This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Future Enterprises Defaults on Debentures Interest Payment

June 9, 2022

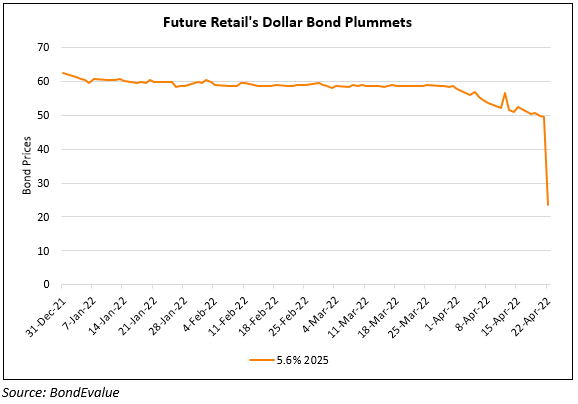

Future Enterprises Ltd (FEL) defaulted on an interest payment of INR 14.17mn ($180k) on a local non-convertible debenture (NCD) that was due on June 6. As per the exchange filing, interest was due for 182 days on the outstanding INR 290mn ($3.73mn) bond maturing in 2023 with a coupon of 9.8%. FEL had defaulted on INR 28.35bn ($360mn) debt due to a consortium of banks in March 2022. Future Group’s company, Future Retail (FRL) had also defaulted on loan repayment of INR 53.2bn ($697mn) to a consortium of banks due in March 2022. Defaults on local debt by FEL and FRL in the face of the rejection of the Reliance-Future Group deal have only worsened financial troubles, bringing into question Future Retail’s ability to pay the coupon of $14mn on its 5.6% dollar bond due 2025.

Future Retail’s 5.6% dollar bonds due 2025 are trading at distressed levels of 13.75 cents to a dollar.

For the full story, click here

Go back to Latest bond Market News

Related Posts: