This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

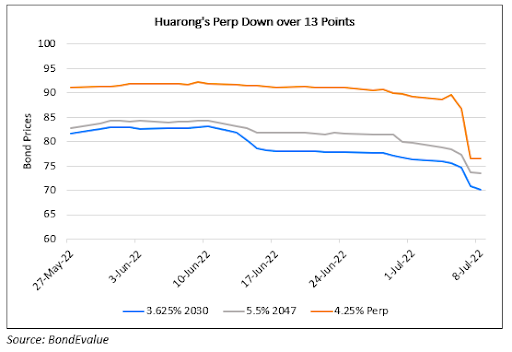

Huarong to Call Back 4% Dollar Perp

September 29, 2022

China Huarong announced that it will redeem/call back its $700mn 4% Perp at par on the upcoming call date of November 7, as per an exchange filing. The bonds are guaranteed by China Huarong International Holdings, a wholly-owned subsidiary of China Huarong Asset Management. The bonds rose 0.55 points to 99.31, with a yield-to-call of 11.26%. While the bonds were trading close to par, assuming that the bonds would be called back, broader concerns have emerged on Huarong after it reported a $2.7bn loss in H1 this year. China Huarong AMC was downgraded to BBB- from BBB earlier this week by S&P.

Go back to Latest bond Market News

Related Posts: