This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Genting, Rolls Royce, American Airlines & British Airways Downgraded; HSBC Tender Offer; China Jinjiang on Review for Downgrade

May 29, 2020

Markets in Asia are opening with a negative tone this morning after a late reversal of earlier gains on Wall Street. The main indices had started the day extending earlier gains of the week, but trade tensions between US and China along with an executive order to regulate social media weighed on investor sentiment and triggered a selling spree towards the end of the session. The European Commission’s €750bn ($825bn) package of grants and loans fueled an optimistic mood in the market and helped riskier assets climb to help European indices close higher on the day. Primary deals issuance continue to be strong and CDS spreads tighten across the board.

New Bond Issues

- Sichuan Language Dev. $ 2yr @ 11.875% area

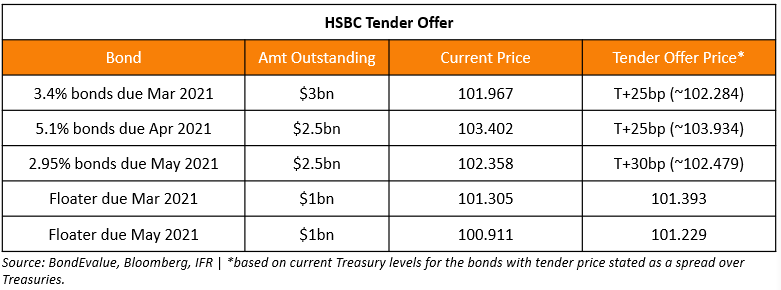

HSBC Holdings raised $3.5bn via fix-to-float bonds. It raised $2bn via 6Y non-call five-year (6NC5) bonds at a yield of 2.099%, 175bp over Treasuries and 25bps inside initial guidance of T+200bp area. It also raised $1.5bn via 11Y non-call 10-year (11NC10) bonds at a yield of 2.848%, 215bp over Treasuries and 20bp inside initial guidance of T+235bp area. Part of the bond proceeds will be used to fund its tender offer for up to $10bn in principal of five outstanding bonds.

HSBC last issued 6NC5 bonds in Oct 2019 at a yield of 2.633%, 112bp over Treasuries at the time of issuance. It last issued 11NC10 bonds in May 2019 at a yield of 3.973%, 160bp over Treasuries. The older 6NC5 and 11NC10 bonds are currently trading at a yield-to-call (YTC) of 1.872% and 2.706% respectively.

Singapore-based Keppel raised $300mn via 5Y bonds at a yield of 2.459%, 210bp over Treasuries and 40bp inside initial guidance of T+250bp area. This is the first US dollar bond by Keppel since 2013.

Bank of Nova Scotia raised $1.25bn via Perpetual non-call five-year AT1 bonds at a yield of 4.9%, 35bp inside initial guidance of 5.25% area. The bonds are expected to be rated BBB-/Baa3. The bond’s coupon will be reset if not called to the 5Y Treasury constant maturity yield plus a spread of 490bp. Bank of Nova Scotia’s 4.65% Perp AT1s issued in Oct 2017 and callable in Oct 2022 are currently trading at a yield-to-call (YTC) of 6.69%. These AT1s’ coupon will be reset to 3-month Libor plus a spread of 264.8bp if not called.

China-based AVIC Capital raised $400mn via 5Y bonds at a yield of 2.607%, 225bp over Treasuries and 45bp inside initial guidance of T+270bp area. The bonds will be issued by wholly-owned subsidiary Blue Bright and guaranteed by AVIC Capital, rated A-/A3. Orderbook exceeded $1.3bn, over 3x issue size. Moody’s has assigned an A3 rating on the new bonds.

UK-based insurance company Phoenic Group raised $500mn via 11.25Y non-call 6.25Y Tier 2 bonds at a yield of 4.75%, 62.5bp inside initial guidance of 5.375% area. The bonds, expected to be rated BBB by Fitch, met with strong investor demand as orders exceeded $6bn, 12x issue size.

Rating Changes

Airbus SE Downgraded To ‘A/A-1’ On Lower Aircraft Demand And Weaker Credit Metrics; Outlook Negative

Rolls-Royce PLC Downgraded To ‘BB’; Outlook Negative

Moody’s downgrades CBL’s corporate family rating to Ca; outlook remains negative

Moody’s downgrades Tupperware’s CFR to Caa3; debt repurchase likely a distressed exchange

Moody’s downgrades easyJet to Baa3 from Baa2; outlook negative

Moody’s downgrades British Airways to Ba1 from Baa3; outlook negative

Singapore 1-Month SOR Dips Below Zero Briefly; Likely To Remain Low But Not Negative Till 2021

Singapore Dollar Swap Offer Rate (SOR) is an implied interest rate, determined by examining the spot and forward foreign exchange rate between the US dollar and Singapore dollar and the appropriate US dollar interest rate for the term of the forward. This is a common benchmark used for business loans in Singapore. The 1-month SOR was back in positive territory at 0.13% as of May 28, but its brief drop to -0.01% on May 20 was the lowest since August 2011. Usually, SOR would go negative due to huge changes in foreign exchange rate expectations. This time, it is the fall in USD Libor and a large shift lower in USD Libor expectations as speculation that the Fed might adopt negative rates, that has driven the SOR into negative territory, even if just for a moment.

