This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Huarong Says It Wired Funds for Coupons on 5 Offshore Bonds

May 7, 2021

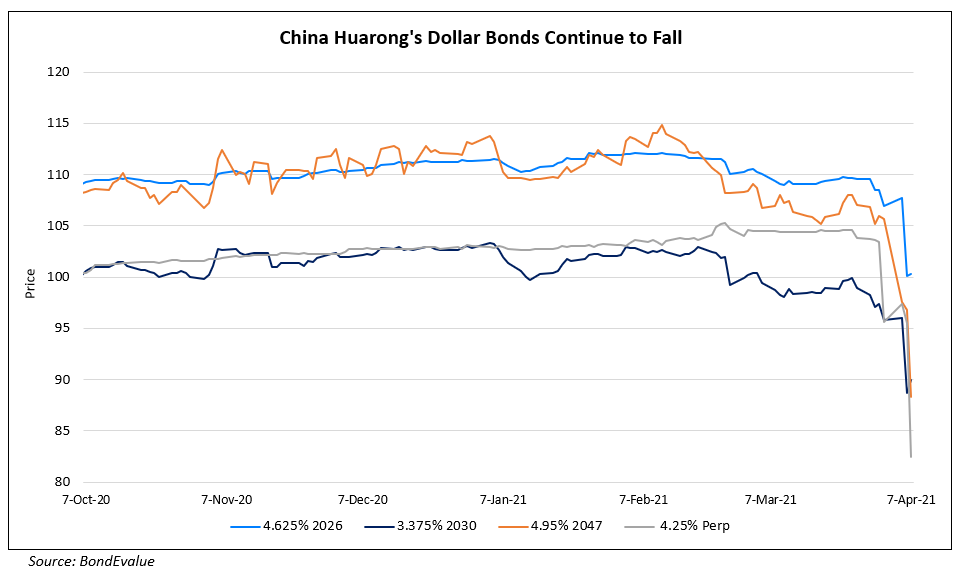

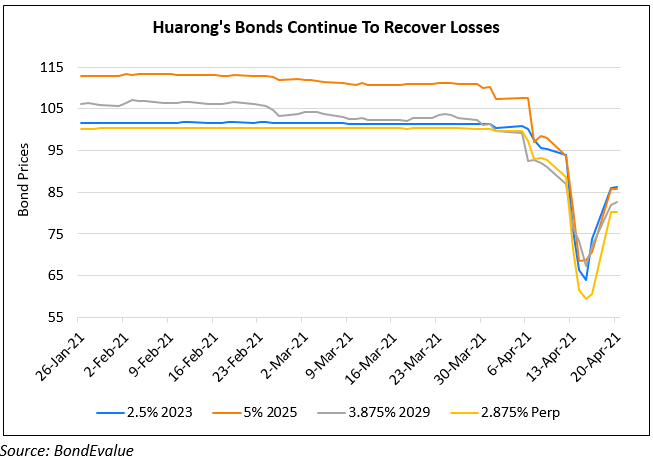

Huarong said that it has wired funds to pay coupons on five offshore bonds due today. The state-owned bad-debt manager’s latest move is considered an effort to reduce concerns on its financial health. The bonds include their 4% Perps, up 0.2 to trade at 67.9. Huarong said, “At present, the company is operating normally with sufficient liquidity, and all bonds have been paid on schedule.” Huarong recently repaid its SGD 3.2% 2021s borrowing S$600mn from ICBC. Huarong’s bonds had been beaten down in the last month after it delayed its earnings release in March. The company was recently downgraded by Moody’s and Fitch to Baa1 and BBB.

Huarongs bonds were trading mixed – its 3.375% 2030s were up 0.2 to 75.5 and its 2.125% 2023s were down 0.4 to 80.

Go back to Latest bond Market News

Related Posts: