This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Ghana Downgraded to Caa2

October 3, 2022

Ghana was downgraded to Caa2 from Caa1 by Moody’s and further placed on review for downgrade on deteriorating macroeconomic conditions, difficulties in the government’s liquidity and debt sustainability, and increasing risk of default. Ghana is currently negotiating an IMF support program that may include a debt restructuring condition for sustainability. Moody’s believes that such a restructuring would likely be considered a distressed exchange and thus a default. Higher government borrowing costs led to increased interest spending to almost half of the government’s revenue in 2021; interest costs are expected to be even higher at 58% of revenue in 2022, one of the highest globally. Its weak finances have pushed its currency, the Cedi 40% lower vs. the dollar YTD. Moody’s forecasts debt-to-GDP rising to 104% of GDP in 2022, contributed by the sharp currency depreciation. The balance of payments position is weak as substantial outflows in 1H 2022 led to a fall in forex reserves to $5.9bn as of June 2022 from $8.4bn at the beginning of the year. Inflation in Ghana also trending at a 20-year high of 34% as of August despite previous monetary tightening. This comes after Fitch downgraded Ghana to CC from CCC last week

Ghana’s 8.125% 2032s were down 0.14 points to 37.73, yielding 26.1%.

Go back to Latest bond Market News

Related Posts:

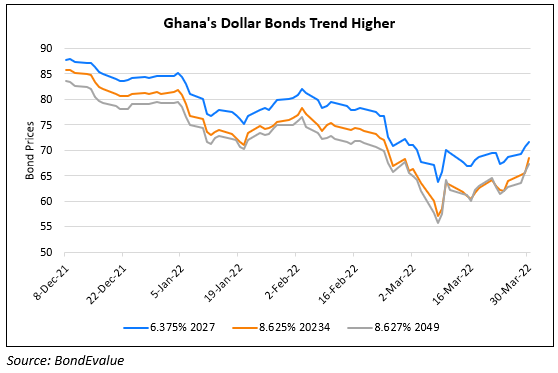

Ghana Downgraded to Caa1 by Moody’s

February 7, 2022

Ghana Downgraded to CCC+/C by S&P

August 8, 2022