This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Evergrande Plans Using Onshore Assets for Offshore Debt Restructuring: Sources

November 18, 2022

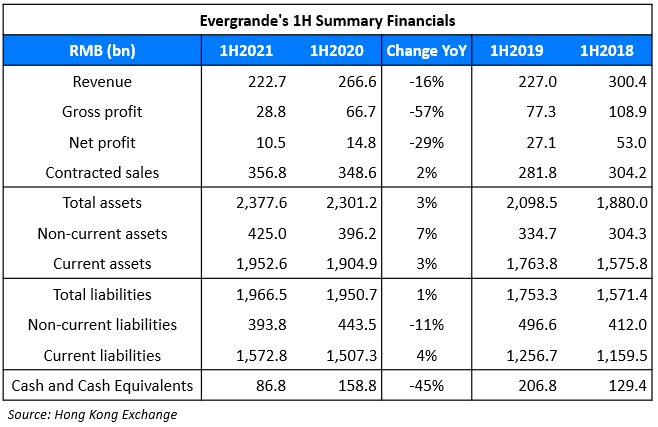

China Evergrande is said to include its onshore assets in its debt restructuring proposal in order to win offshore creditors’s approval, as per sources. They note that if Evergrande’s use of its onshore assets as a ‘sweetener’ is accepted by offshore bondholders, it would be the first Chinese developer to use such an arrangement. One of the sources noted that Evergrande will sign NDAs with bondholders by end-November to prepare for negotiations in December. The question now focuses on what onshore assets could be offered, as the developer has pledged most of its assets to onshore creditors and parties such as local governments. Reuters notes that offshore, its major assets in Hong Kong have already been seized by creditors. Sources also note that the winding-up petition against Evergrande adds to further complications. If the petition is successful, it could reduce the value of its onshore assets leading them to scour for other credit enhancement options.

Evergrande’s dollar bonds were trading 0.4-0.9 points higher at ~6 cents on the dollar.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Evergrande Cuts Borrowings by 10% to $109 Billion

April 1, 2021

China Evergrande Warns of Default Risk & Rising Litigation Cases

September 1, 2021