This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Future Group to Raise $167mn via Insurance JV Sale to Generali

January 27, 2022

India’s Future Group announced that it will be selling a 25% stake in its insurance JV, Future Generali Insurance Company Limited (FGIICL) to JV partner Generali for a cash consideration of INR 12.53bn ($167mn) “plus an additional consideration that is linked to the date of the closing of the transaction”. Further, the filing said that Generali has also acquired an option to buyout the remaining stake in Future Generali at an agreed valuation subject to regulatory approvals.

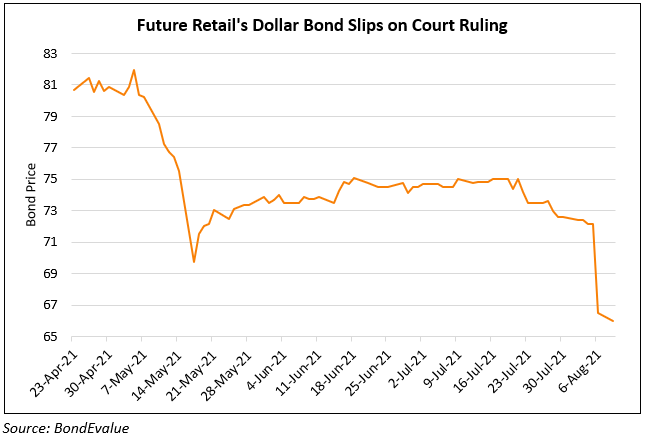

The news comes just hours after Future Retail seeks to fend off its creditors, asking Supreme Court judges to order its lenders and the central bank to allow the debt-ridden company more time and stop them from declaring the company in default. The latest filing by Future referenced a January 15 letter from State Bank of India (SBI) that warned the Biyani-led company that if it failed to pay the INR 35bn ($466mn) it owed to local lenders, SBI would take legal action including “initiating insolvency proceedings”, as per India Today. The company also missed a $14mn coupon on its dollar bonds for the third time, currently under the 30-day grace period that ends on February 22.

Future Retail’s 5.6% 2025s are currently trading at 58.5 cents on the dollar yielding 26.7%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: