This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Huarong Repays $250mn Dollar Bond

June 24, 2021

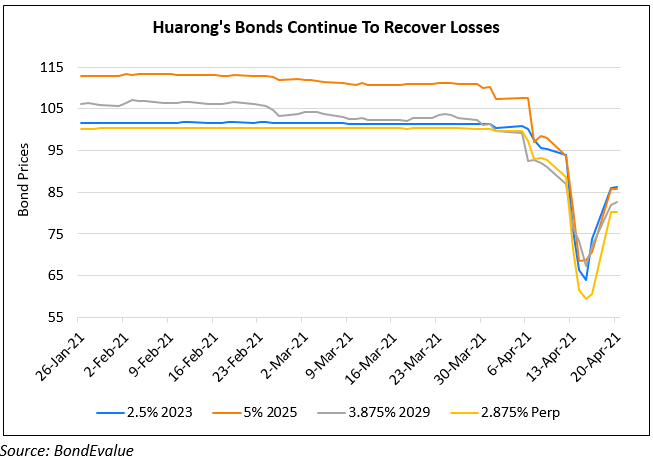

China Huarong Asset Management Co. has repaid a $250mn dollar bond that matured on Wednesday. This comes after the company had repaid a $900mn bond earlier this month. Huarong is one of the four biggest distressed asset management firms in China. Investors cited concerns over Huarong’s creditworthiness after the company delayed the release of its 2020 earnings. This was due to claims of an unfinalized “relevant transaction”. Huarong International has said that the company’s liquidity was normal and that its operations were “continuously improving”. However, Reuters reported that regulators were pushing for Huarong to sell off non-core financial assets to meet its $20bn debt obligations due this year.

Huarong’s dollar bonds were mixed – its 2.5% 2021s due to mature in July were up 0.1 points to 99, while their 3.625% 2021s maturing in November were down 0.1 points to 93.875.

For the full story, click here

Go back to Latest bond Market News

Related Posts: