This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Finding Value in Popular Bank AT1 & Tier 2 Bonds

April 5, 2023

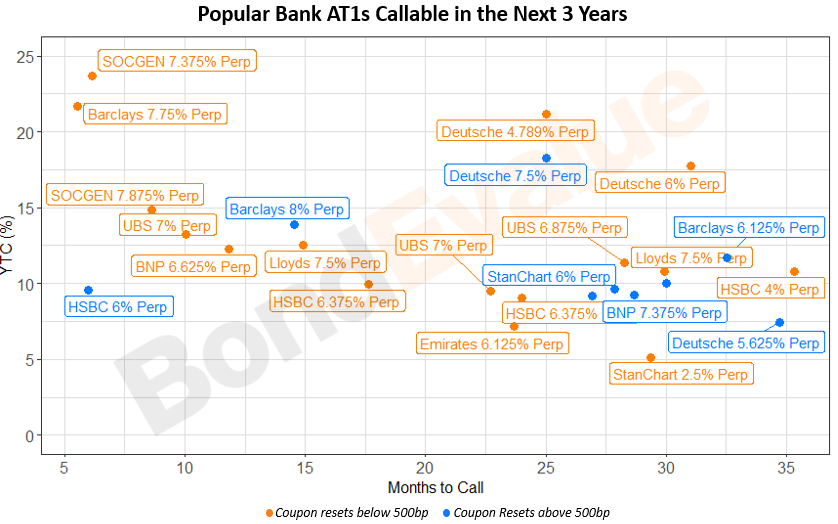

The historic write-off of Credit Suisse’s AT1 bonds has rattled bond markets and private investors in particular, who commonly own AT1 bonds. This has seen a ripple effect across the broader European AT1 market with prices of several bank AT1s trading at lower levels and thus offering juicier yields. With over 300 USD and EUR denominated AT1s listed on the BondbloX App, it can be overwhelmingly difficult for investors to decide which bonds might be worth investing in. To make things easier, we have put together a scatterplot above of USD and EUR AT1 perpetuals from the 10 most popular banks among our subscribers, callable within the next 3 years. The X-axis represents the remaining months to the next call date while the Y-axis represents the yield-to-call (YTC). Each dot represents an AT1 bond

What do market participants think of AT1 bonds during this period of time? Here is what analysts have to say about them:

“When you see these types of markets, you’ve got to take advantage of them. This is why I’ve been in the business longer than anybody else” – Mark LiebSource, CEO of Spectrum Asset Management

“There were some weak hands, shaky hands, and the market is now mispriced. The market is a spectacular buy” – Sebastiano Pirro, an investor running a €9bn fund for Algebris Investments

“Credit Suisse was an idiosyncratic event. While the underlying story had not changed, spreads have widened for the wrong reasons, which we believe creates an opportunity.” – Romain Miginiac, a credit investor at Geneva-based Atlanticomnium

