This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Ghana’s Dollar Bonds Rally After Securing $3bn IMF Bailout Agreement

December 14, 2022

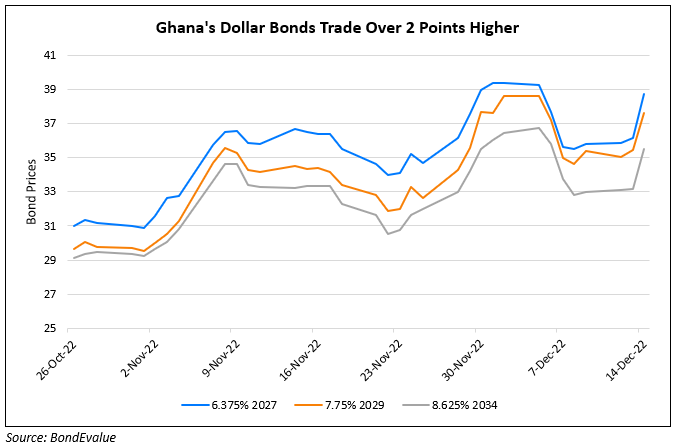

Ghana’s dollar bonds were trading over 2.5 points higher across the curve after it secured an IMF staff-level agreement for a $3bn bailout, pending the IMF board’s approval. The deal is set to provide some relief to the nation in restoring macroeconomic stability and debt sustainability. Ghana secured the IMF deal after its local bondholders were asked to accept losses on interest payments, however without a principal haircut. On the other hand, offshore bondholders’ terms of restructuring are not yet revealed. Going by Deputy Finance Minister John Kumah’s comments, it is possible that offshore holders may be asked to accept losses of up to 30% on their principal and may have to forgo some interest payments. Ghana is also willing to consider debt treatment under the G20 Common Debt Framework.

Go back to Latest bond Market News

Related Posts:

Ghana Downgraded to Caa1 by Moody’s

February 7, 2022

Ghana Downgraded to CCC+/C by S&P

August 8, 2022