This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

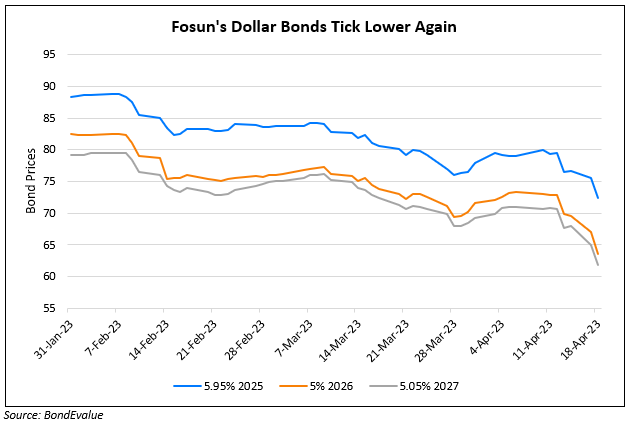

Fosun’s Dollar Bonds Drop 5-8% After Ratings Withdrawal

April 18, 2023

Dollar bonds of Fosun Group dropped by 5-8% after its ratings withdrawal by Moody’s due to insufficient information. Fosun’s dollar bonds have been under pressure this year, losing ~20% of its value. The company is trying to manage its liquidity position amid a decline in the market value of its listed assets and execution risks related to its fundraising plans. The company has been focusing on strategic asset sales to repay its debts while its operating profit has been decreasing. As of end-2022 it had cash, bank balances and time deposits of RMB 100.5bn ($14.6bn) while total debt stood at RMB 227bn ($33bn).

Go back to Latest bond Market News

Related Posts:

Fosun Launches Tender Offer; Redsun, Logan Buyback Bonds

October 12, 2021

Fosun’s Dollar Bonds Jump on Plans of $2.1bn Asset Sales

October 18, 2022