Searching for a Bank AT1 or Tier 2 Bond That Meets Your Criteria

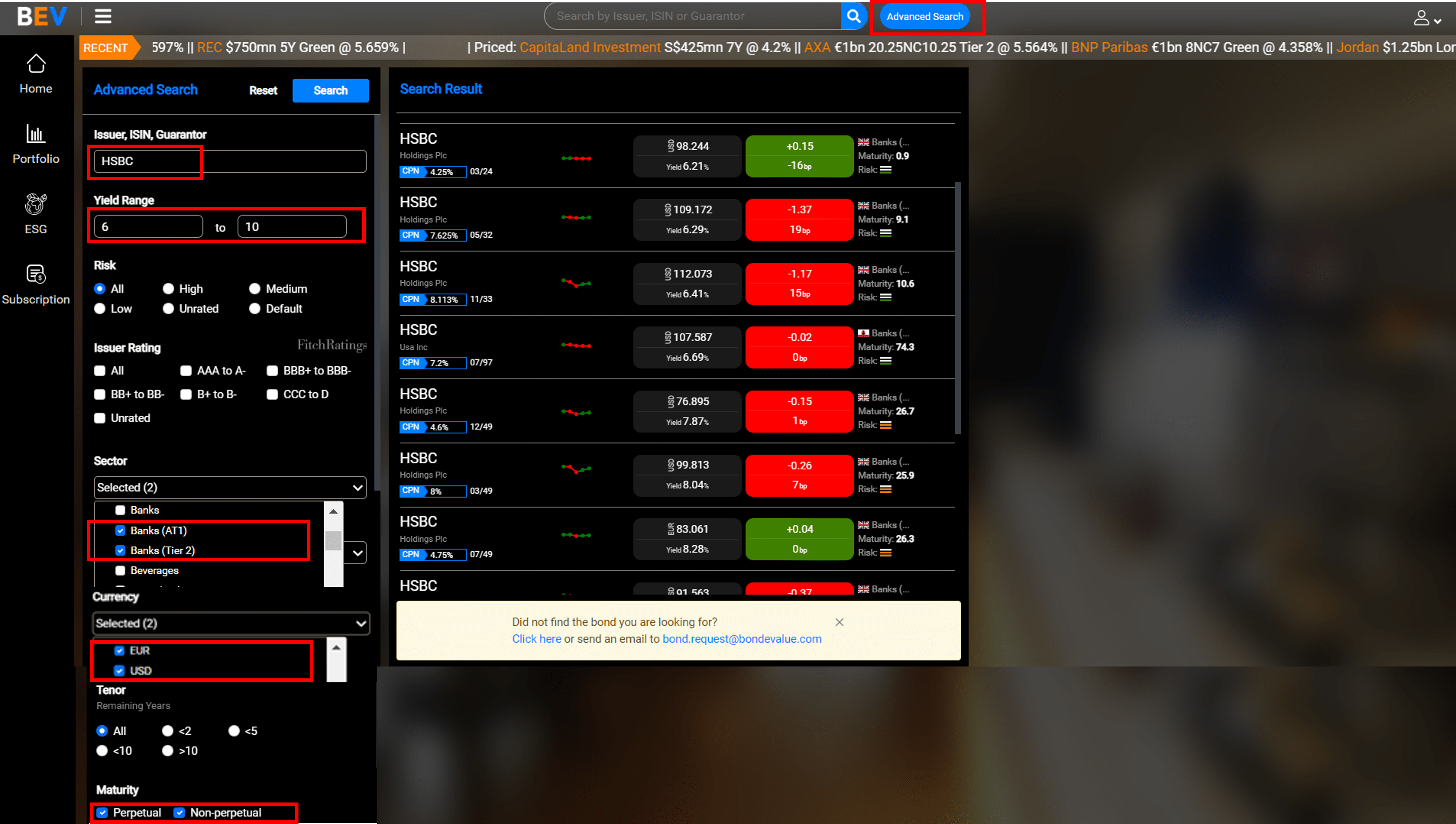

The BondEvalue App has a way for investors to search for bank AT1s an Tier 2 bonds that meet their custom criteria using the Advanced Search tool. Let us take a look at an example.

If a user wants to find HSBC AT1 and Tier 2 bonds, denominated in EUR and USD with a yield range between 6-10%, one can go through the below steps:

- Click on the “Advanced Search” button

- Under the “Issuer, ISIN, Guarantor” section, type ‘HSBC’

- Go to the ‘Yield Range’ and enter ‘6’ and ’10’ in the two boxes respectively

- Next, click on the “Sector”‘ dropdown and uncheck the ‘Select All’ checkbox. After this, click on the checkboxes beside ‘Banks (AT1)’ and ‘Banks (Tier 2)’

- To further filter for EUR and USD denominated bonds, click on the “Currency” filter and uncheck the ‘Select All’ checkbox. Then click on the checkboxes beside EUR and USD.

- Click on the “Search” button and voila! HSBC EUR and USD AT1s and Tier 2s will appear in the search results.

You can perform similar searches on the Mobile App as well using the Advanced Search tool.

Click Here to Screen for AT1s and Tier 2 Bonds on the BondEvalue App

Go back to Latest bond Market News

Related Posts:

Chinese Banks to Call Back $12bn in Perpetual Bonds amid Surge in Rates

September 20, 2022

UniCredit Set To Redeem Its 6.625% Perps in June

March 27, 2023

UniCredit and Lloyds to Repay AT1 Bonds

May 2, 2023