For the full story, click here

China Jinjiang’s 6% Bonds Due in July 2020 on Review for Downgrade by Moody’s

Moody’s has placed Zheneng Jinjiang Environment Holding Co Ltd’s Ba3 corporate family rating and its $200mn 6% bonds due July 2020’s B1 rating on review for downgrade. The rating agency said that the company does not have adequate internal financial resources to repay the bond that is due for redemption in July this year, and thus needs to secure refinancing arrangements. Moody’s added that the company may have to rely on support from Zhejiang Provincial Energy Group Co. Ltd, which is its largest shareholder given its stronger credit profile (rated A2). However, the short time frame to secure the required funding adds uncertainty. China Jinjiang Environment’s 6% bonds due July 2020 are currently trading at 97.75 on the secondary markets.

For the full story, click here

In Gloom Lies Hope for Saudi Electric – Rating Outlook Stable from Negative

S&P Global Ratings revised their outlook on Saudi Electric Co. (SEC) to stable from negative while affirming the rating of A-. This positive change is unusual in these times of rating downgrades. The improved outlook is based on the support provided to the company by the Saudi Arabian government following the pandemic outbreak. The loss of revenue to the company due to the government’s decision of a 30% electricity discount on power bills of consumers has been compensated by a similar reduction in the operating costs representing the value of government fee. The company also achieved a cash flow savings of SAR 2.2 billion due to a dividend waivers in 2019 on Public Investment Fund’s shares. These actions reinforce the company’s link with the government and the stable outlook by S&P mirrors that on Saudi Arabia. Saudi Electric bonds were largely stable and witnessed only a marginal improvement during the current month.

For the full story, click here

US Money-Market Funds Waive Fees to Stave Off Negative Returns

US asset managers are cutting the fees they charge for money market funds after the dramatic decline in yields on the short-term debt they rely on threatened to leave clients with negative returns. Federated Hermes, Fidelity and TIAA-CREF, which manage some of the largest money market funds, have already waived fees on several products. Vanguard, another large manager, said that it has not yet needed to waive fees but remains committed to keeping investors’ returns positive. Peter Crane, who runs information provider Crane Data, said other managers were likely to follow suit, adding: “The last time rates went to zero we saw most funds cut expenses in half.” The Federal Reserve slashed its target for short-term interest rates by 1.5 percentage points to between zero and 0.25 per cent when coronavirus ripped through global markets. That has dragged the three-month Treasury yield down to just 0.14 per cent.

For the full story, click here

BEV Term of the Day

Duration

Duration or Macaulay Duration is the weighted average time until repayment. It is measured in years and is less than the final maturity of coupon bearing vanilla fixed rate bonds. The higher the duration, the higher will be the change in bond price for a given change in interest rates. It is considered a better measure of risk than using final maturity, as it gives weightage to the coupons payments as well. For very long tenor bonds like century bonds or high coupon bonds, the duration is significantly less than the years to maturity.

You can read more about duration on our blog post What to Look for When Buying Bonds

Talking Heads

On Europe’s 750 Billion Euro Package

Gary Kirk, money manager at TwentyFour Asset Management

Gary is sticking with his U.S. bias. “It’s a bit early to get overly excited,” said Kirk, who’s waiting to see how the details are hammered out and whether it will pass muster with more austere governments in north Europe.

Michael Strobaek, global chief investment officer at Credit Suisse Group AG

“It’s completely new territory for the European Union,”, said in a Bloomberg TV interview. “And that would make the European Union as an investment much more attractive for global investors.”

On Tools Available to Fed – Federal Reserve Bank President John Williams

“Negative interest rates are not a tool that makes sense for the U.S. central bank, New York” he said on Thursday. “We have other tools that I think are more effective and more powerful to stimulate the economy.” Williams pointed to low interest rates, forward guidance and the Fed’s balance sheet as tools the central bank could use to help the U.S. economy return to maximum employment.

According to Newman, past recessions such as the global financial crisis shows that if you invest during the recession, fallen angels outperform the high yield market and the equity market, based on 12-month forward returns, A key to the fallen angels’ strategy is active security selection to avoid ‘falling knives’ that progress straight to distress. “If you get it wrong and these businesses aren’t going to survive, these are fallen knives and they may never return and could default.”

Top Gainers & Losers – 29-May-20*

Go back to Latest bond Market News

Related Posts: