This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

February 2022: Inflation & Geopolitical Risks Drag 93% of Dollar Bonds Lower

March 2, 2022

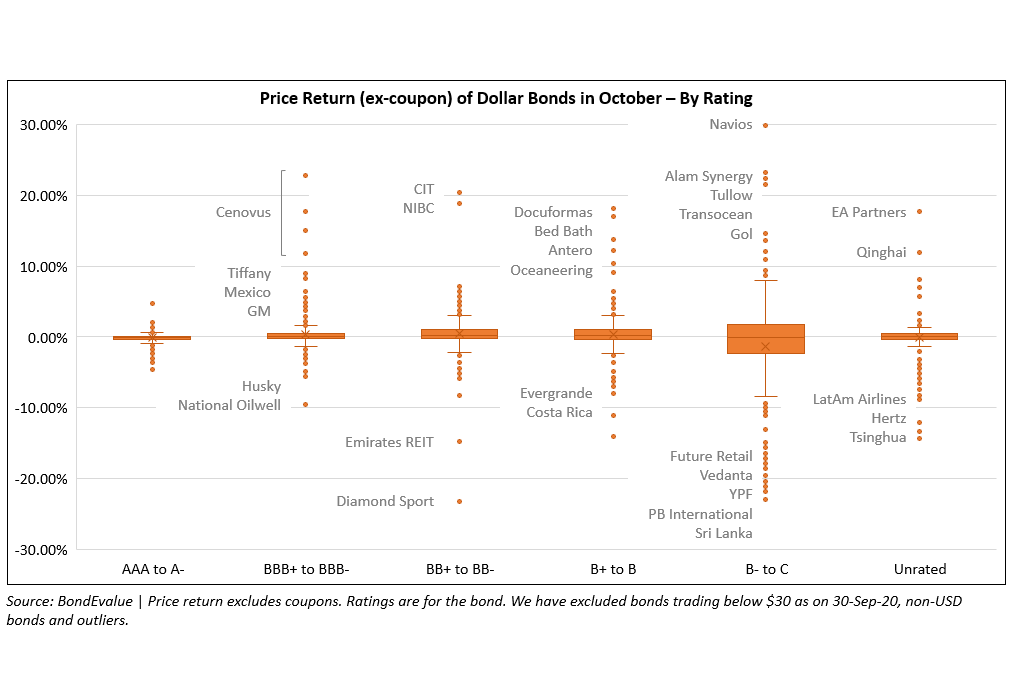

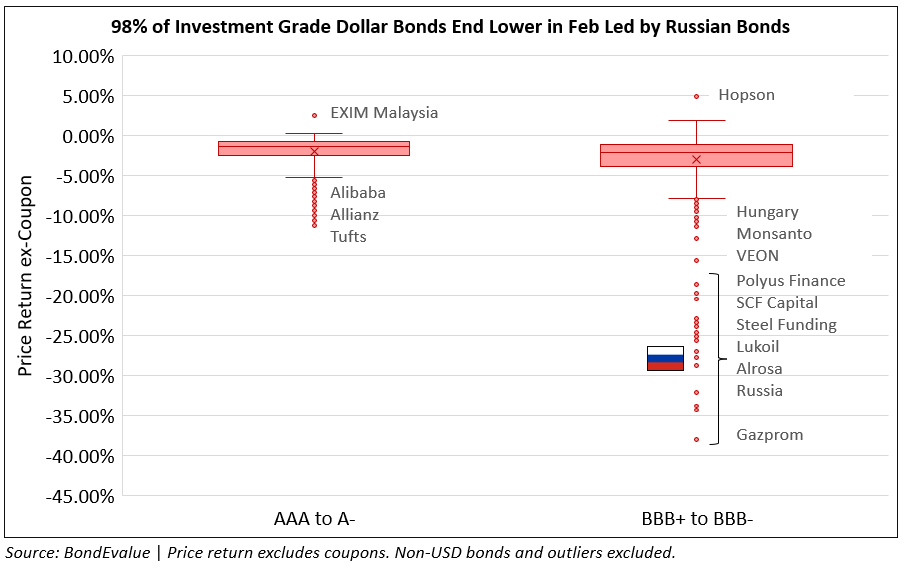

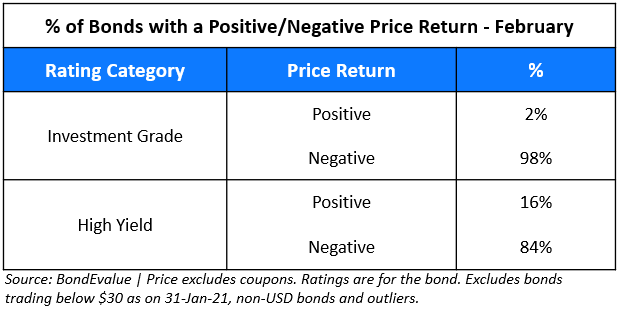

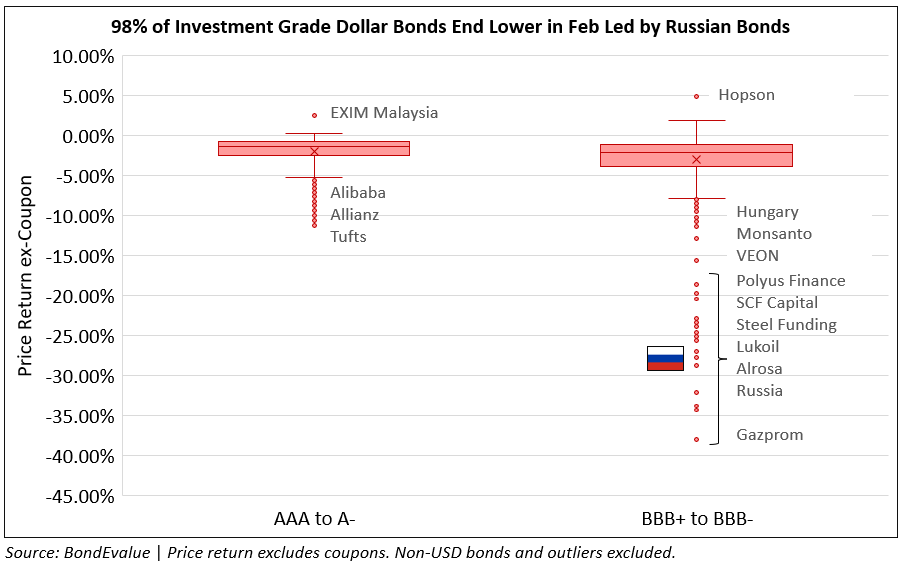

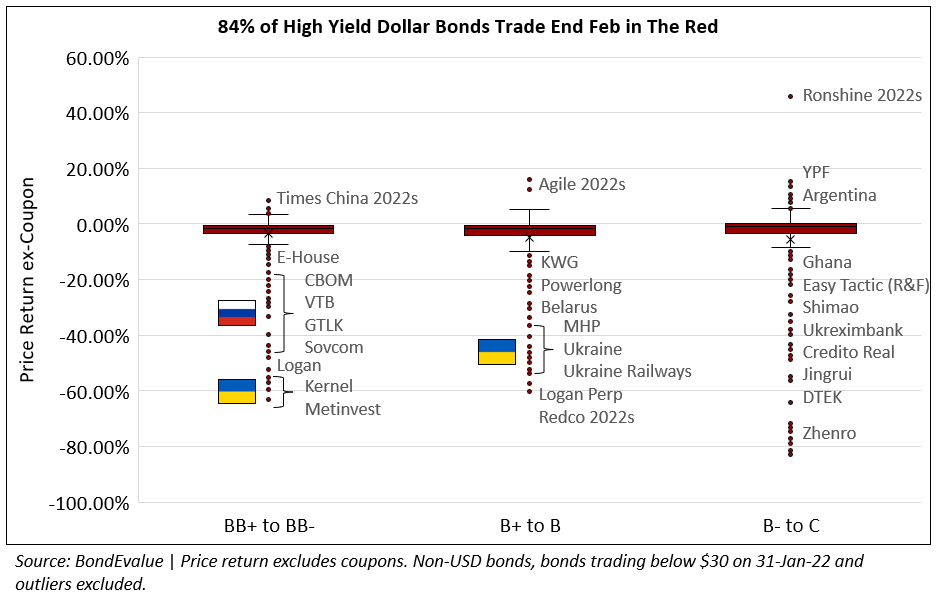

February was the sixth consecutive month where dollar bonds in our universe ended the month lower, with 93% of bonds in the red. This was after a similarly dreadful January where 92% of dollar bonds ended in the red. Investment grade (IG) bonds – more sensitive to interest rate changes compared to high yield (HY) bonds, all else equal – were the most impacted. 98% of investment grade dollar bonds ended February in the red, compared to 86% of high yield dollar bonds that ended the month lower. The move in the IG space comes after US 10Y Treasury yields spiked higher during the month, from 1.78% on January 31, to cross the 2% mark for the first time since July 2019 after a 7.5% inflation print on February 10, the highest inflation reading in 40 years. The 10Y Treasury yield has since eased to 1.86% currently on the back of a risk-off sentiment triggered by Russia’s invasion of Ukraine.

Adding to the negative sentiment, the Russia-Ukraine crisis has brought about massive volatility across global markets affecting everything from commodities to stocks. Bonds have not been spared either - the EM dollar bond index is down 7.1% YTD, US investment grade and high yield indices are down 5.3% and 3.7% respectively, while the Asian investment grade and high yield dollar bond indices are down 3.8% and 7.7%.

Comprehensive 8-Module Course on Bonds | Starting 28 March 2022

In the current environment marred by geopolitical concerns, impending rate hikes and crisis in China real estate, it is imperative for investors and advisors to be able to analyze bonds effectively. This course will help you do just that via 8 interactive sessions conducted live via Zoom by senior debt capital market bankers and professionals starting 28 March.

Click on the banner below to know more and to sign up.

Among the top-rated names within the investment grade space (AAA to A-), Alibaba's dollar bonds were down ~5% after rumours of a fresh round of regulatory checks on its fintech business arm, Ant Group. Allianz's 3.875% fixed-for-life Perp dropped over 10% after the company indicated that it will not be redeeming the bonds on the first call date of March 7. Besides, the German insurer also posted a net loss of €292mn ($332mn) in Q4 2021, taking a massive $4.2bn hit over the collapse of a multi-billion-euro set of investment funds. Within the BBB+ to BBB- names, Russian issuers dominated the losers list - the Russian sovereign and corporates like Gazprom, Alrosa, Lukoil, Polyus Finance etc. dropped between 20-40% as an array of sanctions were introduced by the US, EU and UK following its attack on Ukraine.

Investment Grade Bond Price Returns - Feb 2022

Within the HY space, the usual suspects - Chinese property developers - yet again dominated the losers, with some outliers like Ronshine, Times China and Agile's bonds that saw their upcoming 2022s jump. The biggest loser was Zhenro Properties whose dollar bonds dropped over 80% to distressed levels of ~15 cents on the dollar. The developer backtracked on its January statement citing liquidity issues and thereby its inability to be able to redeem its 14.724% Perp on its call date of March 5, 2022. Other peers like Logan, Redco, Jingrui, DaFa etc. also saw their dollar bonds collapse in the aftermath of the Zhenro’s collapse with liquidity concerns coming to the fore. Globally, apart from Chinese developers, the biggest group of losers were bonds of Ukraine, Russia and corporates within – the likes of Ukrexim Bank, Metinvest, VEB Bank, Gazprom, DTEK, MHP, Alfa Bond, VTB Bank etc. that dropped over 40%.

High Yield Bond Price Returns - Feb 2022

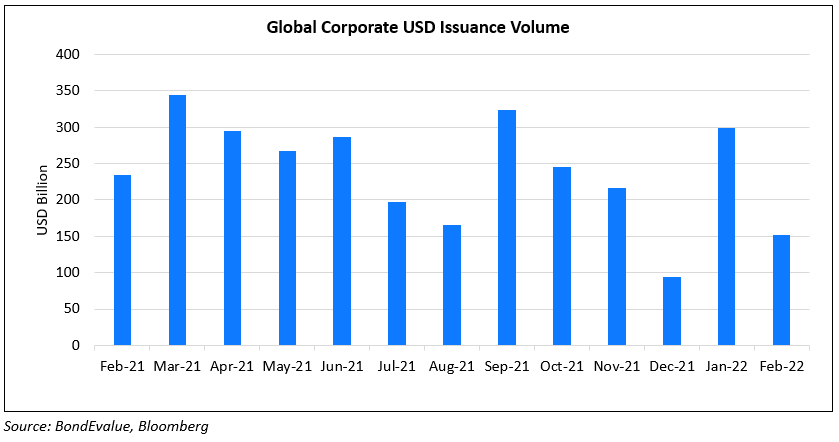

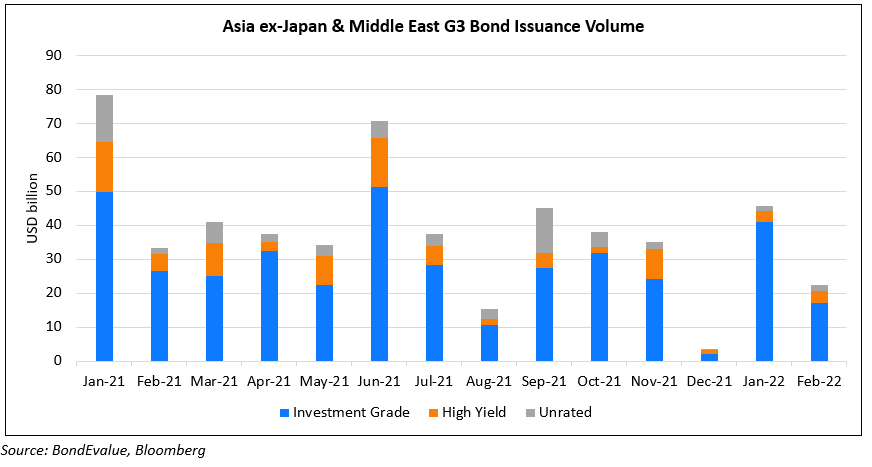

Issuance Volumes

Global corporate dollar bond issuance was muted given the dismal environment. New bond issuance volume stood at $151bn, down 49% MoM and 35% lower YoY. 85% of total issuances came from investment grade issuers while only 11% came from high yield or junk-rated issuers as market volatility weighed on high yield deals in particular.

APAC ex-Japan & Middle East G3 issuance stood at $22.4bn, down 33% YoY and over 50% MoM. Investment grade issuances dropped 58% MoM to $17bn while high yield was near flat at about $3bn.

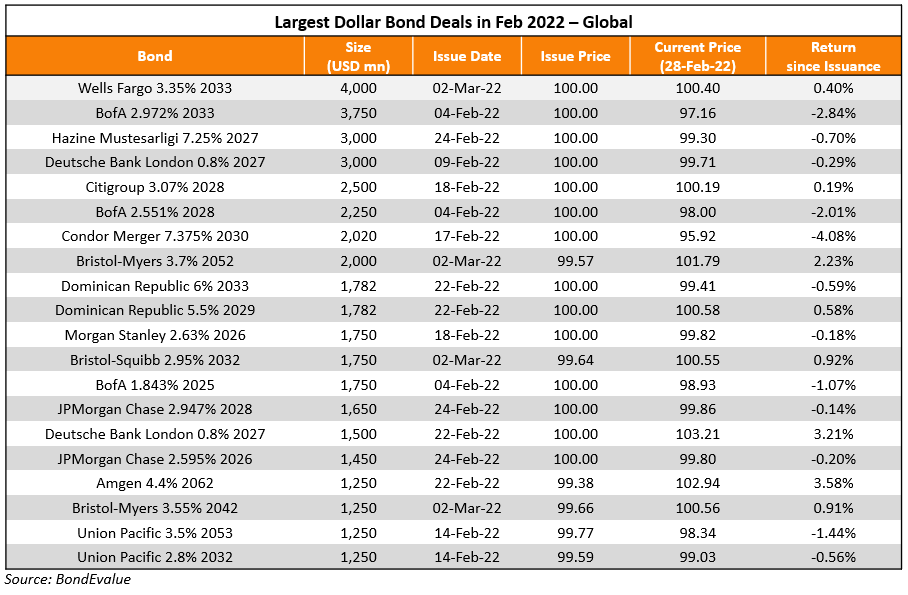

Largest Deals

The largest deals last month were led by global banking majors - Bank of America (BofA) raised $9bn via a five-trancher, JPMorgan raised $4.6bn via a four-trancher and Wells Fargo raised $4bn. Other large bank issuances included Deutsche Bank London's $3bn issuance, Citigroup's $3bn two-trancher and Morgan Stanley's $2.5bn two-part deal.

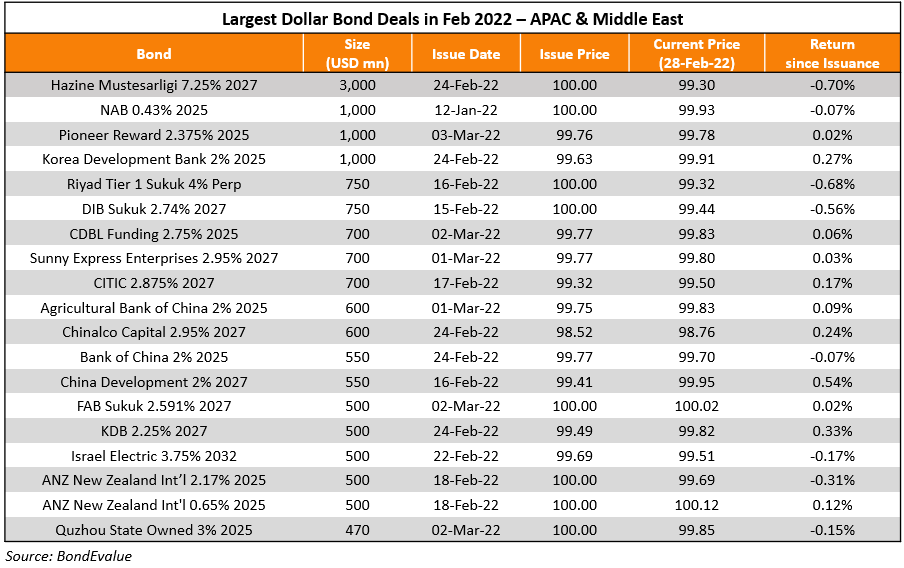

The largest deals from the APAC & Middle East region came from Turkey (Hazine Mustesarligi) raising $3bn via a sukuk, followed by Korea Development Bank's (KDB) $1.5bn two-trancher and Huatai Securities' $1bn issuance by Pioneer Reward. Other prominent sukuk issuances during the month included Riyad Bank and Dubai Islamic Bank's (DIB) $750mn issuances each.

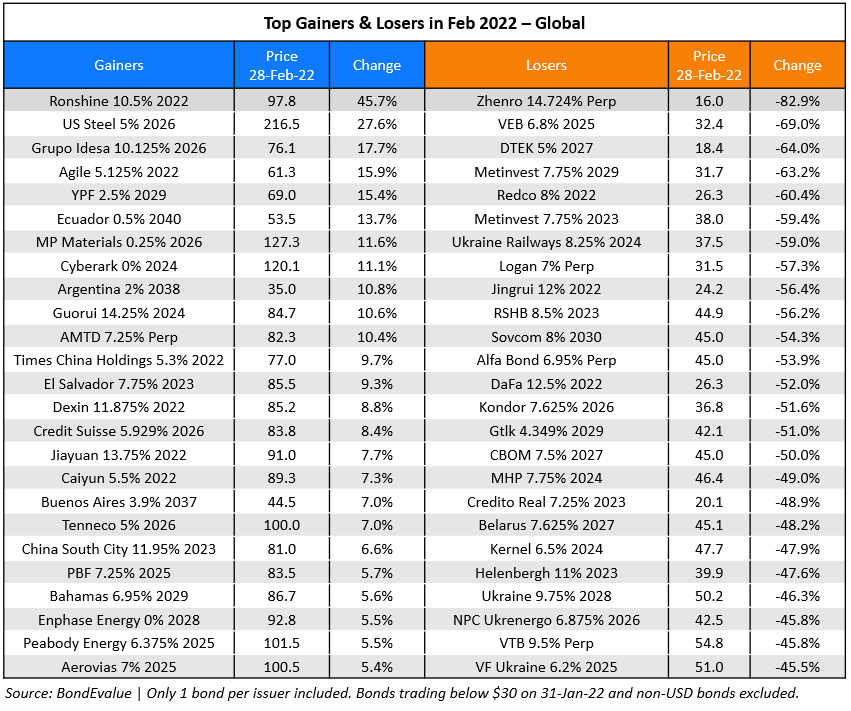

Top Gainers & Losers

Among the top gainers in January were select Chinese property developers like Ronshine, Agile and Times China's dollar bonds due in 2022. Other Chinese developers dominated the losers list led by Zhenro, Redco and Logan. Bonds of issuers operating in commodities such as US Steel, YPF, Grupo Idesa, Ecuador etc. rallied alongside the rally in commodities as inflation has been on the rise, coupled with the Russia-Ukraine crisis. For instance, Brent crude breached $100-105/bbl for the first time since 2014, helping oil and other commodity-related bonds outperform.

Amongst the biggest group of losers globally were bonds of Ukraine, Russia and corporates/financials from these regions – led by VEB Bank, DTEK, Metinvest, Ukraine Railways, Sovocom, Ukrexim Bank, Gazprom, MHP, Alfa Bond, VTB Bank etc. that dropped over 40%. The ongoing war coupled with harsh sanctions from the US, UK and EU on Russia/Russian corporates has led to the sudden sharp drop in these bonds.

Besides Russia and Ukraine, the usual suspects - Chinese property developers - continued to make headlines – Zhenro Properties’ dollar bonds dropped over 80% to distressed levels of ~15 cents on the dollar becoming the latest victim in the sector as the company nudged closer towards default. Zhenro backtracked on its January statement citing liquidity issues and thereby its inability to be able to redeem its 14.724% Perp on its call date of March 5, 2022. Other peers like Logan, Redco, Jingrui, DaFa etc. also saw their dollar bonds slip in the aftermath of Zhenro’s collapse with liquidity concerns coming to the fore.

All eyes are now on the upcoming Fed meeting on 16 March when market participants are pricing in a 89% probability of a 25bp rate hike and a 11% probability of a 50bp rate hike. While this will largely be in-line with expectations, the impact on bonds remains to be seen, especially given the ongoing geopolitical crisis.

Go back to Latest bond Market News

Related Posts:

The Record-Setting ‘Bubka’ Bond Market of 2020

October 14, 2020

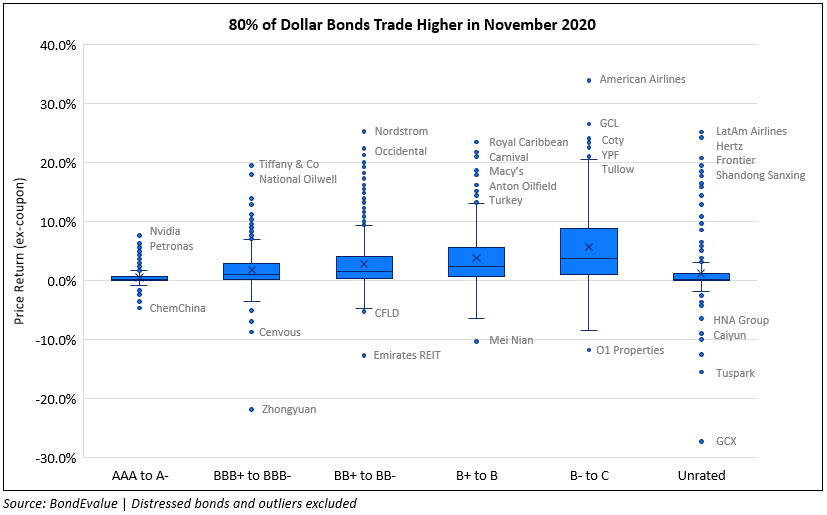

November 2020: 80% of Dollar Bonds In The Green on Vaccine Hopes

December 1, 2020