This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Huarong Nudged by Beijing to Sell Non-Core Assets in Exchange for Implicit Debt Guarantee

June 7, 2021

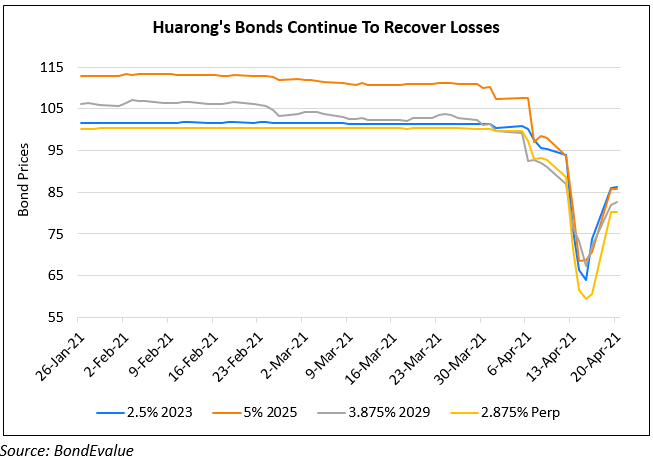

Beijing is allegedly nudging Huarong to sell non-core assets while considering offering an implicit guarantee of their liabilities, sources involved in the revamp told Reuters. One of the sources said that the plan would see the authorities informally backing $20bn in dollar debt due this year. This led to a strong rally in Huarong’s bonds on Friday – its 5.5% 2025s were up 5 points to 76.3, yielding 14.1% while its 2.875% Perp callable in September 2021 is up ~10 cents in the last two days to 81.7 cents on the dollar.

They also said that authorities were considering asking Huarong’s peers China Cinda AMC, China Orient AMC and Great Wall AMC to undertake a similar streamlining of their businesses. While Huarong did not confirm or deny the asset sales or guarantees, they said, “The company will earnestly fulfill our debt repayment obligations with a responsible attitude” and that regulators have asked them to “return to our roots, focus on our main business and build up core competitiveness.” Reuters sources report different possible asset sales in the offing – the government of Hunan province being in talks to take a controlling stake in Changsha-based Huarong Xiangjiang Bank; Deutsche Bank planning to buy Huarong’s stake in their JV firm Huarong Rongde Asset Management though Deutsche denied this claim; putting Huarong Consumer Finance on sale to Meituan.

For the full story, click here

Go back to Latest bond Market News

Related Posts: