This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

HDB, MUFG Launch Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

October 5, 2021

US markets saw a sharp drop yesterday, continuing its volatile movement from last week – S&P and Nasdaq were down 1.3% and 2.4% respectively. US 10Y Treasury yields were marginally higher by 1bp to 1.48%. Energy and Utilities were up over 1.4% while IT and Communication Services were down over 2.1%. European stocks were also lower with the DAX falling 0.8%, CAC falling 0.6% and FTSE down 0.2%. Brazil’s Bovespa was down sharply by 2.2%. In the Middle East, UAE’s ADX was down 0.3% and Saudi TASI was up 0.1%. Asia Pacific markets are broadly lower again – STI is down 0.8% and Nikkei 2.8% while Shanghai remains closed, HSI recovered after opening ~1% lower and was up 0.3%,. US IG CDS spreads were 0.95bp wider while HY CDX spreads widened 4.7bp. EU Main CDS spreads were 0.9bp wider and Crossover CDS spreads widened 5bp. Asia ex-Japan CDS spreads widened 0.1bp.

US Factory orders came higher than forecasts at 1.2%. Meanwhile, oil prices jumped as the OPEC+ said it would stick to the existing pact for only a gradual increase in oil output. Brent hit a 3Y high at $81.48, up 2.8%.

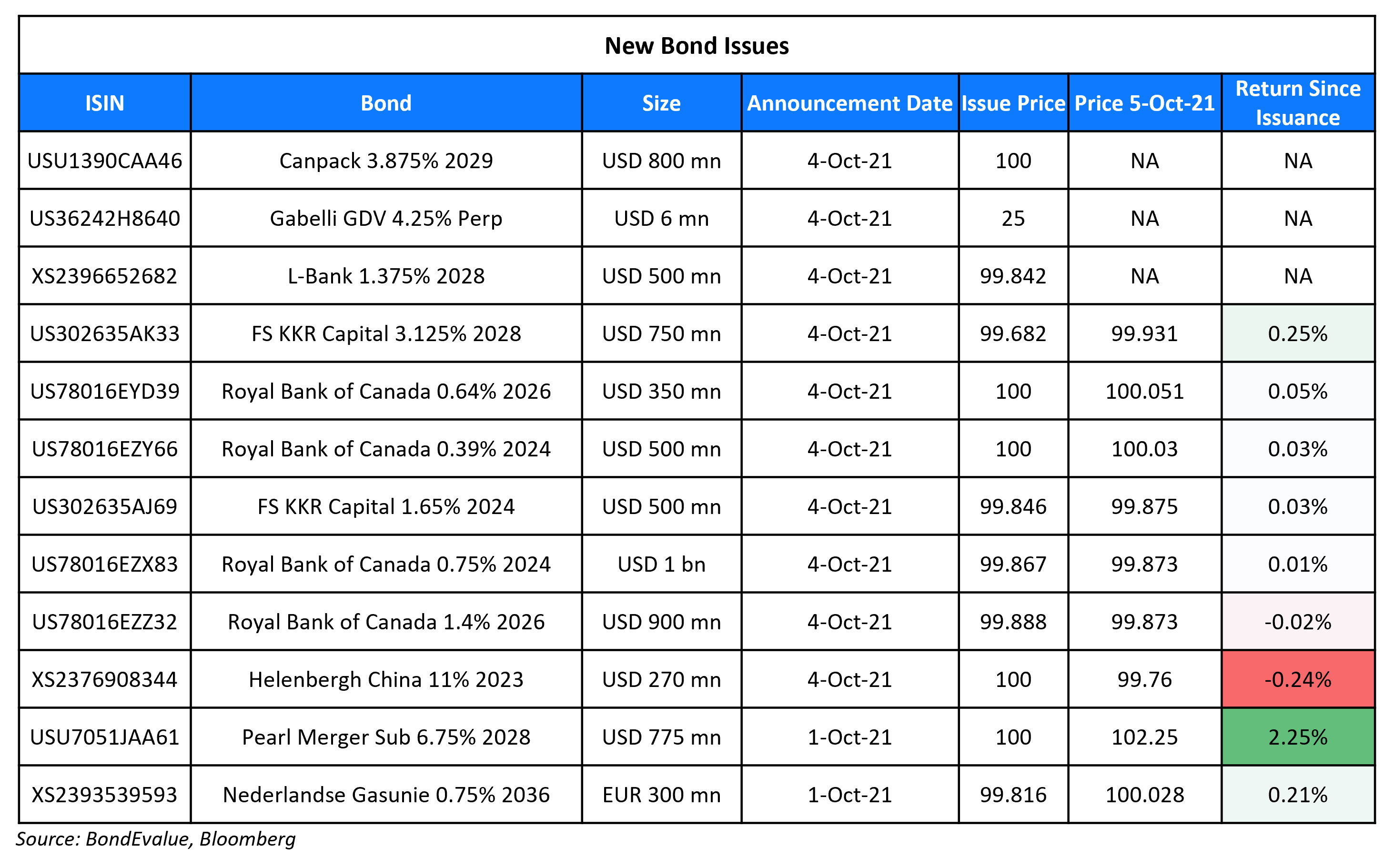

New Bond Issues

- HDB S$ 800 mn 7Y @ 1.54%

- MUFG $ 4NC3/6NC5/11NC10 @ T+70/90/120bp area

Helenbergh China raised $102mn via a 2Y green bond at a yield of 11%, unchanged from initial guidance. The new bonds have expected ratings of B3 (Moody’s), and are priced 286bp tighter to its existing 11% non-green 2023s that yield 15.27%. It also raised $168mn under an exchange offer for its 12.875% 2021 notes which were trading at 96.75, bringing the total size of the new green bonds to $270mn.

New Bonds Pipeline

- UAE plans for $ 10/20/40Y bonds

- Tuan Sing hires for S$ bond

- Korea hires for € 3Y to 5Y bond and/or $ 10Y bond

- China plans for $4bn 3/5/10/30Y bond

- Saigon-Hanoi Bank hires for $ bond

- Burgan Bank hires for $500mn 6NC5 bond

- Kexim hires for $/€ bond

- GD-HKGBA Holdings hires for $ 2Y bond

Rating Changes

- Moody’s changes outlook on KDB Asia’s ratings to negative; affirms Aa2 ratings of Korea Development Bank and KDB Asia

- Sinic Holdings Downgraded To ‘CC’ On Imminent Default Risk; Company Stays On Watch Negative

- Fitch Downgrades Fantasia to ‘CCC-‘ on Repayment Risk, Weak Transparency

- Jamaica Outlook Revised To Stable From Negative; ‘B+’ Long-Term And ‘B’ Short-Term Ratings Affirmed

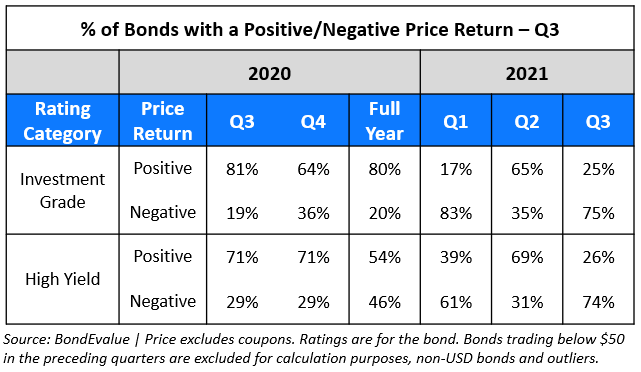

Q3 Update: $44.5bn Wiped Out With 75% of Dollar Bonds Ending Lower

The third quarter of 2021 was a volatile one with three-quarters of our dollar bond universe ending in the red in terms of price return ex-coupon. This is in contrast to Q2 which saw 67% of dollar bonds delivering a positive price return, reversing losses from a gloomy Q1. The somber third quarter was largely due to a massive selloff in September, which saw 86% of dollar bonds trading lower following a mixed July and August. Investors saw a solid $44.5bn wiped out from dollar bonds during the quarter, calculated as the mark-to-market loss based on the percentage change in bond prices multiplied by the amount outstanding. The 10Y US Treasury yield jumped over 20bp following the hawkish September FOMC meeting, dragging bonds across the spectrum. Further, the global impact of Evergrande and the China property market added to the negative sentiment.

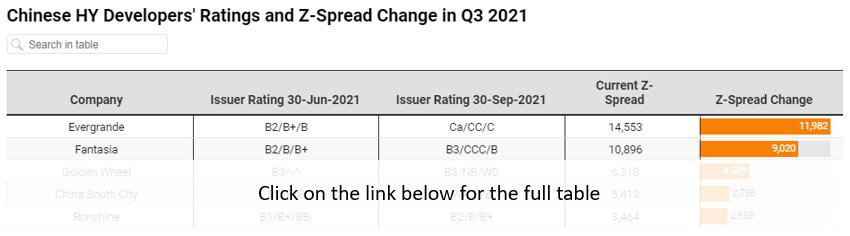

As part of our quarterly report, we have added a special section with an interactive chart focusing on Chinese High Yield Real Estate Developers where we plot the change in the companies’ credit ratings through Q3 alongside the change in their dollar bonds’ Z-Spreads.

Term of the Day

Second-lien Bond

A second lien bond is a bond with a lien, that is subordinated to its senior bonds. A lien is a legal right where a creditor can claim a security interest or seize control in an asset provided by the asset’s owner. It gives a type of a legal guarantee to the lender for obligations like loan or debt repayments. Bonds typically can be either first lien, which consist of senior secured debt, or second lien, which consists of junior or subordinated debt that rank below first lien debt in the capital structure. A bondholder of a ‘first lien bond’ gets repaid before all other liens and bondholders in the event of a default. Second lien holders get repaid only after the first lien holders get paid back.

Talking Heads

On 60/40 portfolios suffering worst losses since March 2020

Seth Bernstein, president and chief executive of AllianceBernstein

The fall in both equity and bond prices in September “is a problem for all investors and not only asset managers.” “The 10-year yield can easily rise to 2 per cent,” and “investors are entering a period of much greater volatility for bonds given the uncertainty over inflation and the small amount of income they now provide,” said Bernstein. “Everyone thinks about diversifying, but it comes back to owning fixed income or being in cash,” he said. “Alternative assets and hedge funds don’t provide the scale [of diversification] to protect a portfolio for many investors.”

David Giroux, portfolio manager at T Rowe Price.

“It is mathematically impossible to repeat the record of the 60/40 portfolio over past decades because rates are now so low.” “I run a portfolio that competes with 60/40 strategies and it does not contain Treasuries and we also think most equities are not attractive.” “In five years’ time I would not be surprised to see 4% annual return for equities.”

Joseph Davis, chief economist at Vanguard

“Our forecasts today tell us that investors shouldn’t expect the next decade to look like the last, and they’ll need to plan strategically to overcome a low-return environment.”

“Our forecasts today tell us that investors shouldn’t expect the next decade to look like the last, and they’ll need to plan strategically to overcome a low-return environment.”

“Bond yields appear to be preparing for an eventual pull back by the Fed while equities could rebound briefly on upcoming strong earnings reports.” “October can often be a volatile month for financial markets as companies acknowledge they can’t all make their original forecasts for the year.”

On overdue correction in recent bond market selloff

Blake Gwinn, head of U.S. rates strategy at RBC Capital Markets

“I don’t think there’s really anything particularly fundamental going on.”

In a report by analysts at Cornerstone Macro

“It’s very hard, mathematically, to contemplate, say, a 3% 10-year Treasury yield when the nominal neutral rate is below 2%.”

On covid-related losses for airlines exceeding $200 billion – Willie Walsh, IATA Director General

“The magnitude of the Covid-19 crisis for airlines is enormous.” “People have not lost their desire to travel as we see in solid domestic market resilience. But they are being held back from international travel by restrictions, uncertainty and complexity.” “Travel restrictions bought governments time to respond in the early days of the pandemic,” he said. “Nearly two years later, that rationale no longer exists.”

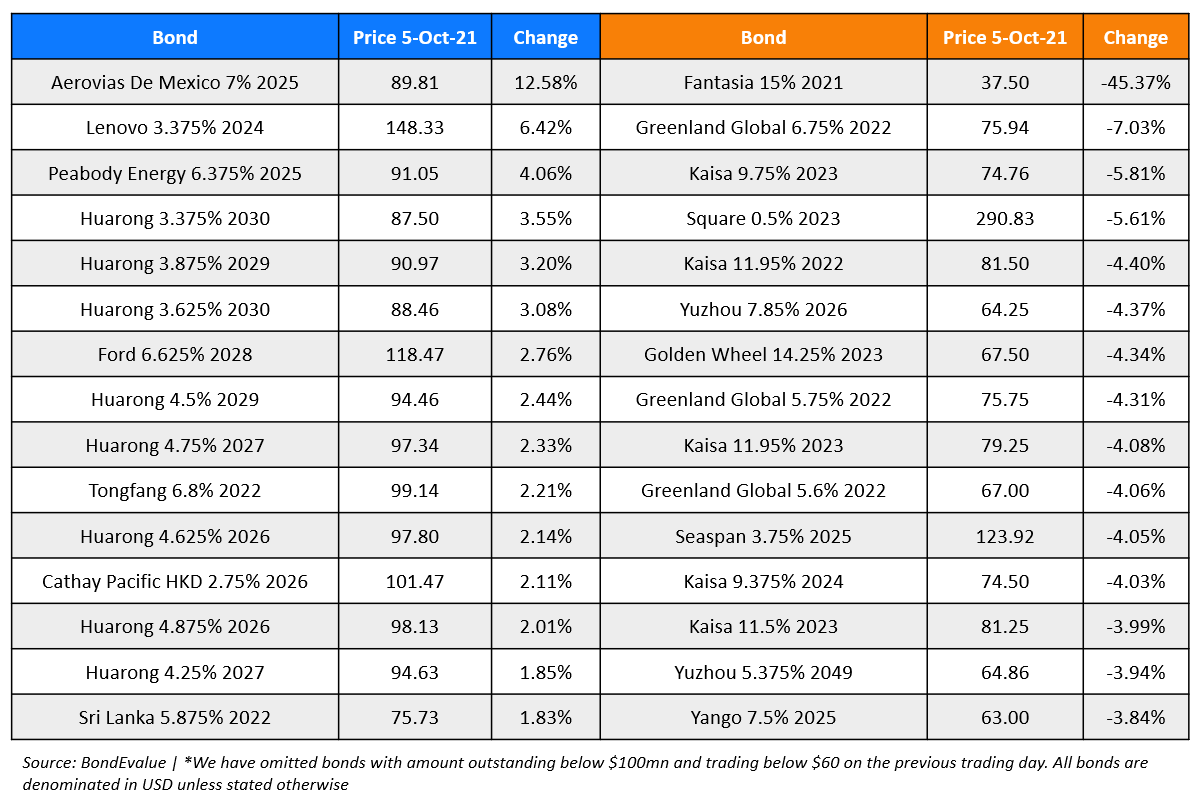

Top Gainers & Losers – 05-Oct-21*

Go back to Latest bond Market News

Related Posts:-1.png)