This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Hedge Funds Load Up on Record Junk Bond Short Positions

May 10, 2021

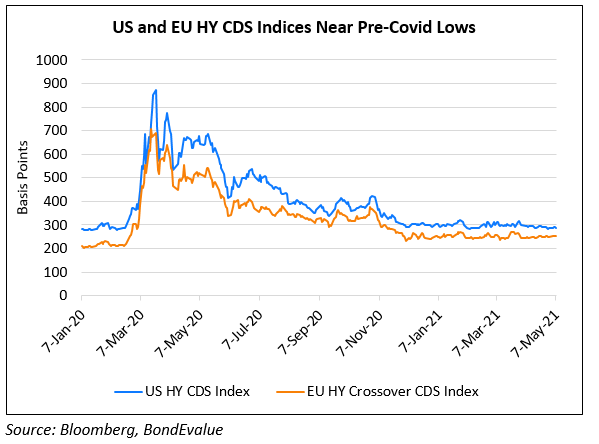

Hedge funds’ short positions on junk bonds have hit its highest level since 2008 with data from IHS Markit showing ~$55bn of global high yield (HY) bonds being shorted, up from $35bn at the start of the year. Bloomberg adds that rich valuations, willingness of bond bulls to pour cash into ever-riskier companies and the threat of rising interest rates are causing some investors to be nervous. “I would expect that list to get bigger as spreads tighten and/or people get worried about rates rising… At these levels of valuations, I’m not surprised more people, such as hedge funds, are setting shorts,” said Tim Winstone, a portfolio manager at Janus Henderson. Bloomberg notes that almost one in four HY bonds issued this year is trading below the price it was issued at. Despite this, some say that the shorting of bonds may be premature – Kshitij Sinha, a PM at Canada Life Investments said, “Shorting cash corporate bonds just for spread widening is very expensive…You are better off expressing that view through CDS, either in single names or indices”.

For the full story, click here

Go back to Latest bond Market News

Related Posts: