This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Fantasia’s Bonds Drop; Chinese HY Index Falls to Lowest since a Year

September 6, 2021

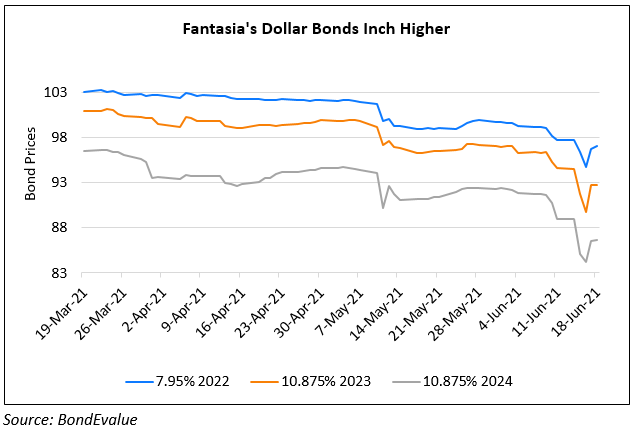

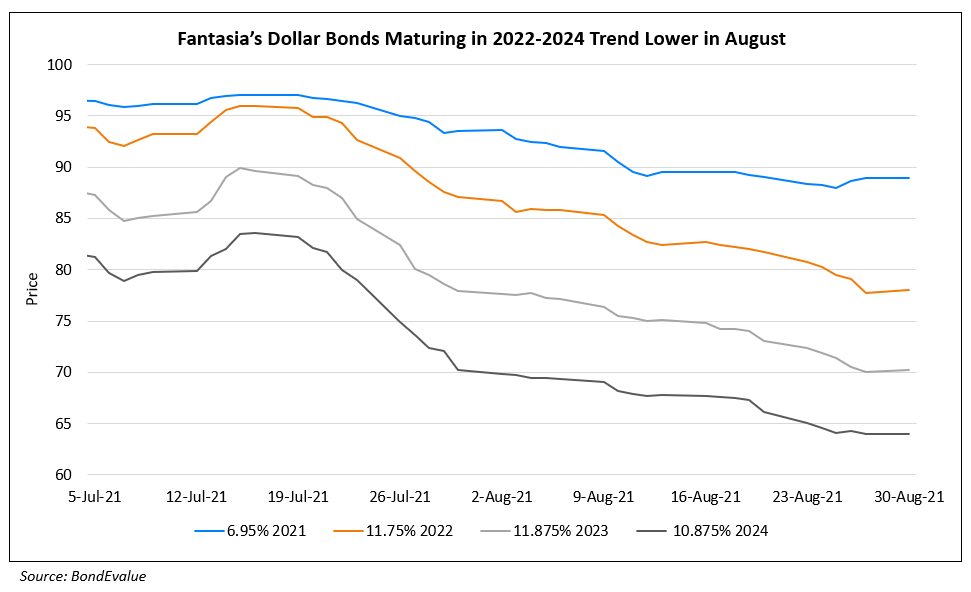

Dollar bonds of Fantasia have dropped this morning with its 10.875% 2023s in particular down 21 cents to trade at 52.8 cents on the dollar. Fantasia’s bonds have been trending lower for more than a week and have followed the path of peers like R&F Properties and Evergrande on refinancing concerns. Fantasia’s dollar bonds maturing beyond 2022 now trade near distressed levels of ~50 cents with its 10.875% 2024s at 48.5 and its 9.875% 2023s at 50.5. In a bid to calm investor concerns, Fantasia has repurchased $6mn of principal worth of five separate dollar bonds since mid-August, according to Bloomberg. It has bought $1mn of its 6.95% 2021s, $1mn of its 15% 2021s, $1.5mn of its 11.75% 2022s, $1.5mn of its 11.875% 2023s and $1mn of its 9.875% 2023s.

In related news, the ICE BofA Asian Dollar High Yield Corporate China Issuer index has fallen to its lowest since May 2020 on investor concerns over credit risks about Evergrande, according to Reuters. The index fell 5 points to 380bp on Friday.

Go back to Latest bond Market News

Related Posts: