This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Fallen Angel ETF’s Assets Double to $1 Billion on Strong Flows in The New Year

January 21, 2021

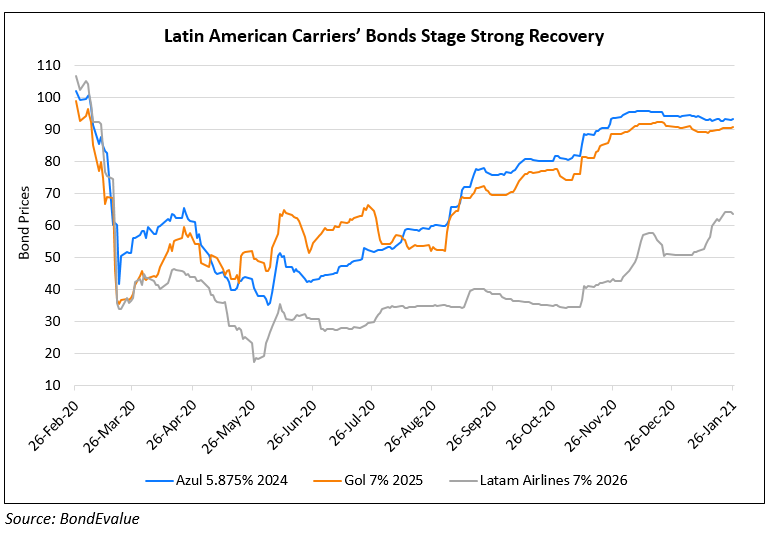

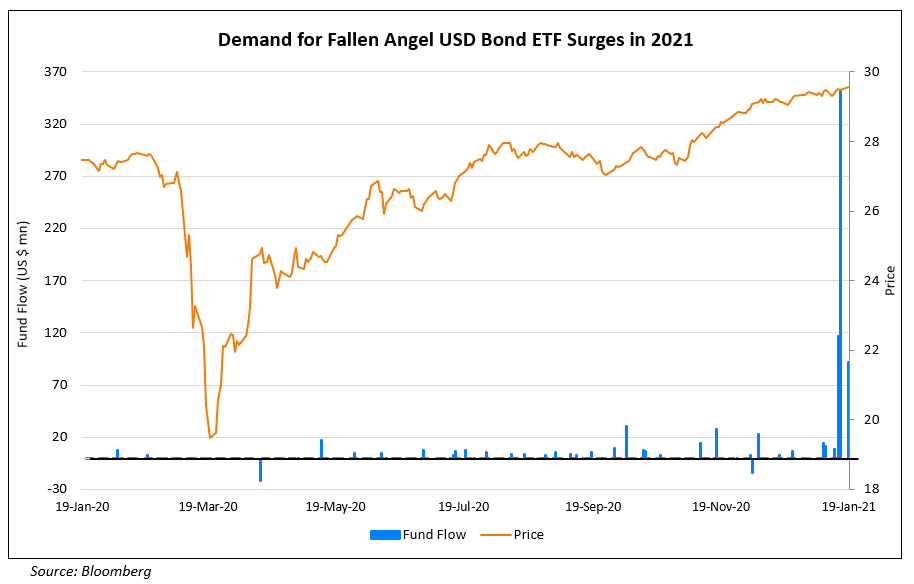

Strong appetite for fallen angel bonds – bonds of issuers that have recently been downgraded to junk from investment grade – have led to solid inflows in the iShares FALN ETF in the new year. Record weekly inflows of $478mn, followed by another $93mn have boosted FALN’s total assets to over $1bn now. Strong demand on the back of stimulus from the Fed led the ETF to rise 7.75% in 2020 in price terms ex-coupon and a massive 41.6% since late March last year when fears regarding the pandemic led to a sharp sell-off. FALN’s single largest bond holding (2.21%), Carnival’s 11.5% bond due 2023 has rallied over 15% since issuance at 99 in early April 2020 to now trade at 114. Sameer Samana, senior global market strategist at Wells Fargo Investment Institute said, “The whole script flipped in early November. Investors are betting that a re-opening of the global economy, along with the reflationary trends that we’re seeing, will lead to spread tightening and credit rating upgrades.”

For the full story, click here

Go back to Latest bond Market News

Related Posts: