This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

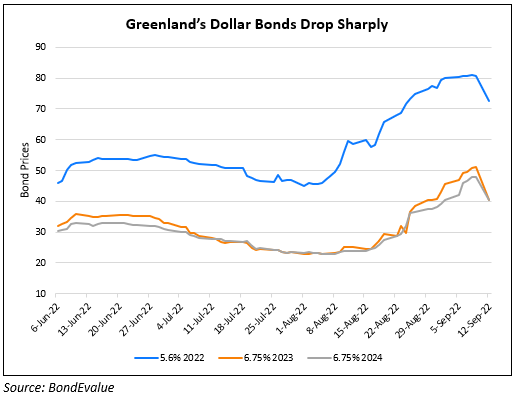

Greenland’s Dollar Bonds Drop by Over 10%

September 12, 2022

Dollar bonds of Greenland Holdings dropped sharply on Friday, down by over 10%. Greenland reported that its contracted sales from January-August 2022 stood at RMB 10.2bn ($1.5bn), down over 58% YoY from RMB 24.2bn ($3.5bn) a year ago. Bloomberg analysts note that a recovery prospect for Chinese property developers does not seem to be in sight after the much-needed sales recovery in 2H 2022 has not yet taken place. This is on account of mortgage-payment boycotts that have weakened housing demand in the country. They added that contracted sales across the sector could continue falling for the rest of the year despite the lower base in September-December 2021.

Go back to Latest bond Market News

Related Posts:

Greenland Downgraded to B- by S&P

May 24, 2022

More Details Emerge on the Restructuring Proposal of Shimao

August 29, 2022