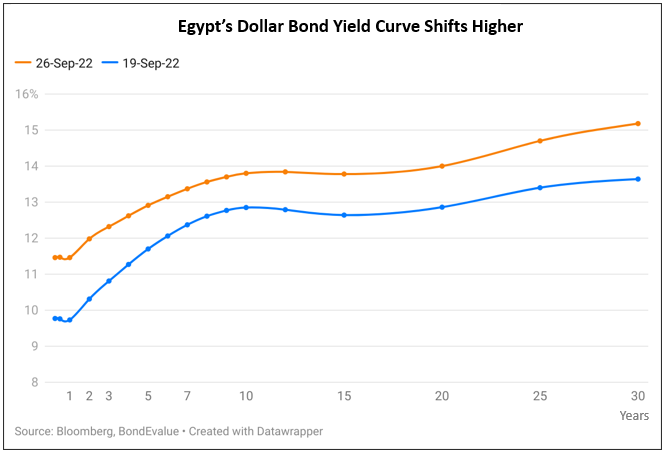

Egypt’s dollar bonds have fallen over 5% since the beginning of the month. The sovereign was downgraded recently to B3 from B2 by Moody’s citing “reduced external buffers and shock absorption capacity”. The nation’s forex reserves have fallen 17% to $34.2bn from last year’s high of $41bn that Moody’s says has increased “external vulnerability”. Last month, Egypt adopted a flexible exchange rate after years of closely managing the currency. This had helped the country secure a $3bn loan from the IMF. The Egyptian Pound has dropped 19% vs the US dollar this year.

Go back to Latest bond Market News

Related Posts: