This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Huarong Asset Management Cut to Baa2 by Moody’s

August 24, 2021

China Huarong Asset Management Co. (Huarong AMC) has been downgraded to Baa2 from Baa1 by Moody’s following the company’s announcement last week that the net losses attributable to shareholders in 2020 are expected to be as high as RMB 102.903bn ($16bn). The rating agency opined that net losses of such magnitude could result in the company failing to comply with the minimum regulatory requirements on capital adequacy as well as leverage. Furthermore, such losses indicate that the company cannot sustain its operations without government support. The company is attempting to mitigate the impact of these losses by trying to offload non-core assets on their balance sheet and raising new capital with a consortium of strategic investors, mostly state owned enterprises (SOEs) including CITIC Group (A3), China Insurance Investment, China Life Asset Management, China Cinda Asset Management (A3) and Sino-Ocean Capital. However, timelines and magnitude of any such capital raises remain mired in uncertainty. Moody’s has kept Huarong AMC on review for downgrade with the review focused on:

- The impact of the introduction of strategic investors and the level of government support

- Its ability to strengthen its capital base through capital injection and disposal of its units, and stabilize its asset quality and profitability

- Its ability to maintain diversified funding sources and adequate liquidity

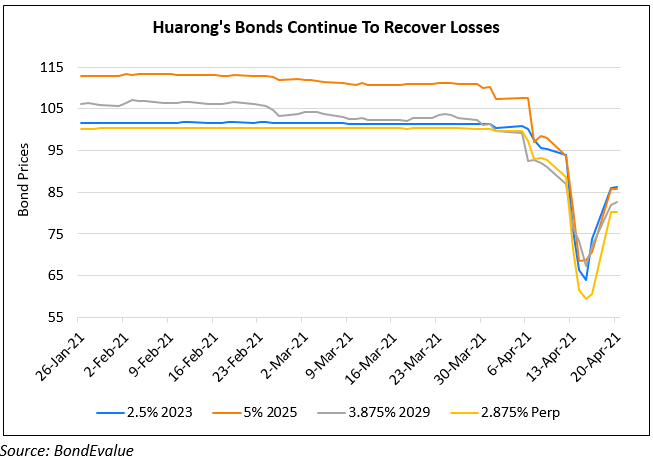

The company has $21bn in outstanding offshore bonds, including $3.5bn due this year, and while it has reassured investors that it does not intend to restructure any of its debts, a Bank of America report in August estimated that 56% of surveyed fund managers would force liquidate their bonds if it lost its investment grade rating. Bond trading remains volatile since April with a steep selloff in Huarong bonds followed by a recent rally in August recouping some of the losses. It’s 3.25% 2024s are trading stable at 93.25 yielding 5.57%.

For the full story, click here

In related news, Fitch revised Huarong AMC’s Rating Watch to Positive from Negative while maintaining its BBB rating on the back of the company’s announcements last week.

Go back to Latest bond Market News

Related Posts: