This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Fosun’s Dollar Bonds Drop over 15% to Near 50 Cents on the Dollar

June 22, 2022

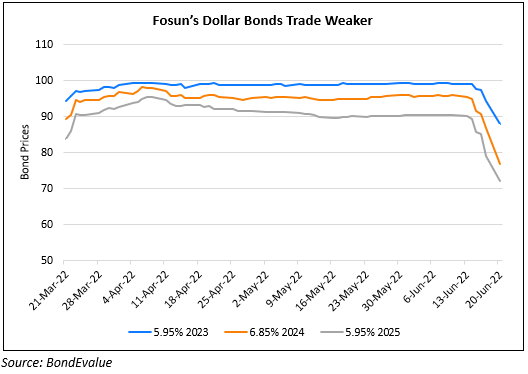

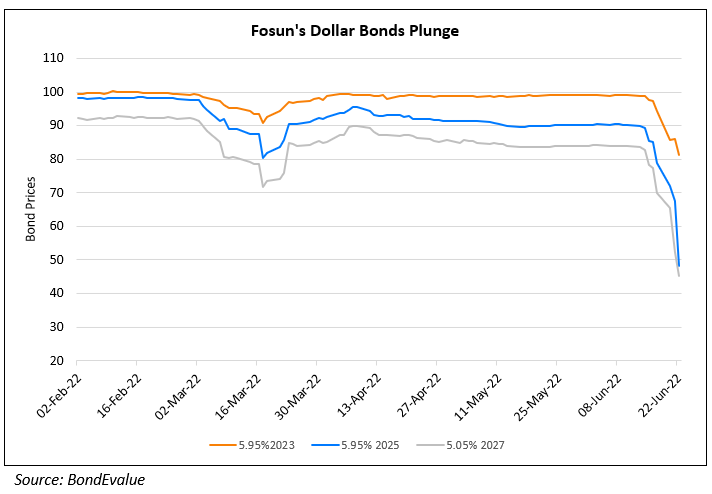

Fosun International’s dollar bonds plunged over 15% on Monday. Its bonds with maturities beyond 2025 have now sunk to near distressed levels of 50 cents on the dollar. The fall highlights investors’ concerns about the conglomerate’s ability to repay large maturities in the next 12 months, which began with Moody’s reviewing them for a downgrade last week. Bloomberg notes that investors are broadly worried about Fosun’s refinancing risks due to restrained financing channels. It is noteworthy that the drop in its bond prices is despite Fosun’s tender offer to buyback a €384.2mn ($403mn) bond due October 9 and a $379.8mn dollar bond due August 2023 last week, which some analysts had considered an effort to indicate a positive signal.

Go back to Latest bond Market News

Related Posts: