This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

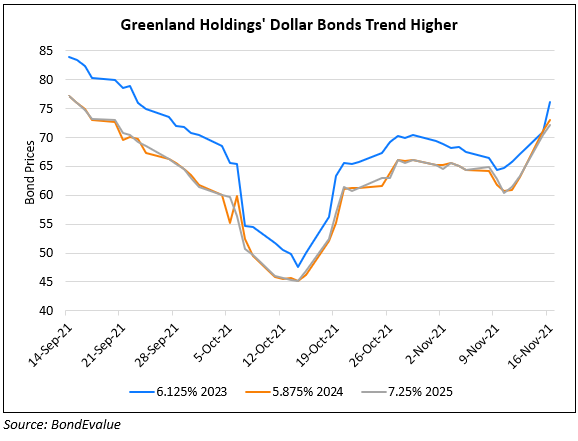

Greenland Holdings’ Dollar Bonds Jump after Reclassification

November 16, 2021

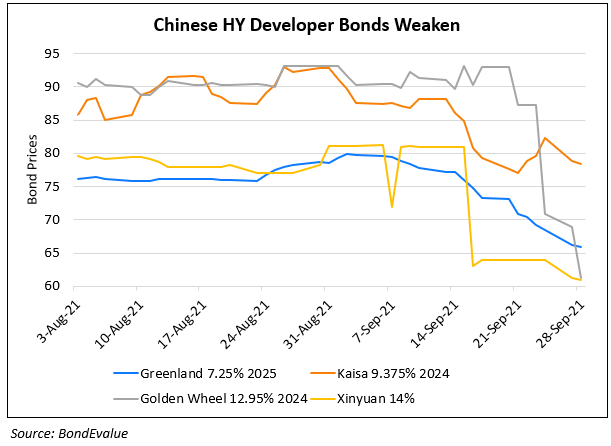

Greenland Holdings’ dollar bonds jumped as much as 18% following a statement that the firm would now be classified as in the ‘construction’ rather than the ‘real estate’ sector based on a CSRC rule as over 50% of its 2020 and 1H 2021 revenues came from its infrastructure business as per Bloomberg. It will be “difficult for other developers to follow Greenland’s example” said Leonard Law, senior credit analyst at Lucror Analytics, given that the company has material non-property businesses, unlike other industry peers. The change in classification could benefit its stock and bonds as institutional investors that are mandated to cut exposure to real estate could still hold Greenland’s securities. The move comes at a time when its property sector peers have been hit badly since the beginning of the Evergrande saga. However more recently, loosening rules on local-currency issuances have led to a rise in developers’ bonds.

Go back to Latest bond Market News

Related Posts: